In the dark corners of the internet, where cybercriminals thrive, platforms like Bclub.st have gained prominence for their role in facilitating illegal activities. Specializing in the trade of dumps and CVV2 data, Bclub.st has become a hub for those engaged in credit card fraud. This post aims to shed light on what Bclub.st is, how it operates, and the broader implications of its existence in the cybercrime ecosystem.

What Are Dumps and CVV2 Data?

To understand the significance of Bclub.st, it's essential first to grasp the concepts of dumps and CVV2 data, two crucial elements in credit card fraud.

- Dumps: Dumps refer to the data stored on the magnetic stripe of a credit card. This data includes the cardholder's name, card number, expiration date, and other details required for a transaction. Cybercriminals acquire dumps by skimming devices or hacking into point-of-sale systems. Once they have the data, it can be used to create counterfeit cards, enabling fraudulent in-store purchases.

- CVV2 Data: The CVV2 (Card Verification Value 2) is a three-digit code found on the back of a credit card. It is used to verify that the cardholder is in possession of the physical card during online transactions. When cybercriminals obtain CVV2 data, often through phishing schemes or hacking, they can make unauthorized online purchases.

Bclub.st: A Marketplace for Cybercriminals

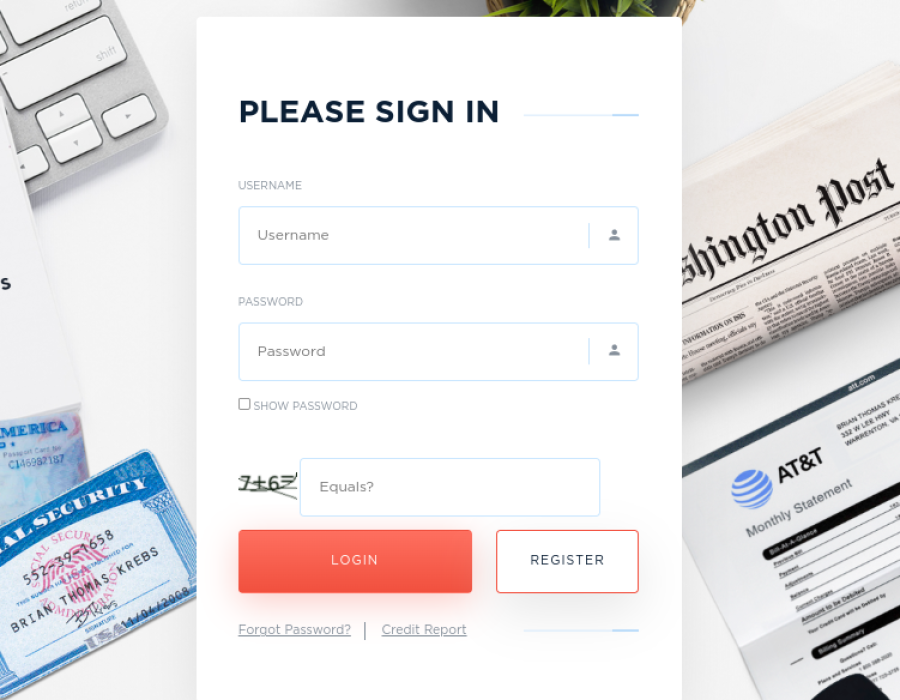

Bclub.st operates as a marketplace on the dark web, where buyers and sellers of stolen credit card information can conduct their business anonymously. The platform is particularly known for offering a wide range of dumps and CVV2 data, catering to a global audience of fraudsters. It provides a structured environment where cybercriminals can trade information with relative ease, often using cryptocurrencies to maintain anonymity.

The platform's user interface and transaction processes are designed to be user-friendly, even for those who may not be highly tech-savvy. This accessibility has contributed to its popularity, making it a significant player in the underground economy of credit card fraud.

The Mechanics of Bclub.st

Bclub.st likely follows a model similar to other dark web marketplaces, where users must create accounts and possibly pay a membership fee to access the full range of services. Once inside, users can browse listings of stolen credit card data, which typically include detailed information such as the card number, expiration date, CVV2 code, and sometimes additional data like the cardholder's address.

The listings are often categorized by country, card type, and even the balance available on the card, allowing buyers to choose the information that best suits their needs. Sellers on Bclub.st earn a reputation based on the quality and accuracy of the data they provide, which can be crucial for attracting repeat business.

The Role of Cryptocurrencies

Cryptocurrencies play a pivotal role in the operations of Bclub.st. Bitcoin, for example, is the preferred method of payment due to its relative anonymity and ease of transfer across borders. This use of cryptocurrencies complicates efforts by law enforcement agencies to trace transactions and identify the individuals behind them.

However, while cryptocurrencies provide a layer of anonymity, they are not entirely untraceable. Blockchain analysis tools are becoming increasingly sophisticated, allowing law enforcement to track the flow of funds in and out of platforms like Bclub.st. Nevertheless, the use of cryptocurrencies remains a significant challenge in the fight against cybercrime.

The Impact of Bclub.st on Credit Card Fraud

The existence of platforms like Bclub.st has far-reaching implications for the prevalence of credit card fraud. By centralizing the trade of stolen credit card data, Bclub.st lowers the barrier to entry for would-be fraudsters. This, in turn, leads to an increase in the number of fraudulent transactions, which can have devastating effects on both individuals and businesses.

- Impact on Individuals: For the average person, becoming a victim of credit card fraud can be a harrowing experience. It often leads to financial losses, damage to credit scores, and the time-consuming process of disputing fraudulent charges. In some cases, the stress and anxiety caused by such an experience can have long-lasting psychological effects.

- Impact on Businesses: Businesses are also heavily impacted by credit card fraud. They may face chargebacks from banks, which can result in lost revenue. Additionally, businesses may need to invest in more robust security measures to protect against future breaches, which can be costly. Repeated incidents of fraud can also damage a business's reputation, leading to a loss of customer trust and, ultimately, revenue.

Law Enforcement Challenges

Law enforcement agencies around the world are engaged in an ongoing battle against platforms like Bclub.st. However, several challenges make this fight particularly difficult.

- Anonymity: The dark web offers a high level of anonymity to its users, making it difficult for law enforcement to identify and apprehend those involved in illegal activities. The use of cryptocurrencies further complicates efforts to trace transactions.

- Jurisdictional Issues: Cybercrime is a global issue, and platforms like Bclub.st may have users spread across multiple countries. This presents significant jurisdictional challenges, as law enforcement agencies must navigate a complex web of international laws and cooperation agreements.

- Rapid Evolution: Cybercriminals are constantly evolving their tactics to stay ahead of law enforcement. As soon as one platform is shut down, another often emerges to take its place, making it a continuous game of cat and mouse.

Mitigating the Risks: What Can Be Done?

While shutting down platforms like Bclub.st is a daunting task, several steps can be taken to mitigate the risks associated with credit card fraud.

- Enhanced Security Measures: Businesses must invest in advanced security measures, such as EMV chip technology, end-to-end encryption, and tokenization, to protect against data breaches. Regular security audits and employee training can also help prevent fraud.

- Consumer Awareness: Educating consumers about the risks of credit card fraud and how to protect their information is crucial. This includes encouraging the use of strong passwords, avoiding suspicious links or emails, and regularly monitoring bank statements for unauthorized transactions.

- International Cooperation: Given the global nature of cybercrime, international cooperation among law enforcement agencies is essential. This includes sharing intelligence, collaborating on investigations, and harmonizing laws to ensure that cybercriminals have fewer places to hide.

- Regulating Cryptocurrencies: While cryptocurrencies offer certain benefits, their role in facilitating cybercrime cannot be ignored. Governments and regulatory bodies must work together to develop frameworks that balance the need for privacy with the need to prevent illegal activities.

Conclusion

Bclub.st represents a significant threat in the ongoing battle against credit card fraud. By providing a platform for the trade of dumps and CVV2 data, it has contributed to the proliferation of cybercrime and the victimization of countless individuals and businesses. Combating this threat requires a multifaceted approach, involving enhanced security measures, consumer education, international cooperation, and the regulation of cryptocurrencies. Only by addressing these challenges head-on can we hope to reduce the impact of platforms like Bclub.st on the global economy.

Comments