Rutile Market 2024-2032:

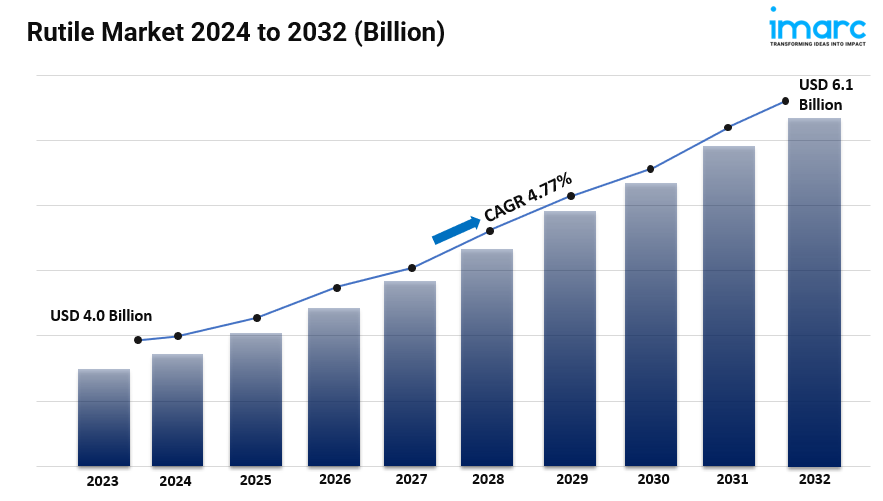

- The global rutile market size reached USD 4.0 Billion in 2023.

- The market is expected to reach USD 6.1 Billion by 2032, exhibiting a growth rate (CAGR) of 4.77% during 2024-2032.

- Asia Pacific leads the market, accounting for the largest rutile market share due to rapid industrialization.

- Synthetic rutile accounts for the majority of the market share in the type segment owing to its high purity and suitability.

- Automotive holds the largest share in the rutile industry as this sector relies on rutile-based coatings and pigments.

- The rising product demand in the paints and coatings industry across the globe is a primary driver of the rutile market.

- The increasing product usage in the plastics industry and significant growth in the cosmetics sector are reshaping the rutile market.

Request for a sample copy of this report: https://www.imarcgroup.com/rutile-market/requestsample

Industry Trends and Drivers:

- Rising Demand in the Paints and Coatings Industry:

The paints and coatings industry represents one of the largest consumers of rutile, particularly due to its titanium dioxide (TiO₂) content, which is boosting the market share. Rutile's high refractive index makes it an ideal pigment that provides exceptional opacity, brightness, and color retention, which are critical for quality paint products. Titanium dioxide from rutile enhances the coverage and durability of paints, reducing the need for multiple coats and ensuring long-lasting finishes. As construction activities rise worldwide, the demand for advanced architectural coatings is increasing, particularly in emerging economies, where urbanization is accelerating. Automotive manufacturing also relies heavily on rutile-based paints due to their ability to withstand harsh weather conditions, ultraviolet (UV) exposure, and environmental pollutants, ensuring longevity in vehicle aesthetics.

- Increasing Usage in the Plastic Industry:

According to the latest market trends, rutile plays a critical role in the plastics industry, where it is valued as a titanium dioxide pigment that enhances durability, color vibrancy, and UV resistance. Plastics formulated with rutile-based titanium dioxide gain resilience against yellowing and deterioration caused by sunlight, which is essential for products like outdoor furniture, automotive parts, and packaging. In the packaging industry, particularly for food products, rutile’s opacity helps reduce light penetration, thereby prolonging shelf life and preserving contents. The automotive and consumer goods sectors also demand rutile-modified plastics for components that need to retain color and strength under various environmental conditions. As demand grows for durable, UV-resistant plastic materials, manufacturers are increasingly using rutile as an additive, contributing to significant growth in this sector.

- Growth in the Cosmetics Sector:

The cosmetics industry is another key factor boosting the rutile market size, particularly with the rising trend toward natural, mineral-based products. Rutile's titanium dioxide is widely used in cosmetics as a safe, skin-friendly pigment that provides a brightening effect without harsh chemicals. It is commonly found in products such as foundations, sunscreens, and powders, where it not only improves product color but also provides a natural sunscreen effect, protecting skin from harmful UV rays. As consumers become more aware of skincare ingredients, the demand for cosmetics with high-quality, non-toxic components is increasing. Rutile is especially favored in “clean beauty” formulations due to its mineral origin and effectiveness in UV protection, an essential feature as awareness of sun damage grows.

Rutile Market Report Segmentation:

Breakup By Type:

- Natural Rutile

- Synthetic Rutile

Synthetic rutile accounts for the majority of shares due to its higher purity and suitability for use in producing high-grade titanium dioxide for various industrial applications.

Breakup By End User:

- Plastics and Papers

- Paints and Coatings

- Automotive

- Food

- Others

Automotive dominates the market as it heavily relies on rutile-based coatings and pigments for durability and aesthetic purposes.

Breakup By Region:

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- North America (United States, Canada)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others)

- Middle East and Africa ( Turkey, Saudi Arabia, Iran, United Arab Emirates, Others)

Asia Pacific holds the leading position owing to rapid industrialization, expanding automotive manufacturing, and increasing infrastructure development.

Top Rutile Market Leaders:

The rutile market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies.

Some of the key players in the market are:

- East Minerals

- Iluka Resources Limited

- IREL (India) Limited

- Kerala Minerals & Metals Ltd

- Shanghai Yuejiang Titanium Chemical Manufacturer Co. Ltd.

- Sierra Rutile Limited

- V.V Mineral

Ask Analyst Browse full report with TOC List of Figures: https://www.imarcgroup.com/request?type=report&id=10804&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Comments