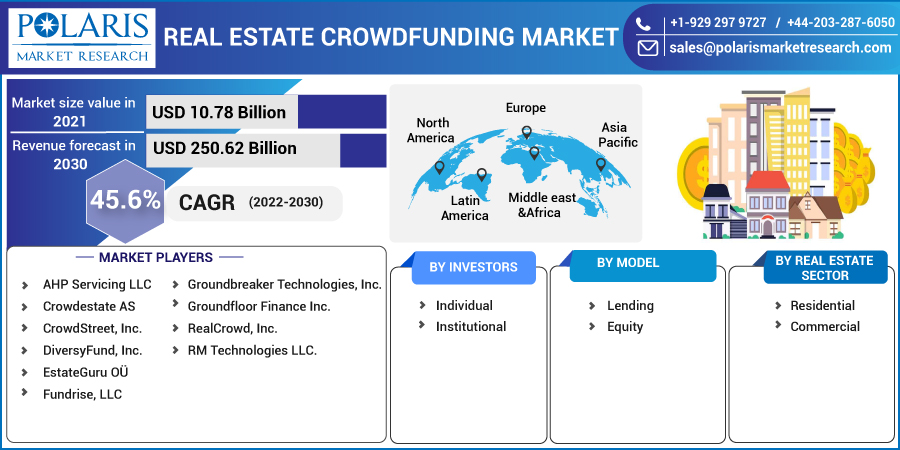

“According to the research report, the global real estate crowdfunding market was valued at USD 14,294.9 million in 2022 and is expected to reach USD 793,476.5 million by 2032, to grow at a CAGR of 50.9% during the forecast period.”

Introduction

In recent years, the landscape of real estate investment has witnessed a paradigm shift with the emergence of crowdfunding platforms. Real estate crowdfunding, a method of pooling funds from various investors to finance property projects, has rapidly gained traction, reshaping the dynamics of the market. This innovative approach offers a range of benefits, fostering accessibility, diversification, and democratization in real estate investment.

Request Our Free Sample Report for Real Estate Crowdfunding Market Insights and Emerging Trends @ https://www.polarismarketresearch.com/industry-analysis/real-estate-crowdfunding-market/request-for-sample

The Rise of Real Estate Crowdfunding

The real estate crowdfunding market has experienced exponential growth, fueled by advancements in technology and changes in investor preferences. Traditionally, investing in real estate required substantial capital and often limited smaller investors from participating. However, crowdfunding platforms have broken down these barriers, enabling individuals to invest in real estate with relatively modest amounts.

Accessibility and Democratization

One of the key advantages of real estate crowdfunding is its accessibility. Investors can now access a diverse range of real estate projects with minimal entry requirements. This democratization of real estate investment allows a broader segment of the population to participate in an asset class that was once reserved for high-net-worth individuals and institutional investors.

Diversification Opportunities

Real estate crowdfunding provides investors with a unique opportunity to diversify their portfolios. By contributing to different projects across various locations and property types, investors can spread risk and reduce their exposure to market fluctuations. This diversification potential is particularly attractive for those seeking to balance their investment portfolios and mitigate risks associated with traditional asset classes.

Innovative Platforms and Models

Several crowdfunding platforms have emerged, each offering its own unique approach to real estate investment. Some platforms operate on a debt-based model, where investors receive regular interest payments and the return of principal upon project completion. Others follow an equity-based model, granting investors ownership stakes in the property and a share of rental income and potential appreciation.

Request Our Free Sample Report for Real Estate Crowdfunding Market Insights and Emerging Trends @ https://www.polarismarketresearch.com/industry-analysis/real-estate-crowdfunding-market/request-for-sample

Technology Driving the Revolution

Technology plays a pivotal role in the success of real estate crowdfunding. Online platforms leverage cutting-edge tools and blockchain technology to streamline the investment process, enhance transparency, and ensure secure transactions. Investors can browse projects, conduct due diligence, and manage their portfolios conveniently through user-friendly interfaces.

Challenges and Regulatory Landscape

While the real estate crowdfunding market presents promising opportunities, it is not without challenges. Regulatory frameworks vary across regions, and navigating compliance requirements can be complex. Additionally, as with any investment, there are inherent risks, and investors must conduct thorough due diligence before committing funds.

Inquire your Questions If any before Purchasing this Report @ https://www.polarismarketresearch.com/industry-analysis/real-estate-crowdfunding-market/inquire-before-buying

The key players operating in the market are:

- AHP Servicing LLC

- Crowdestate AS

- CrowdStreet

- Inc.

- DiversyFund

- Inc.

- EstateGuru OÜ

- Fundrise

- LLC

- Groundbreaker Technologies

- Inc.

- Groundfloor Finance Inc.

- RealCrowd

- Inc.

- and RM Technologies LLC.

The Future Outlook

The real estate crowdfunding market is poised for continued growth, driven by ongoing technological advancements and increasing investor interest. As the industry matures, regulatory frameworks are likely to evolve, providing further legitimacy and security to investors. The diversification benefits, accessibility, and innovative models offered by crowdfunding platforms position them as a formidable force in the real estate investment landscape.

Conclusion

The real estate crowdfunding market stands as a testament to the transformative power of technology in reshaping traditional industries. By democratizing access to real estate investment, fostering diversification, and introducing innovative models, crowdfunding platforms have opened new doors for investors. As the sector continues to evolve and overcome regulatory challenges, it is poised to become an integral component of modern investment portfolios, providing individuals with unprecedented opportunities to participate in the lucrative world of real estate.

Request for Customization on This Report as Per Your Requirements - https://www.polarismarketresearch.com/industry-analysis/real-estate-crowdfunding-market/request-for-customization

Contact Us:

Polaris Market Research

Ph: +1-929 297-9727

Comments