India Adhesives Market Overview

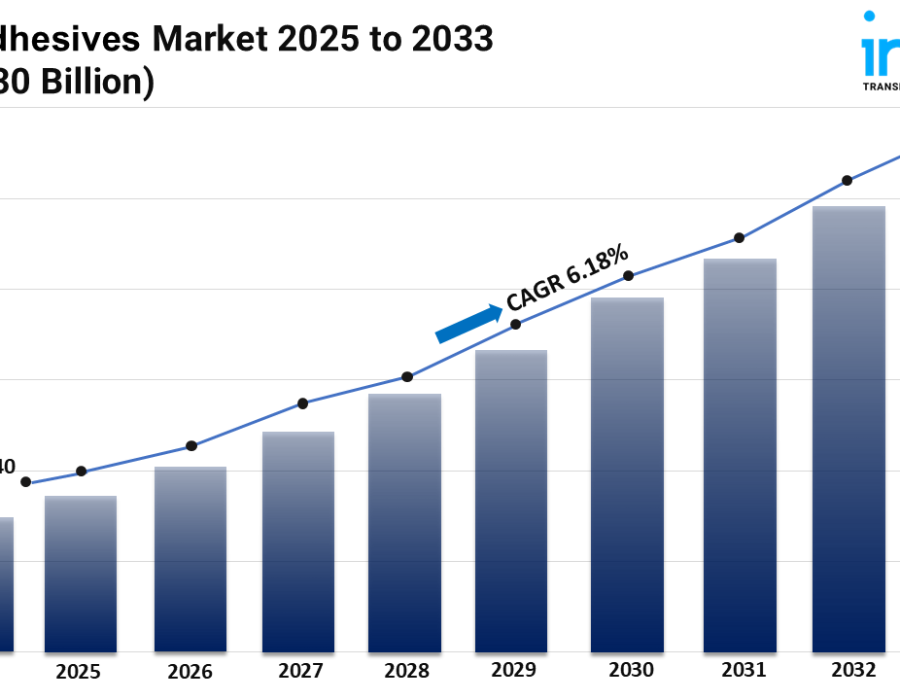

Market Size in 2024: USD 2.40 Billion

Market Forecast in 2033: USD 4.30 Billion

Market Growth Rate: 6.18% (2025-2033)

According to the latest report by IMARC Group, the India adhesives market size reached USD 2.40 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.30 Billion by 2033, exhibiting a growth rate (CAGR) of 6.18% during 2025-2033.

India Adhesives Industry Trends and Drivers:

The India adhesives market is experiencing robust growth, primarily driven by the increasing demand across various end-user industries, such as automotive, construction, packaging, and electronics. The automobile industry, in particular, is seeing significant adoption of advanced adhesives due to their ability to enhance product durability and performance. Manufacturers are increasingly relying on adhesives to replace traditional mechanical fasteners, improving the structural integrity of vehicles while reducing weight. The construction sector is also fueling demand, with adhesives being used in everything from flooring to insulation materials. These trends are being driven by the need for more efficient, sustainable, and cost-effective bonding solutions that support the rapid expansion of infrastructure projects.

Moreover, the growing emphasis on environmentally friendly products is pushing the adhesives market toward innovation. The development of eco-friendly, high-performance adhesives is responding to the rising demand for sustainable materials in various industries. These adhesives are formulated to meet stricter environmental regulations while offering the same, if not superior, performance compared to traditional adhesives. Innovations in resin and technology are helping meet the market's demand for products that not only improve efficiency but also adhere to sustainability goals. The growing adoption of smart adhesives, which offer enhanced functionality, is also contributing to the expansion of the market. These adhesives have applications across a range of industries, from packaging to electronics, where smart technology is becoming an integral part of product development.

Technological advancements and regulatory developments are further supporting the market's growth trajectory. Industrial automation is driving the need for adhesives that can improve manufacturing efficiency and product quality. Additionally, the tightening of environmental laws is encouraging companies to seek out adhesives that are more energy-efficient and less harmful to the environment. With infrastructure projects continuously expanding and the demand for high-performance adhesives rising, the India adhesives market is well-positioned for future growth. Manufacturers are investing heavily in R&D to meet the evolving needs of industries, positioning India as a major player in the global adhesives market. This dynamic combination of technological, environmental, and industry-specific drivers is setting the stage for long-term market expansion.

Download sample copy of the Report: https://www.imarcgroup.com/india-adhesives-market/requestsample

India Adhesives Industry Segmentation:

The report has segmented the market into the following categories:

Technology Insights:

- Hot Melt

- Reactive

- Solvent-borne

- UV Cured Adhesives

- Water-borne

Resin Insights:

- Acrylic

- Cyanoacrylate

- Epoxy

- Polyurethane

- Silicone

- VAE/EVA

- Others

End User Industry Insights:

- Aerospace

- Automotive

- Building and Construction

- Footwear and Leather

- Healthcare

- Packaging

- Woodworking and Joinery

- Others

Regional Insights:

- North India

- South India

- East India

- West India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

India Adhesives Market News:

- In April 2024, Toyo Ink India, a Japanese artience Co., Ltd. subsidiary, revealed plans to double its Gujarat plant, raising solvent-based adhesive output 3.5 times by 2026. The expansion aims to capture increasing demand in automotive interior, home appliances, and labels markets, seeking a 30% market share in India's adhesive market.

- In April 2024, Pidilite Industries introduced Fevikwik Precision Pro, Fevikwik Gel, Fevikwik Advanced, and Fevikwik Craft, making repair experiences better for consumers. These products provide precise application, spill-free usage, waterproof bonding, and crafting ease, supporting Fevikwik's leadership in India's instant adhesive market.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=29308&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Comments