Delayed payments can strangle your cash flow. Chasing down customers, sending follow-ups, and manually updating records drains valuable time from your finance team.

That’s why automating your accounts receivable (AR) isn’t just smart—it’s necessary.

With the right tools in place, businesses are now collecting payments twice as fast — improving financial stability and reducing time spent on manual tasks.

What Is Accounts Receivable Automation?

Accounts receivable automation is the process of using software to handle tasks like:

- Creating and sending invoices

- Tracking due and overdue payments

- Sending automated reminders

- Reconciling payments with invoices

- Providing online payment options

Instead of juggling spreadsheets or chasing emails, AR automation streamlines the entire invoice-to-cash cycle.

Benefits of Automating Your Accounts Receivable

🚀 Faster Collections

Automation tools send invoices instantly and trigger follow-up reminders automatically—reducing the risk of forgotten or late payments.

🕒 Save Time & Reduce Manual Work

Free up your finance team from repetitive data entry and payment tracking. Automation handles it, so your team can focus on strategy, not spreadsheets.

📈 Improve Cash Flow

Quicker collections mean more predictable cash inflows. That gives you better control over budgeting, payroll, and growth investments.

🤝 Stronger Customer Relationships

Polite, consistent automated reminders reduce awkward follow-ups and improve the customer experience with transparency and professionalism.

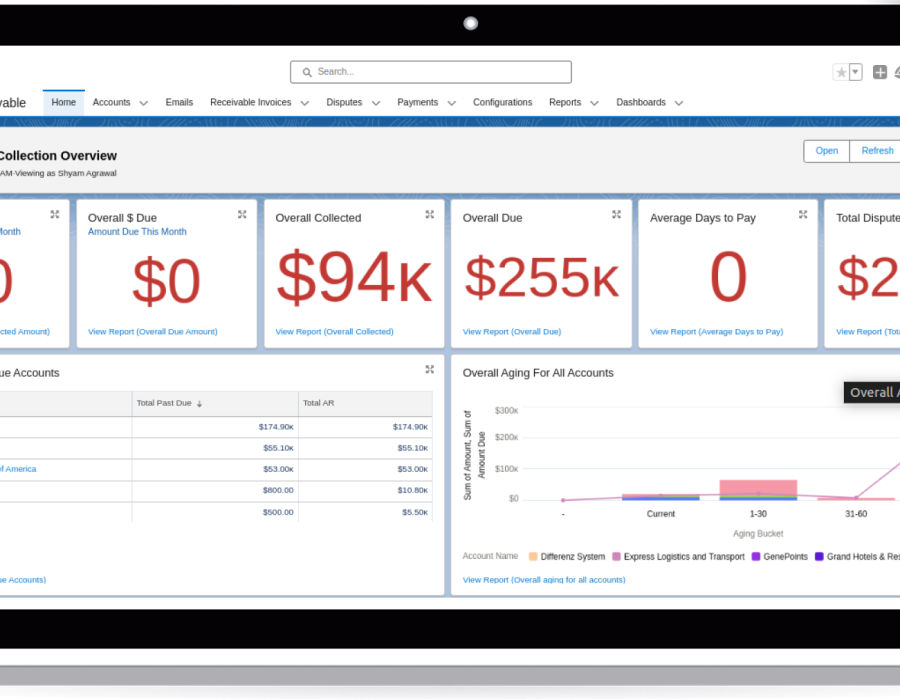

🧠 Real-Time Insights

Get a bird’s-eye view of who owes you, what’s overdue, and what’s been collected—all in real time.

Features You Should Look For in AR Automation Software

- Automated invoicing & scheduling

- Custom payment reminders

- Online payment portals (ACH, cards, wallets)

- Customer self-service access

- Invoice tracking & status updates

- Accounting system integration

- Multi-currency support for global clients

- Reporting & analytics dashboards

Why Businesses Are Making the Switch

Manual receivables management often leads to:

- Delayed payments

- Lost invoices

- Human error in records

- Slow dispute resolution

- Strained customer relationships

By automating AR, businesses not only reduce days sales outstanding (DSO) but also position themselves for sustainable, cash-positive growth.

Real Results: 2× Faster Collections

Many businesses that adopt AR automation report collecting payments up to 2x faster compared to manual methods.

That means:

- More working capital on hand

- Reduced borrowing or credit reliance

- Fewer overdue accounts

Final Thoughts

In today's economy, every day a payment is delayed is a missed opportunity. By automating your accounts receivable process, you're not just making life easier for your team—you’re securing your business’s financial future.

Ready to speed up your collections and eliminate manual chasing?

Start automating your accounts receivable and watch your cash flow turn from slow to steady.

Comments