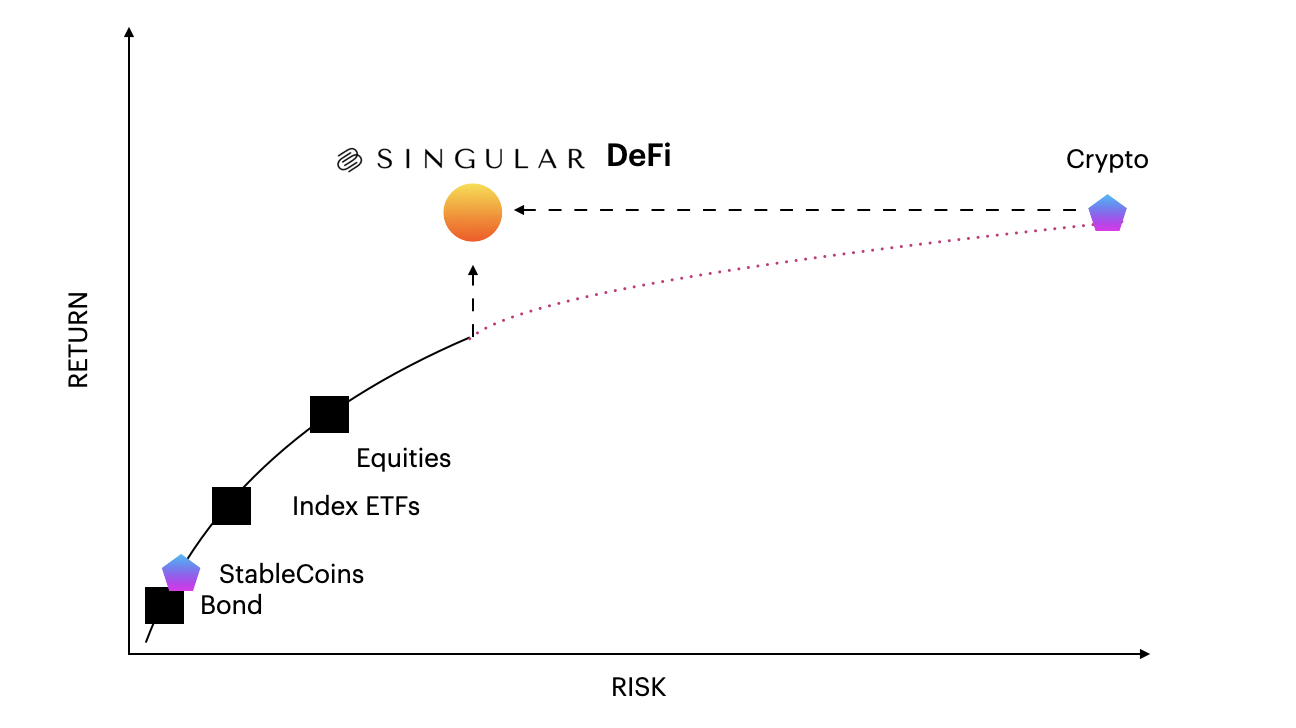

The financial world is undergoing considerable change, primarily influenced by blockchain technology and the emergence of decentralized systems. This shift profoundly impacts areas like Decentralized Hedge Fund and Decentralized Investment Management. These innovative models challenge conventional investment methods, providing fresh perspectives and opportunities. By leveraging blockchain's transparency and security, they offer a more democratic and inclusive approach to investments, appealing to a diverse range of investors and fund managers seeking new ways to maximize returns and minimize risks in an ever-evolving market.

The Rise of Decentralized Hedge Funds: In the world of hedge funds, decentralization introduces a new paradigm. Traditional hedge funds are known for their centralized management structures, where a select group makes decisions of fund managers or investment committees. However, Decentralized Hedge Funds operate differently. By leveraging blockchain technology, these funds distribute decision-making power among a wider group of participants. This approach democratizes investment management, enhances transparency, and potentially reduces the risks associated with central points of failure.

The Shift to Decentralized Investment Management: Similarly, Decentralized Investment Management is gaining momentum. This model utilizes blockchain and innovative contract technologies to manage investment portfolios. Unlike traditional investment management, which relies heavily on human expertise and discretion, decentralized investment management automates many processes, ensuring that investment strategies are executed precisely and without human bias. This move offers improved efficiency, lower costs, and more accessibility to various investors.

Advantages and Challenges: The decentralized approach offers several advantages, such as enhanced transparency, improved security, and increased inclusivity. However, it's not without challenges. Regulatory uncertainty, technological complexities, and the need for robust cybersecurity measures are some hurdles that need to be navigated.

Future Prospects: Hedge Funds and Investment Management

Despite these challenges, the potential of decentralized finance (DeFi) in reshaping the investment landscape is immense. As technology evolves and regulatory frameworks become more apparent, we can expect broader adoption of decentralized methods in hedge funds and investment management.

Conclusion:

Integrating blockchain technology in hedge funds and investment management heralds a new era in finance. As we witness the growth of Decentralized Hedge Funds and Decentralized Investment Management, it's clear that the future of investing is tilting towards greater decentralization. For those keen to stay ahead of the curve in this evolving landscape, singularvest.com offers insights and services tailored to these innovative investment approaches. Embracing these new paradigms could be the key to unlocking unprecedented opportunities in finance.

Blog Source URL:

https://singularvest.blogspot.com/2024/01/embracing-innovation-decentralized.html

Comments