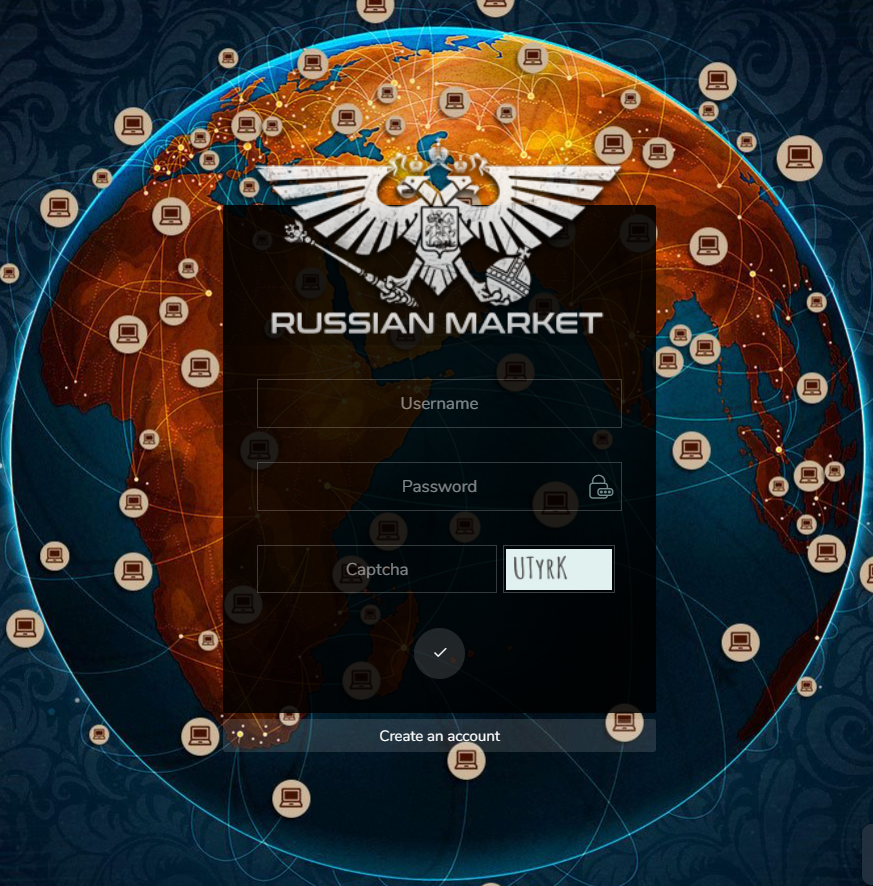

In the rapidly evolving world of cryptocurrency and digital transactions, Bitcoin continues to lead the charge as a transformative force in the financial landscape. As businesses and consumers increasingly adopt digital currencies, Bitcoin’s role in facilitating automatic payments is gaining significant traction. We explore the intersection of Bitcoin, automatic payments, and the burgeoning Russianmarket, offering insights into how these elements are reshaping e-commerce and financial transactions.

The Rise of Bitcoin as a Payment Method

Bitcoin, the pioneering cryptocurrency, was introduced in 2009 by the pseudonymous Satoshi Nakamoto. Over the years, it has evolved from a niche digital asset into a mainstream financial tool. One of Bitcoin's most compelling features is its ability to facilitate automatic payments. This capability is revolutionizing the way businesses and consumers handle transactions.

Automatic payments, also known as recurring payments, involve setting up a system where payments are made automatically at predetermined intervals. This can include subscription services, utility bills, or even e-commerce purchases. Bitcoin's integration into these systems offers several advantages:

- Global Accessibility: Bitcoin transcends national borders, making it an ideal choice for international transactions. Unlike traditional payment systems that may have geographic restrictions, Bitcoin can be used by anyone with an internet connection, facilitating seamless global commerce.

- Reduced Transaction Fees: Traditional payment methods often involve multiple intermediaries, each of which charges a fee. Bitcoin, on the other hand, operates on a decentralized network, which can significantly reduce transaction costs. This is particularly beneficial for businesses and consumers engaged in frequent or high-value transactions.

- Enhanced Security: Bitcoin transactions are secured by blockchain technology, which provides a high level of security and transparency. This reduces the risk of fraud and chargebacks, issues that are common in traditional payment systems.

Bitcoin Automatic Payments in the Russianmarket

The Russianmarket, a significant player in the global e-commerce arena, is experiencing a surge in cryptocurrency adoption. As more Russian businesses and consumers embrace digital currencies, Bitcoin automatic payments are becoming an increasingly popular method of conducting transactions.

Several factors contribute to the growing acceptance of Bitcoin in the Russianmarket:

- Economic Uncertainty: Russia has faced various economic challenges, including currency fluctuations and international sanctions. In such an environment, Bitcoin offers a stable alternative that is less susceptible to geopolitical and economic instability.

- Technological Advancement: Russia has a strong tech sector and a growing number of blockchain startups. This technological prowess is driving the adoption of Bitcoin and other cryptocurrencies in the country, leading to more innovative payment solutions.

- Consumer Demand: As Russian consumers become more tech-savvy, there is a growing demand for alternative payment methods. Bitcoin’s ease of use and the ability to set up automatic payments make it an attractive option for tech-forward consumers.

Benefits of Bitcoin Automatic Payments for Businesses

For businesses operating in the Russianmarket and beyond, integrating Bitcoin automatic payments can offer numerous benefits:

- Streamlined Operations: Automatic payments simplify the payment process, reducing administrative overhead and minimizing the risk of late or missed payments. This allows businesses to focus on growth and customer satisfaction rather than payment logistics.

- Attracting Tech-Savvy Customers: By offering Bitcoin as a payment option, businesses can appeal to a demographic that values innovation and digital solutions. This can enhance customer loyalty and attract a broader audience.

- Enhanced Financial Management: Bitcoin’s transparent and immutable ledger provides businesses with clear and reliable transaction records. This can improve financial management and reporting, making it easier to track and reconcile payments.

Challenges and Considerations

Despite its advantages, Bitcoin automatic payments come with certain challenges and considerations:

- Volatility: Bitcoin’s value can fluctuate significantly, which may impact the stability of automatic payments. Businesses and consumers must be prepared for potential price swings and consider strategies to mitigate this risk.

- Regulatory Uncertainty: The regulatory environment for cryptocurrencies varies by region and is continually evolving. Businesses must stay informed about legal requirements and ensure compliance with relevant regulations in their jurisdiction.

- Technical Integration: Implementing Bitcoin automatic payments requires technical expertise and infrastructure. Businesses need to invest in secure payment gateways and ensure that their systems can handle cryptocurrency transactions effectively.

The Future Outlook

As Bitcoin and other cryptocurrencies become increasingly integrated into the global financial system, the future of automatic payments looks promising. The Russianmarket, with its growing adoption of digital currencies, is poised to play a significant role in this evolution.

Innovations in blockchain technology and payment processing will continue to drive the expansion of Bitcoin automatic payments, offering new opportunities for businesses and consumers alike. As the market matures, we can expect to see more seamless and efficient payment solutions that leverage the strengths of cryptocurrencies.

In conclusion, Bitcoin’s role in automatic payments is transforming the landscape of e-commerce and financial transactions. The Russianmarket, with its dynamic environment and increasing cryptocurrency adoption, is at the forefront of this change. Businesses and consumers who embrace Bitcoin automatic payments stand to gain significant advantages in terms of cost savings, security, and convenience. As the digital economy continues to evolve, staying informed and adaptable will be key to leveraging the full potential of Bitcoin and other cryptocurrencies.

Comments