UAE Building Materials Market Overview

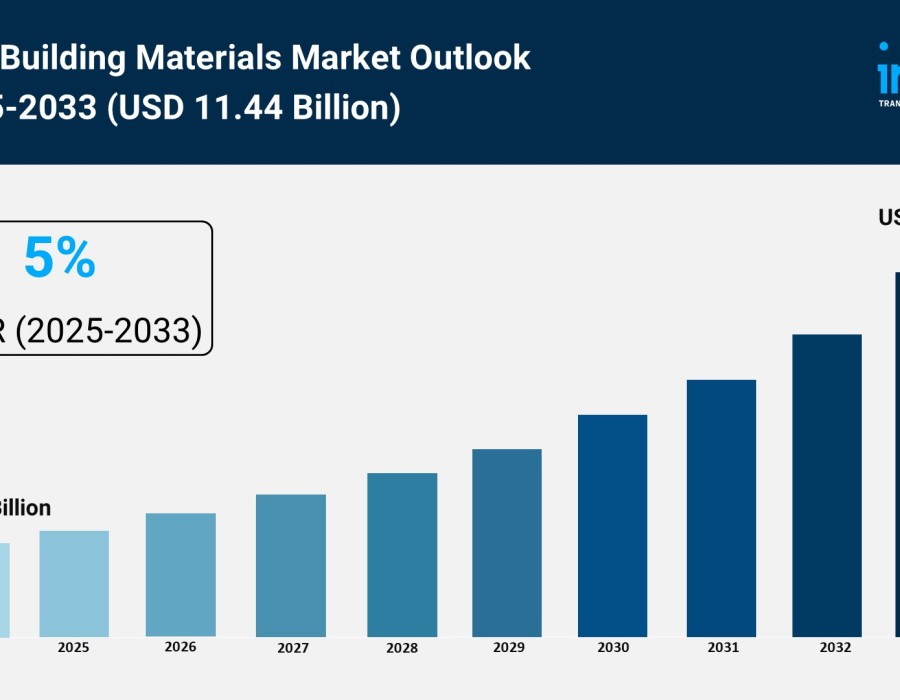

Market Size in 2024: USD 6.75 Billion

Market Size in 2033: USD 11.44 Billion

Market Growth Rate 2025-2033: 5%

According to IMARC Group's latest research publication, "UAE Building Materials Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The UAE building materials market size reached USD 6.75 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 11.44 Billion by 2033, exhibiting a growth rate of 5% during 2025-2033.

How AI is Reshaping the Future of UAE Building Materials Market

- Revolutionizing Design and Planning: Building Information Modeling (BIM) integrated with AI algorithms is cutting down project delays and cost overruns by enabling better coordination between stakeholders, reducing change orders that traditionally plagued the construction industry.

- Optimizing Material Production: AI-powered manufacturing systems are enhancing the precision of cement and concrete production, minimizing waste by up to 30% while improving material consistency across batches for mega-projects in Dubai and Abu Dhabi.

- Accelerating 3D Printing Technology: Companies like 3DXB built the world's largest 3D-printed villa in Dubai, with AI systems controlling robotic arms that extrude concrete layers with almost zero waste, aligning with Dubai's goal of having 25% of new buildings 3D-printed by 2030.

- Smart Material Innovation: AI-driven research is advancing self-healing concrete and thermochromic glass applications, automatically adjusting building materials to enhance durability and energy efficiency across residential and commercial projects.

- Enhancing Supply Chain Efficiency: AI analytics are streamlining inventory management for building material distributors, using predictive algorithms to forecast demand patterns based on construction activity in regions like Dubai, Abu Dhabi, and Sharjah.

Grab a sample PDF of this report: https://www.imarcgroup.com/uae-building-materials-market/requestsample

UAE Building Materials Market Trends & Drivers:

The UAE construction boom is creating unprecedented demand for building materials, and the government is putting serious muscle behind it. Major projects like Expo City Dubai's legacy developments, the Hatta Beach Master Plan with its 10,000-square-meter Crystal Lagoon, and countless residential towers are consuming massive quantities of cement, aggregates, and bricks. Dubai mandated BIM implementation for all projects starting January 2024, forcing contractors to adopt digital workflows that require precise material specifications and tracking. Abu Dhabi's Estidama green building regulations are pushing developers toward sustainable materials, creating a whole new market segment. The residential sector is particularly hot—prefabricated building materials alone are expected to hit over a billion dollars as developers look for faster construction methods to meet housing demand from the expanding expat population.

Sustainability isn't just a buzzword anymore; it's becoming the baseline expectation. Recycled steel, low-carbon concrete, and energy-efficient insulation materials are now standard specs in new developments rather than premium options. The shift is driven partly by regulations but also by real economics—buildings that use sustainable materials qualify for green certifications that boost property values and attract international investors. Local manufacturers are responding by investing heavily in eco-friendly production processes. Smart materials are entering the mainstream too, with self-healing concrete showing up in infrastructure projects and thermochromic glass becoming popular in high-rise towers where energy efficiency directly impacts operating costs. This trend is reshaping supply chains, with material suppliers needing to prove sustainability credentials to win contracts on major projects.

Technology is completely transforming how materials get specified, produced, and used. 3D printing of concrete structures is moving from experimental to commercial, with companies like 3DXB, CyBe Construction, and AC3D launching actual projects across Dubai. The economics make sense—3D printing reduces labor costs, cuts material waste significantly, and accelerates construction timelines. IoT sensors embedded in materials are providing real-time data on structural integrity, helping contractors spot issues before they become expensive problems. Drones equipped with imaging technology are conducting site surveys and monitoring material usage, catching discrepancies that used to result in budget overruns. Advanced manufacturing techniques are producing specialized materials for specific applications—whether it's high-strength concrete for supertall towers or lightweight aggregates for floating structures. The UAE's ambitious smart city initiatives demand materials that integrate with digital infrastructure, creating entirely new product categories that didn't exist five years ago.

UAE Building Materials Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

- Aggregates

- Cement

- Bricks

- Others

Application Insights:

- Residential

- Commercial

- Industrial

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in UAE Building Materials Market

- January 2024: Dubai Municipality approved the Hatta Beach development featuring a 10,000-square-meter engineered Crystal Lagoon, requiring specialized building materials for eco-friendly hotels, luxury resorts, and leisure facilities under the Hatta Master Development Plan.

- January 2024: Dubai mandated Building Information Modeling (BIM) for all construction projects, requiring digital material specifications and tracking systems that integrate AI-driven analytics for supply chain optimization and waste reduction.

- March 2024: 3DXB completed the world's largest 3D-printed villa in Dubai, demonstrating commercial viability of additive manufacturing for residential construction with specialized concrete mixtures developed using local UAE materials.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Comments