Introduction

Before diving into crypto investments, you have probably heard about their wild price swings. This volatility makes trends hard to predict. However, knowing the key factors influencing prices can give you an edge.

Crypto assets are notorious for their rapid price fluctuations. It’s common for them to rise by triple digits only to fall into the red soon after. This unpredictability makes it difficult to forecast movements, especially during sideways markets. Yet, understanding the factors that drive these changes can help investors be better prepared.

For example, Bitcoin's price can rise or fall by over 10% in a single day. These swings are even more pronounced with altcoins. Let’s explore what drives these volatile price movements.

Factors Influencing Crypto Asset's Prices

1. Economic Performance

Crypto assets, like other high-risk investments, often perform better in a thriving economy when investors are more willing to take risks. In economic downturns, risk appetite decreases, which can lead to lower crypto prices. Macroeconomic factors such as inflation, interest rates, and unemployment levels also play a significant role. For example, during times of high inflation, some investors turn to crypto as a hedge.

2. Supply and Demand

As with any asset, when the supply of a crypto asset exceeds its demand, prices drop. Conversely, when demand outpaces supply, prices rise.

Supply Side: Crypto asset supply is often fixed or capped, such as Bitcoin’s 21 million limit, which influences its scarcity and value over time. Events like Bitcoin halving reduce the supply and are often followed by price increases.

Demand Side: Demand is driven by factors such as utility, network effect, and innovation. For instance, Ethereum’s use as a decentralized platform for DApps boosts its long-term demand.

3. Government Regulations

Government policies have a significant impact on crypto markets. Regulations, whether favourable or restrictive, can influence investor sentiment and market prices. The introduction of crypto-friendly laws by various countries often results in a surge in the crypto market, while restrictive policies can trigger price declines and panic selling.

4. Market Sentiment and Social Media

Sentiment is often influenced by emotions rather than market fundamentals. Social media platforms, influencers, and news can create waves of fear (FUD) or excitement (FOMO) that impact prices. For example, Elon Musk’s tweets have famously caused Dogecoin’s price to skyrocket. Likewise, bad news or rumours can drive prices down.

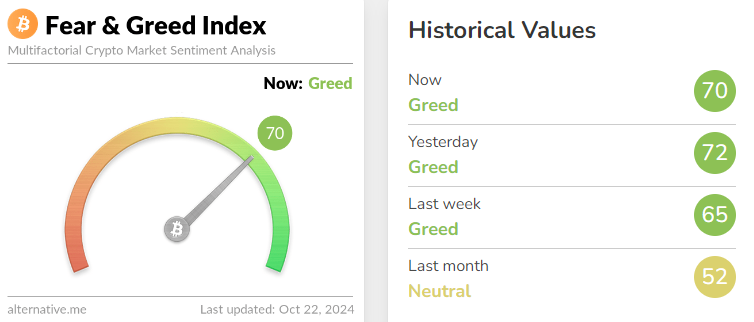

Sentiment can be gathered by tools like the Fear and Greed Index, which provides insight into whether the market is leaning bullish or bearish. Alternative.me is a popular tool to check sentiment.

It ranges from 0 to 100, with lower scores indicating fear and higher scores indicating greed.

5. Federal Bank Interest Rates

Federal interest rate changes have an inverse relationship with crypto prices. Higher interest rates reduce the appetite for high-risk assets like crypto assets, leading to price declines. For instance, the interest rate hikes in 2022 led to a prolonged bearish trend in the crypto market, as investors shifted their focus to safer, interest-bearing assets.

6. Technical Development

The technological evolution of blockchain platforms can affect the demand and price of crypto assets. Updates like Ethereum’s transition from Proof of Work to Proof of Stake reduce energy costs to 99.95% and improve scalability, making the token more attractive to investors.

Moreover, trading signals and automated strategies based on technical patterns (like golden crosses or short squeezes) can also influence buying or selling pressure, leading to sudden price movements.

7. Node Count and Listings

Node count reflects the number of active participants in a crypto’s network, which is an indicator of decentralization and network strength. A higher node count usually indicates a healthier network and can be a sign of future price growth. Listings on popular exchanges are another key factor. When a crypto asset is listed on major exchanges, its accessibility increases, often followed by a significant price spike.

Final Thoughts

While crypto prices can experience extreme fluctuations, these same price swings create unique trading opportunities for informed investors. Understanding the various factors that influence prices such as supply and demand, macroeconomic conditions, regulations, sentiment, and technological developments, can help you navigate the market effectively.

However, it is essential to conduct thorough research before making any investment decisions. The examples in this article are for informational purposes only and should not be considered financial advice. Given the inherent volatility, the value of crypto assets can increase or decrease significantly, and there is always a risk of losing your entire investment. Remember, past performance is not indicative of future results.

Download KoinBX Android App | Download KoinBX iOS App

Disclaimer: Any financial and crypto market information shared should not be considered investment advice. It is for informational purposes only. Conduct your own research before making investment decisions. Crypto trading is unregulated and highly risky. There may be no regulatory recourse for any loss of such transactions.

Comments