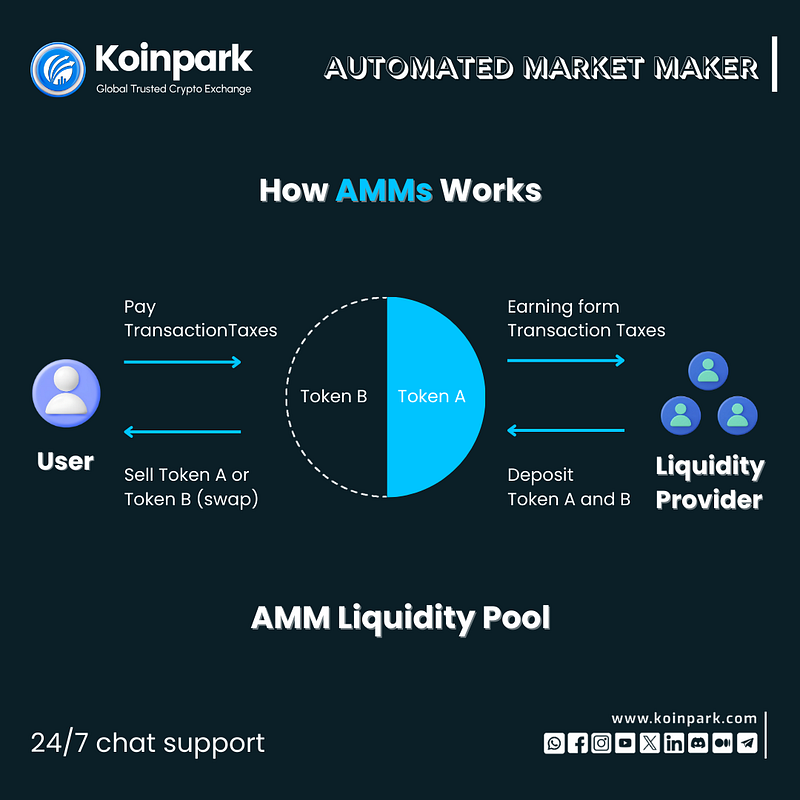

Automated Market Makers (AMMs) are like digital traders that use math to decide prices. They help people trade coins without needing a person to set the prices.

For those interested in cryptocurrencies like Bitcoin and its trading in India, understanding AMMs can be beneficial.

In this article, we’ll explore how AMMs work using apples and potatoes as examples.

An Example: The Potato and Apple Trade

Imagine you’re a potato farmer tired of seeing only potatoes everywhere. You want apples, but in your village, everyone grows potatoes.

Then, a trader comes offering to exchange potatoes for apples, setting up a trade with 50,000 of each.

Similarly, In India, those interested in buying Bitcoin often look towards international exchanges. However, I recommend using an Indian exchange like Koinpark. It’s known for completing millions of trades, including many ICOs and IEOs.

With a large number of users, over 160 trading pairs, and more than a million website visits, it’s a solid choice. Let’s explore how a cryptocurrency gets listed on this global cryptocurrency exchange.

The Role of the Magical Genie (Algorithm)

The trader uses a magical genie, really an algorithm, to keep the trade fair. This genie ensures that the total value of apples and potatoes always stays the same, aiming for a 50/50 ratio.

Likewise, those looking to buy BTC in India might consider using the best exchange platform to buy Bitcoin in India with INR.

Using the Constant Product Formula

The genie uses a formula where the quantities of assets (x and y) multiply to a constant value (k). In this case, k is 2.5 billion.

X = 50 000, Y = 50 000,

K = 50 000 X 50 000 is 2.5 billion.

This concept applies similarly to buying BTC in India, where the value of BTC to INR can be calculated using exchange rates and quantities.

Trading Example: Understanding the Process

When a potato farmer brings 7,000 potatoes to trade for apples, now we have 57 000

Potatoes the genie calculates how many apples to give. The formula helps maintain the constant value.

Total volume / Total potatoes in a pool

= 2.5 billion / 57, 000

Current Apple in the pool

= 43, 859

= 50 000–43, 859 = 6,141 we have to give.

Similarly, individuals looking to buy BTC can observe how prices change based on supply and demand dynamics.

Calculating Asset Prices

Prices go up or down depending on how much people want something or how much of it there is. Right now, because there aren’t many apples, only 43,859, they’re expensive. But we have a lot of potatoes, 57,000, so they’re lower price.

Likewise, understanding the BTC to INR conversion rate can help buyers determine the best time to buy BTC in India.

Let’s quickly go through another example this time a farmer adds 2,000 apples to a pool, bringing the total to 45,859 apples. The pool calculates it needs 54,514 potatoes but has 57,000, so the farmer gets 2486 extra potatoes for his valuable apples.

Total volume / Total apples in pool

= 2.5 billion / 45,859 apples

Current potatoes in the pool

= 54,514

= 57,000–54,514

= a farmer gains 2486 potatoes

Complexity and Future Considerations

Liquidity pools can get complex, especially with larger trades or adding new assets. But understanding the basics helps navigate these systems.

This understanding is crucial for individuals interested in buying BTC or other cryptocurrencies in India.

Conclusion

AMMs like liquidity pools use algorithms to make trading fair and efficient. They’re an essential part of decentralized finance, offering opportunities for traders and investors alike.

Whether it’s exploring the best exchange platforms to buy Bitcoin and how to buy Bitcoin in India or understanding the dynamics of asset trading, grasping these concepts can lead to more informed decisions in the cryptocurrency market.

.png)

Comments