In today’s fast-paced digital world, identity verification is no longer a luxury—it’s a necessity. As more businesses transition online, ensuring the security of user identities has become paramount. With fraud, data breaches, and identity theft on the rise, businesses need robust solutions to verify who their customers are. This is where Identity Verification Service kyc utilizing KYC (Know Your Customer) processes and Face Scan online come into play.

What is KYC in Identity Verification?

Know Your Customer (KYC) is a critical process for businesses, especially in finance, banking, and e-commerce. It ensures that companies verify the identity of their customers before allowing them access to services or transactions. KYC helps businesses mitigate the risk of dealing with fraudulent users, safeguard against money laundering, and comply with global regulatory standards.

KYC identity verification typically involves:

- Document Verification – Customers upload government-issued documents (such as passports, driver’s licenses) for validation.

- Liveness Detection – The system ensures that the customer interacting is real and not using static images or manipulated videos.

- AML (Anti-Money Laundering) Checks – Verifying if the individual is on any international watchlists or has any suspicious history related to financial crimes.

The Role of Face Scan Technology in Online KYC

Incorporating Face Scan technology into the KYC process provides an additional layer of security. With AI-powered face recognition, businesses can verify that the individual presenting the documents matches the person’s face in real time. This method ensures that fraudsters using stolen or synthetic identities are detected early, reducing the risk of impersonation.

Face scan technology works by:

- Capturing and analyzing the customer’s facial biometrics.

- Comparing the live image with the photo in the provided document.

- Detecting liveness by analyzing movements such as blinking or smiling, ensuring that the image is from a live person.

Benefits of Online Identity Verification and Face Scan

- Improved Security and Compliance

- Utilizing KYC with face scan technology ensures businesses comply with strict AML and KYC regulations. It helps prevent identity fraud and protects businesses from regulatory penalties.

- Faster Customer Onboarding

- Automated identity verification processes, including facial scans, significantly reduce the time needed for customer onboarding. Users can complete the process in minutes, which boosts conversion rates and improves customer satisfaction.

- Seamless User Experience

- Online identity verification with face scan technology provides a seamless and hassle-free experience for customers. It eliminates the need for manual document submission, in-person verification, or visiting physical branches.

- Global Reach

- This digital verification method allows businesses to expand globally without being restricted by geographical boundaries. Customers from anywhere in the world can be verified remotely, allowing businesses to reach new markets securely.

Challenges and Future Trends

While KYC and face scan technology have revolutionized identity verification, challenges such as privacy concerns and regulatory compliance in different countries remain. As data security becomes more critical, companies must adopt solutions that offer end-to-end encryption and store customer data securely.

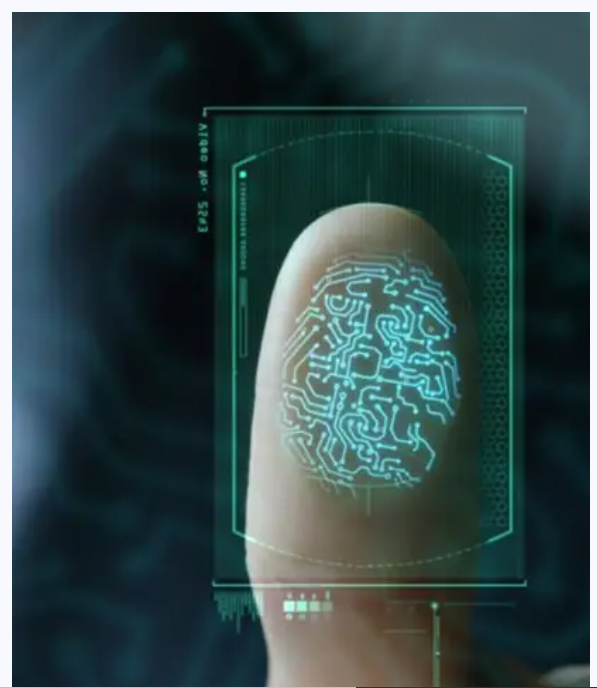

Future trends suggest even more innovation in identity verification services. Technologies like voice biometrics, fingerprint scanning, and multi-factor authentication are being integrated to provide a multi-layered approach to security. Blockchain-based identity verification systems are also gaining traction, offering decentralized and tamper-proof identity solutions.

Choosing the Right Identity Verification Service Provider

For businesses, choosing a reliable identity verification provider that offers comprehensive KYC and face scan capabilities is essential. A trusted provider should offer:

- Global compliance with various KYC and AML regulations.

- Real-time identity verification with minimal friction for users.

- Advanced AI and machine learning technologies for accurate face scan verification.

- Multi-layered security features that protect user data and privacy.

Conclusion

The future of identity verification lies in the combination of KYC and face scan technology, enabling businesses to secure their platforms while providing a seamless customer experience. As digital services continue to expand, adopting these solutions is not just about compliance—it’s about building trust and ensuring security for customers across the globe.

As businesses gear up to face the challenges of digital identity fraud, embracing innovative identity verification services like KYC and face scans will help them stay one step ahead.

Comments