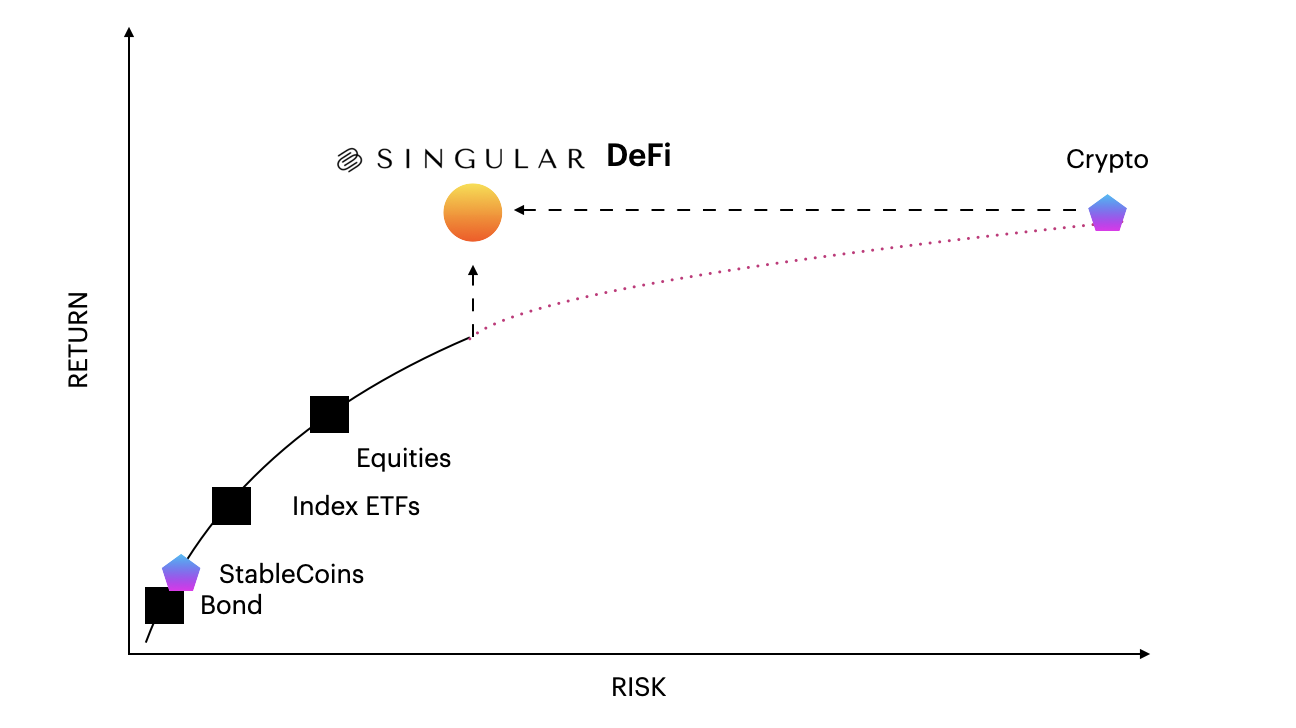

In the evolving landscape of finance, decentralized hedge funds have emerged as a groundbreaking concept, reshaping traditional investment management. Unlike conventional hedge funds, which are managed by centralized entities with specific fund managers, decentralized hedge fund operate on blockchain technology. This innovation leverages intelligent contracts and distributed ledger technology to democratize investment strategies. Typically, these funds are accessible to a broader range of investors, transcending the limitations of traditional hedge fund structures. The decentralized nature ensures transparency, as transactions and holdings are recorded on the blockchain and visible to all participants. This approach significantly reduces the risk of fraud and mismanagement, fostering a trustless environment where investment decisions are made collectively or through algorithmic strategies.

The Democratic Shift in Investment Management through DAOs and AI:

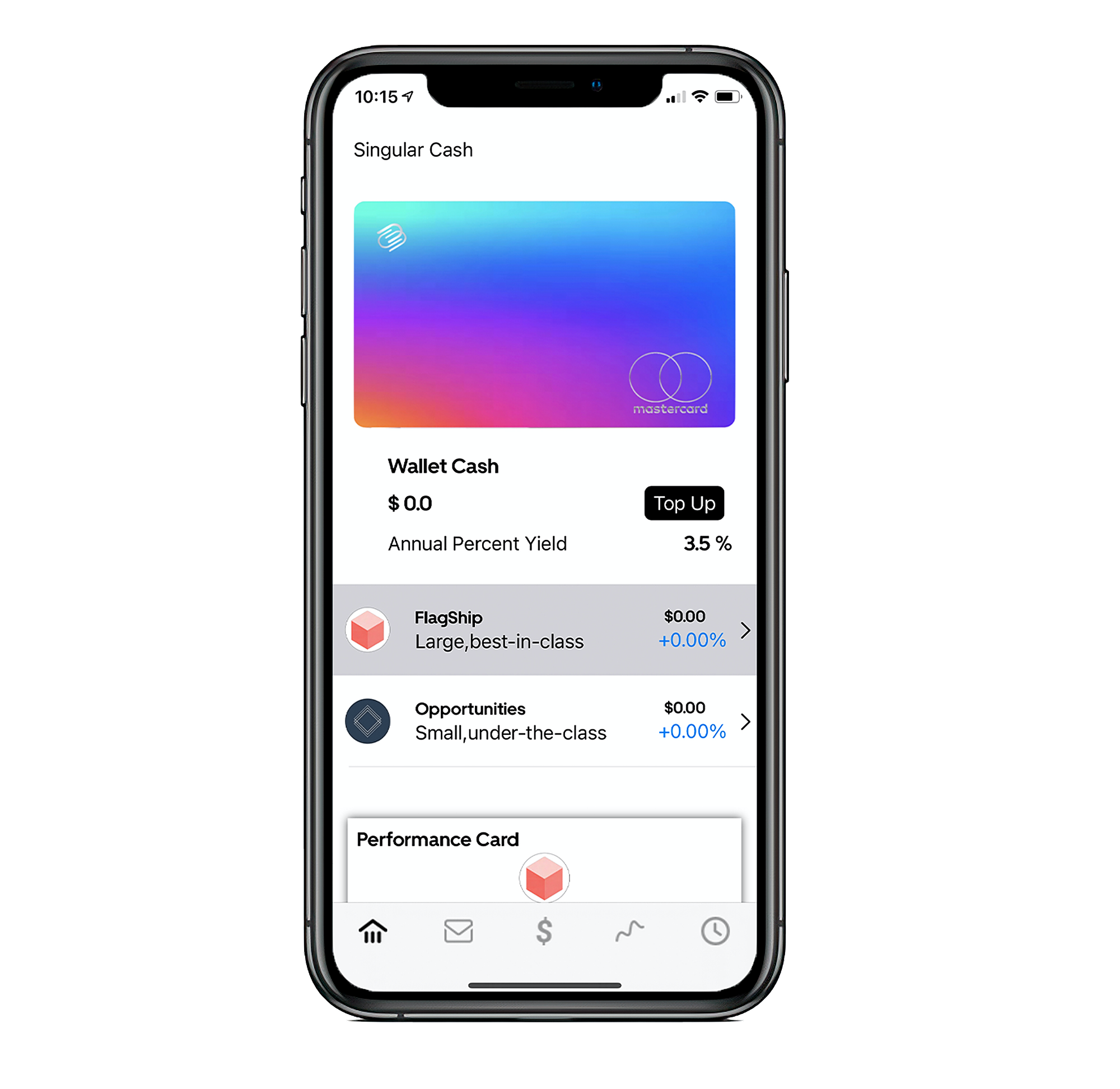

The core of decentralized investment management lies in its ability to offer autonomy and inclusivity to investors. Unlike traditional investment management, where fund managers centrally make decisions, decentralized systems enable investors to have direct control over their investments. This is facilitated through the use of decentralized autonomous organizations (DAOs), where investors can vote on investment decisions, reflecting a truly democratic approach. Moreover, the integration of AI and machine learning in these platforms allows for the development of sophisticated, data-driven investment strategies. The decentralized nature also significantly reduces overhead costs associated with traditional investment management, such as fees for fund managers and administrative expenses. This cost efficiency is particularly appealing to retail investors, who are often excluded from high-end investment opportunities due to high entry barriers.

Challenges and Solutions in Decentralized Finance

While decentralized hedge funds and investment management present numerous advantages, they are not without challenges. One of the primary concerns is the regulatory ambiguity surrounding decentralized finance (DeFi). Given its relatively new emergence, DeFi needs a comprehensive regulatory framework, leading to potential legal uncertainties for investors. Another challenge is the technological complexity and the requirement for a certain level of digital literacy among investors. The use of blockchain and smart contracts, while secure, can be daunting for those unfamiliar with the technology. Solutions to these challenges include ongoing efforts to develop more explicit regulatory guidelines and the creation of more user-friendly platforms. Educational resources and community support also play a crucial role in making decentralized investment management more accessible to a broader audience.

Future Prospects and Innovations

The future of decentralized hedge funds and investment management is poised for significant growth and innovation. As blockchain technology continues to evolve, we can expect more advanced and secure platforms that cater to a diverse range of investment needs. The integration of artificial intelligence in these platforms will likely lead to more sophisticated and personalized investment strategies. Additionally, as regulatory frameworks become more defined, there will be more excellent stability and legitimacy in the DeFi space, attracting more institutional investors. Another exciting prospect is the potential integration of decentralized finance with traditional finance, creating hybrid models that combine the best of both worlds. This evolution will not only enhance investment opportunities but also pave the way for a more inclusive and efficient global financial system.

Conclusion:

In conclusion, decentralized hedge funds and Decentralized Investment Management represent a paradigm shift in the financial industry. By leveraging blockchain technology, these platforms offer greater transparency, autonomy, and inclusivity, fundamentally altering how investments are managed and democratizing access to hedge fund strategies. As the sector continues to evolve, it faces challenges like regulatory uncertainty and technological complexity, but these are being addressed through ongoing innovations and educational efforts. Looking towards the future, the integration of AI and the potential fusion with traditional finance will undoubtedly catalyze further growth and acceptance. Platforms like singularvest.com are at the forefront of this revolution, offering novel solutions and opportunities for investors seeking to navigate the dynamic world of decentralized finance.

Blog Source URL:

https://singularvest.blogspot.com/2024/01/revolutionizing-finance-rise-of.html

Comments