SHARE

SHARE

July 14, 2017

FEATURED

By stockstotrade From Stocks To Trade

Table of Contents [show]

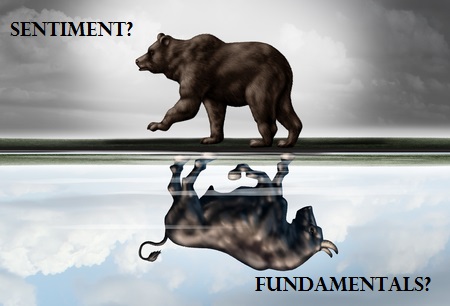

What really moves the markets? Sentiment or fundamentals?

Every time the market rallies without a correction or falls into a bottomless pit, this topic comes to the forefront. With the current bull market extending its stupendous run, this question has again become a hot topic of discussion.

Download the key points of this post as PDF.

For ages, there has been no clear answer to this question. However, we shall try to simplify and demystify the answer for our readers.

Let’s first understand both terms.

Fundamentals

The analysts consider both the macroeconomic fundamentals and the fundamentals of either a sector or an individual company.

The macroeconomic situation affects the overall performance of the markets; however, sector or stock-specific fundamentals is limited in its effect.

The macroeconomic fundamentals are said to be conducive for investing in stocks when the GDP growth rate is good, the political system and the geopolitical environment is conducive for business, inflation is under control, and the monetary policy is supportive. Such a condition encourages growth-oriented measures by the companies, thereby increasing their profits and beating market expectations.

The second is sector or stock fundamentals. For the ease of explanation, we shall consider stock fundamentals as an example. The analysts check various parameters of the company such as sales growth, net profit, Return on Equity, clarity in future earnings, cash flow, dividend distribution, management, etc., and attempt to arrive at an intrinsic value 0f the stock. Comparing the perceived value of the stock with the market price, the fundamental analyst arrives at his conclusion whether the stock is expensive or is attractive for investment.

What is Market sentiment?

Market sentiment, also called “investor sentiment” tells you how bullish or bearish investors are in relation to the market. More often than not people look at the stock market, however, market sentiment can refer to any number of financial indicators.

So, what drives the market fundamentals or market sentiment?

Both Market Sentiment and Fundamentals are Dependent on Each Other

Though at times market sentiment can diverge from the fundamentals, this is not the norm. For the most part, both market sentiment and fundamentals drive each other.

In the first stage of a bull market, the market’s sentiment is driven by the fundamentals. As the fundamentals improve, the companies balance sheets and results tend to recover and beat analysts’ expectations. This change positively uplifts the beaten-down market sentiment, and it slowly changes from bearish to bullish.

But as the market rally continues, sentiment starts to overpower fundamentals. Greed becomes the overpowering sentiment, and market participants disregard the negatives and focus only on the positives. Caution is thrown out of the window. Usually, such a stage sees a vertical rally in the markets, which becomes unsustainable and ends in a crash.

Both the dotcom bubble and the financial crisis of 2007-2008 are examples of how a gradual trending bull market—backed by fundamentals—was overpowered by market sentiment in the later stages, which led to the excesses and resulted in a crash.

What is driving the current bull market?

The current bull market, which completed its 8th anniversary on March 8, has been one of the most hated in history.

Robert C. Doll, CFA of Nuveen Asset Management said: “Since it began in early 2009, I have been fond of saying this was the least-believed bull market of my career.”

There are two types of bull markets. One is an interest-rate-driven bull market, and the other is an earnings-driven bull market.

The first phase of the current bull market was fueled by the expansionary monetary policy of the US Federal Reserve, which was later duplicated by most central banks in developed nations.

Most proponents of fundamental analysis missed the bus or exited early as they failed to see strong GDP growth or earnings expansion. The earnings recession, which started in the fourth quarter of 2014 and continued till the third quarter of 2016, did not help matters either.

StocksToTrade—now better than ever! We ushered in the New Year with some major advancements that include 3 unique features, exclusive to our Platform.

However, as Richard Bernstein, Chief Executive and Chief Investment Officer of Richard Bernstein Advisors says: “One of the most frustrating statements we hear is that bull markets are impossible without price/earnings ratios expanding.”

Expectations of the Next Leg of the Bull Market to be Buoyed by Earnings Growth

As the US Federal Reserve has embarked on a tightening cycle, the bulls don’t have the “Fed put” under them anymore. With interest rates rising, the next leg of the bull market will have to be fuelled by earnings growth.

For Q1 2017, S&P Global Market Intelligence expects S&P 500 earnings to expand to 10% from the 6% profit growth recorded last quarter.

Jeff Saut, chief investment strategist at Raymond James, wrote in an email: This is a “transition from an interest rate-driven to an earnings-driven secular bull market. The profit lows came in 2Q16,” reports CNBC. Hence, the next leg of the bull phase will have to be built on the fundamentals.

Fundamental Analysts Also Differ in Their Opinions

As fundamental analysis has many dependent factors and is not a complete science, different analysts differ in their opinion about the markets.

“Market valuations are still too expensive,” said Steve DeSanctis, equity strategist at Jefferies. “When the Fed hikes a third, fourth and even fifth time, performance starts to slip for the overall market,” reports CNBC.

On the other hand, the legendary investor Warren Buffet thinks otherwise. In a recent interview with CNBC, he said that “we (the US markets) are not in a bubble territory”. He went on to add that the U.S. stock prices are “on the cheap side”

So, who gets the cup? Sentiment or fundamentals?

As the famous Benjamin Graham said: “The day-to-day market isn’t a fundamental analyst; it’s a barometer of investor sentiment. You just can’t take it too seriously.”

The numerous crashes serve as proof that the market corrects the excesses caused by market sentiments. Similarly, the excesses show that the market sentiment takes over fundamentals more often than not.

For the short- to medium-term, market sentiment may prove to be superior to market or stock fundamentals. When the markets are in a grip of strong sentiment, it is fruitless to trade against the market using fundamentals.

You demanded it, and we delivered: StocksToTrade now offers Paper Trading and a new Trading Module. Our Paper Trading platform offers our customers a safe environment to practice trading without ever having to risk a cent of their capital to the market. By leveraging the real-time data provided with our service, the paper trading simulation offers an experience as close to real trading as possible. Learn more …

However, one must always keep in mind that sentiment can support the markets only for a limited duration if the fundamentals fail to catch up.

Hence, there is no clear winner. A smart investor will consider both the parameters before investing into the markets.

Comments