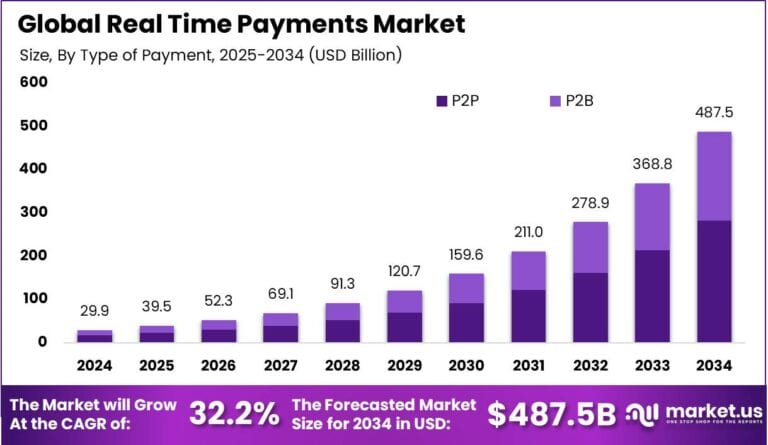

The Global Real Time Payments Market size is expected to be worth around USD 487.5 Billion By 2034, from USD 29.9 Billion in 2024, growing at a CAGR of 32.20% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific led the real-time payments market with over 38% market share and USD 11.3 billion in revenue. China’s market was valued at USD 3.7 billion, reflecting rapid advancements in digital payment infrastructure, with a CAGR of 28.3%.

Real-Time Payments Market

The Real-Time Payments (RTP) market refers to the network infrastructure and digital systems that enable money transfers to be initiated and settled instantly, 24/7, 365 days a year. Unlike traditional payment systems that take hours or even days to process, RTP systems offer immediate fund availability, full transaction visibility, and improved cash flow management. Businesses, financial institutions, and governments worldwide are embracing RTP to meet consumer demand for speed, security, and transparency in transactions. With rising digital transformation and a global shift toward contactless and mobile payments, the RTP market is experiencing robust momentum.

Real-Time Payments Market Demand Analysis and Driving Factors

The surge in demand for real-time payments is strongly influenced by changing consumer expectations, growing e-commerce penetration, and the rise of mobile banking. One of the top driving factors is the need for immediate financial settlement in both B2B and P2C transactions. The pandemic further accelerated digital payment adoption, pushing institutions to re-evaluate their legacy systems. Increasing smartphone usage and high-speed internet availability have also played a crucial role in fueling demand. Enterprises now require real-time payment capabilities to manage liquidity better and maintain a competitive edge in fast-paced economies.

Increasing Adoption of Real-Time Payment Technologies

Banks and fintech firms are investing in advanced RTP platforms powered by APIs, AI, machine learning, and blockchain to enhance transaction speed and security. Cloud-native RTP solutions are being widely adopted due to their scalability and cost-efficiency. These technologies support faster onboarding, intelligent fraud detection, and seamless integration into mobile apps and POS systems. The adoption is also spreading rapidly among small and medium enterprises seeking affordable yet agile payment solutions.

Key Reasons for Adoption

The core reasons organizations are adopting RTP include the desire for faster settlement cycles, improved customer satisfaction, reduced payment fraud, and enhanced control over cash flows. Real-time visibility into transactions allows businesses to make smarter, quicker financial decisions. Consumers, on the other hand, benefit from instant access to funds, reducing the risk of overdrafts or missed payments. The ability to automate reconciliation and reduce operational bottlenecks is another key motivator for enterprises.

Comments