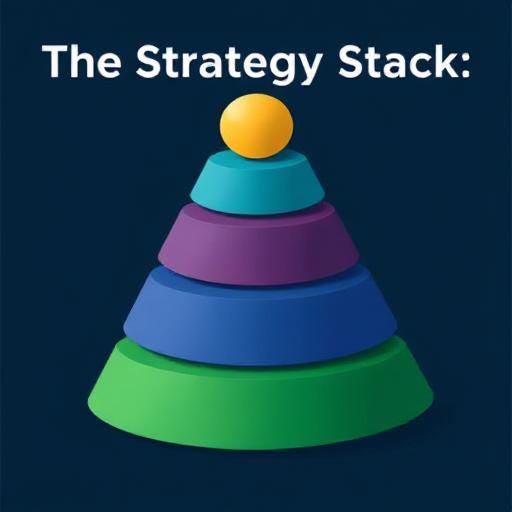

A strategy stack is a combination of different investment strategies layered together to achieve a range of financial goals while managing risk. Just as a diversified portfolio spreads assets across different instruments, a strategy stack diversifies across approaches, such as:

- Core investing (long-term, low-cost index funds)

- Satellite investing (tactical, high-growth opportunities)

- Income strategies (dividends, bonds)

- Risk hedging (options, commodities, alternative assets)

- Thematic plays (ESG, AI, emerging markets)

Instead of relying solely on one approach — say, aggressive growth or dividend income — the strategy stack balances short-term and long-term thinking, risk and reward, and passive and active investment strategies.

Why Layered Investment Strategies Work

A layered approach offers multiple benefits:

1. Diversification of Thought

It’s not just about where you invest, but how you invest. Each layer adds a distinct logic — long-term wealth building, short-term opportunity capture, income generation, or capital preservation. By integrating varied investment strategies, your portfolio gains intellectual and financial resilience.

2. Resilience to Market Cycles

Markets move in cycles. When growth stocks underperform, dividend payers or bonds may hold the line. A layered investment strategy cushions the downside and smooths the ride.

3. Tailored to Multiple Goals

One-size investing doesn’t work. A strategy stack allows you to address multiple financial goals — retirement, wealth accumulation, buying a home, or leaving a legacy — all within one framework of complementary investment strategies.

Building Your Own Investment Strategy Stack

Here’s a basic structure to get started:

🧱 Layer 1: The Core (40–60%)

- Index funds or ETFs

- Long-term holdings aligned with broad market growth

- Low cost, passive strategy

- Example: S&P 500 ETFs, total market funds

This forms the foundation of your investment strategies — steady, diversified, and cost-effective.

⚡ Layer 2: Tactical Plays (10–20%)

- Actively managed funds or individual stocks

- Opportunities in tech, biotech, emerging markets

- Higher risk, higher potential reward

- Example: Growth stocks, sector ETFs

This layer uses more active investment strategies to target short-term trends or emerging sectors.

💰 Layer 3: Income Generation (10–25%)

- Dividend-paying stocks, REITs, bonds

- Designed to produce regular income

- Ideal for stability and cash flow

An essential part of many investment strategies focused on financial independence or retirement planning.

🛡️ Layer 4: Risk Management (5–15%)

- Hedging with gold, options, or cash reserves

- Helps protect in bear markets or during volatility

This layer involves defensive investment strategies that reduce exposure during downturns.

🌱 Layer 5: Thematic & Values-Based (5–10%)

- ESG funds, impact investing, or personal interest themes

- Adds a values-driven or future-focused angle to your investments

Use this to align investment strategies with personal values or long-term societal trends.

Final Thoughts: Strategy Is a Stack, Not a Silo

Relying on a single investment strategy is like building a house with only one material. It might work for a while, but it won’t withstand every storm. A layered approach — the Strategy Stack — offers a dynamic, adaptable framework that evolves with your life and the markets.

Whether you’re a DIY investor or working with an advisor, rethink your portfolio not as a single bet, but as a thoughtful stack of investment strategies working in harmony.

Ready to Build Your Strategy Stack?

If you want to learn more about building a personalized, layered approach using proven investment strategies, stay tuned to our blog for deep dives, tools, and expert insights.

CONTACT US

MICROMUNCH

Preatoni Tower, Unit 2406, Cluster L, JLT, Dubai, UAE.

UAE :+971 4 835 9935

Comments