When it comes to banking, safety is a top priority for many consumers. Which Banks are the Safest in USA, combining strong financial stability, low risk of failure, and robust security measures? Here’s a look at some of the safest banks based on these criteria.

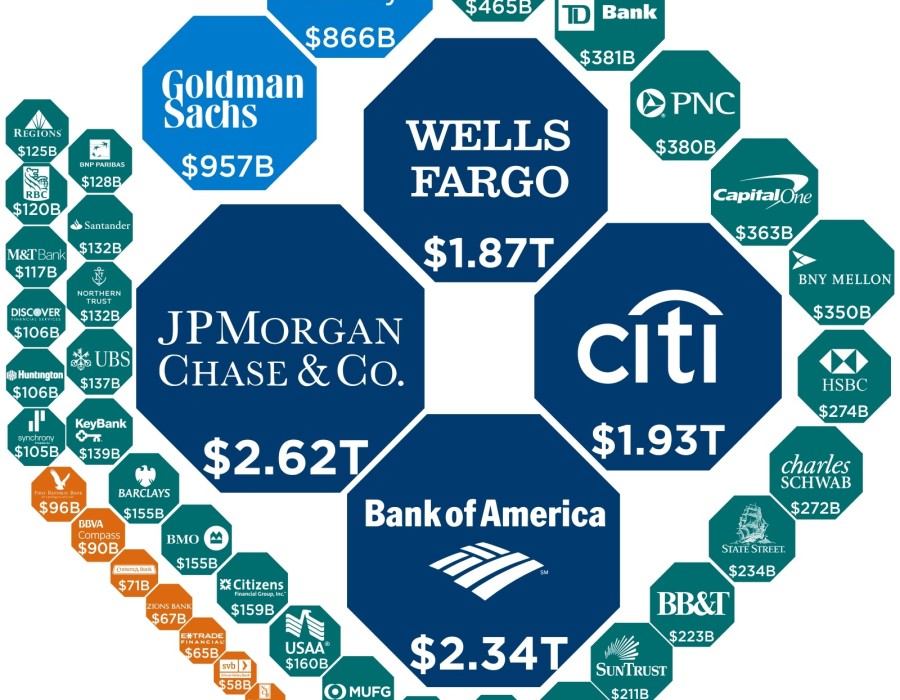

1. JPMorgan Chase

Overview:

As one of the largest and most stable banks in the country, JPMorgan Chase has a solid reputation for safety.

Key Features:

- Strong Capitalization: High capital reserves and strong credit ratings.

- Robust Risk Management: Comprehensive strategies to manage risks effectively.

- FDIC Insured: Deposits are insured up to $250,000.

2. Bank of America

Overview:

Bank of America is another major player known for its financial stability and security measures.

Key Features:

- High Credit Ratings: Consistently receives high ratings from credit agencies.

- Advanced Security Features: Strong online security measures including encryption and fraud monitoring.

- FDIC Insured: Ensures deposit safety up to the insured limit.

3. Wells Fargo

Overview:

Wells Fargo has a long history of stability and is considered safe for consumers.

Key Features:

- Diverse Asset Base: A wide range of financial products and services helps mitigate risk.

- Strong Regulatory Compliance: Adheres to strict regulatory standards.

- FDIC Insured: Protects customer deposits.

4. U.S. Bank

Overview:

U.S. Bank is known for its strong financial performance and commitment to safety.

Key Features:

- Financial Strength: Solid credit ratings and capital ratios.

- Robust Security Protocols: Implements advanced security measures for online banking.

- FDIC Insured: Ensures deposits are protected.

5. Capital One

Overview:

Capital One is recognized for its stability and customer-friendly practices.

Key Features:

- Strong Financial Position: High capital reserves and solid credit ratings.

- Innovative Security Measures: Advanced fraud detection and security features.

- FDIC Insured: Customer deposits are protected up to the insured limit.

6. Charles Schwab Bank

Overview:

Charles Schwab Bank combines banking with investment services, maintaining a strong safety record.

Key Features:

- Financial Stability: High credit ratings and strong capital position.

- Low Risk of Failure: Focuses on conservative lending practices.

- FDIC Insured: Offers deposit insurance for customer accounts.

7. PNC Bank

Overview:

PNC Bank is known for its customer service and financial stability.

Key Features:

- Strong Capital Ratios: Maintains high levels of capital to absorb losses.

- Comprehensive Risk Management: Effective strategies to mitigate various risks.

- FDIC Insured: Protects customer deposits up to the insured limit.

Conclusion

When considering safety in banking, it’s essential to look at factors such as financial stability, regulatory compliance, and security measures. The banks listed above are recognized for their strong safety records, making them reliable choices for consumers looking to safeguard their deposits.

Comments