Crude Oil Prices in the USA

- United States: 01 USD/Barrel (WTI)

In Q4 2023, Crude Oil prices hit $73.01/barrel in the US, $72.5/barrel in India, and $77/barrel in Germany, influenced by inventory levels, demand, and policy changes.

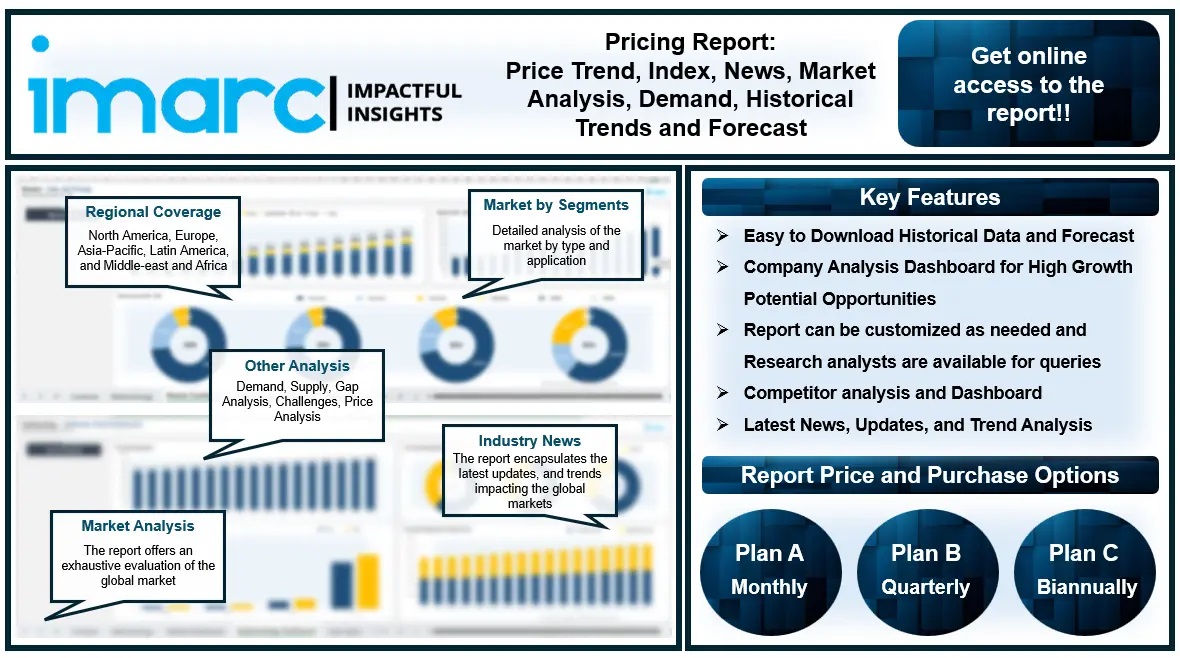

The latest report by IMARC Group, titled " Crude Oil Pricing Report 2024: Price Trend, Chart, Market Analysis, News, Demand, Historical and Forecast Data," provides a thorough examination of the Crude Oil Price Trend. This report delves into the price of Crude Oil globally, presenting a detailed analysis and an informative price chart. Through comprehensive price analysis, the report sheds light on the key factors influencing these trends. Additionally, it includes historical data to offer context and depth to the current pricing landscape. The report also explores the demand, analyzing how it impacts market dynamics. To aid in strategic planning, the price forecast section provides insights into price forecasts, making this report an invaluable resource for industry stakeholders.

Crude Oil Prices December 2023:

- United States: 01 USD/Barrel (WTI)

- India: 5 USD/Barrel (WTI)

- Germany: 77 USD/Barrel

Report Offering:

- Monthly Updates - Annual Subscription

- Quarterly Updates - Annual Subscription

- Biannually Updates - Annual Subscription

The study delves into the factors affecting Crude Oil price variations, including alterations in the cost of raw materials, the balance of supply and demand, geopolitical influences, and sector-specific developments.

The report also incorporates the most recent updates from the market, equipping stakeholders with the latest information on market fluctuations, regulatory modifications, and technological progress. It serves as an exhaustive resource for stakeholders, enhancing strategic planning and forecast capabilities.

Request For a Sample Copy of the Report: https://www.imarcgroup.com/crude-oil-pricing-report/requestsample

Key Details About the Crude Oil Price Trend- Q4 2023

The crude oil market is driven by several key factors, including global economic growth, which increases demand for energy and fuels industrial activities. Geopolitical tensions and conflicts in major oil-producing regions can disrupt supply, causing price fluctuations. Besides this, ongoing technological advancements in extraction methods, such as hydraulic fracturing and deep-sea drilling, have boosted supply capabilities. OPEC's production decisions significantly influence global oil prices and supply dynamics. Additionally, environmental policies and the shift toward renewable energy sources can impact demand, as nations strive to reduce carbon emissions and dependence on fossil fuels.

Factors Influencing Crude Oil Prices in the Last Quarter

The global crude oil market size reached US$ 2829.7 Billion in 2023. By 2032, IMARC Group expects the market to reach US$ 4780.7 Billion, at a projected CAGR of 6.00% during 2023-2032. Due to a few supply and demand-related issues, the North American crude oil market experienced difficulties in the fourth quarter of 2023. The demand for crude oil has decreased due to the pandemic's long-lasting impacts and the growing trend toward renewable energy sources. Additionally, crude oil prices fluctuated across the APAC area during the fourth quarter of 2023. Even though the availability of crude oil was restricted due to supply limitations by significant oil-producing nations such as Saudi Arabia and Russia. The OPEC basket's crude oil prices continued to decline. In addition, the lifting of US sanctions on Venezuela gave Indian refiners access to less expensive crude oil, which might change the country's import profile. The European crude oil market experienced difficulties in the fourth quarter of 2023 due to several reasons that caused prices to exhibit a bearish trend. The persistent worries about the global demand slowdown and the US's increasing oil production and export policies hampered the supply/demand balance and caused market oscillations. Moreover, major shipping companies avoided the Suez Canal, a vital global shipping route, due to attacks by Houthi terrorists in Yemen on merchant vessels in the Red Sea. With low demand and high supply, the fourth quarter of 2023 for crude oil in the MEA area was characterized by a pessimistic market mood. A few factors, such as Russia's possible output reduction, Saudi Arabia's voluntary supply cut through year-end, and other OPEC+ members' partial commitment to production cuts, all affected the price of crude oil globally.

Key Points Covered in the Bromine Pricing Report:

The report delivers the following key findings, alongside a comprehensive breakdown of prices by region:

- Crude Oil Prices

- Crude Oil Price Trend

- Crude Oil Demand & Supply

- Crude Oil Market Analysis

- Demand Supply Analysis by Type

- Demand Supply Analysis by Application

- Demand Supply Analysis of Raw Materials

- Crude Oil Price Analysis

- Crude Oil Industry Drivers, Restraints, and Opportunities

- Crude Oil News and Recent Developments

- Global Event Analysis

- List of Key Players

Regional Price Analysis:

- Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand

- 𝗘𝘂𝗿𝗼𝗽𝗲: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece

- North America: United States and Canada

- Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru

- Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco

Note: The current country list is selective, detailed insights into additional countries can be obtained for clients upon request.

About Us:

IMARC is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic, and technological developments for business leaders in pharmaceutical, industrial, and high-technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology, and novel processing methods are at the top of the company’s expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Comments