Adaptive Cruise Control Market 2024-2032:

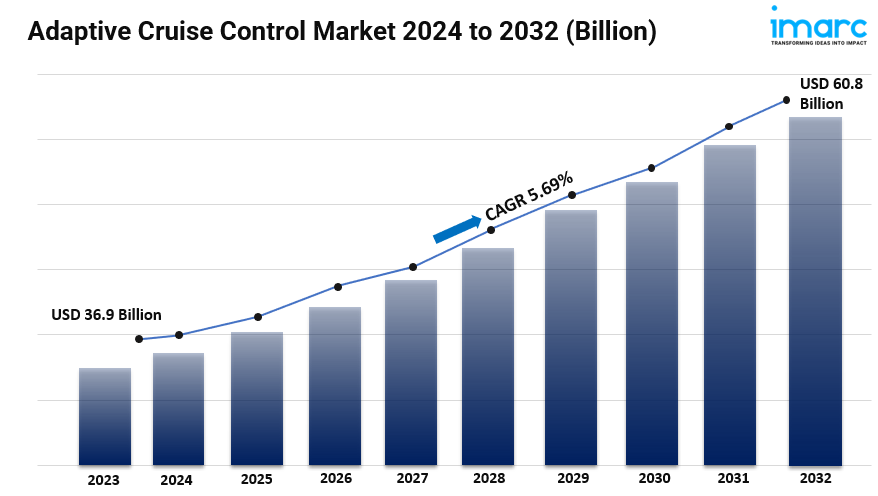

- The global adaptive cruise control market reached USD 36.9 Billion in 2023.

- The adaptive cruise control market size is expected to reach USD 60.8 Billion by 2032, exhibiting a growth rate (CAGR) of 5.69% during 2024-2032.

- North America leads the market, accounting for the largest adaptive cruise control market share.

- RADAR accounts for the majority of the market share in the technology segment because it can accurately determine a vehicle’s speed and distance in a variety of weather conditions.

- Passenger cars hold the largest share in the adaptive cruise control industry.

- OEMs remain a dominant segment in the market because the main purpose of ACC is to satisfy customer and regulatory requirements during the manufacturing process.

- Growing consumer demand for semi-autonomous driving features is pushing automakers to incorporate adaptive cruise control in more vehicle models to enhance driving comfort and convenience.

- Additionally, increased urbanization and traffic congestion, as they help reduce driver fatigue in stop-and-go traffic conditions, are aiding the market growth.

Request for a sample copy of this report: https://www.imarcgroup.com/adaptive-cruise-control-market/requestsample

Industry Trends and Drivers:

- The increasing demand for advanced driver assistance systems (ADAS):

ADAS features are increasingly becoming standard in modern vehicles, driven by consumer demand for enhanced convenience and safety in their driving experience. ACC, as a prominent ADAS feature, automatically adjusts a vehicle’s speed to maintain a safe following distance from other vehicles, providing a more comfortable driving experience, particularly on long journeys or during traffic congestion. Consumers increasingly expect their vehicles to be equipped with ADAS technologies, especially as awareness grows about the benefits of features like ACC. This expectation has influenced automobile manufacturers to incorporate ACC into new models, and the demand has been particularly strong in developed markets where consumer awareness and willingness to pay for advanced vehicle features are high, thus bolstering the market growth.

- Heightened emphasis on vehicle safety:

Regulatory bodies worldwide are setting stricter safety standards, urging automakers to adopt advanced safety technologies. ACC improves road safety by minimizing the risk of rear-end collisions, a common cause of traffic accidents, especially during high-speed driving or sudden braking. Governments and safety organizations are increasingly advocating for technologies like ACC that can potentially reduce human errors in driving. In response, car manufacturers are prioritizing safety features as key differentiators in their models, viewing ACC as a critical addition to vehicle safety. These safety regulations have been especially impactful in Europe and North America, where the integration of ACC and other ADAS features is becoming mandatory in certain vehicle categories, further contributing to the market growth.

- Advancements in sensor and AI technology:

Advancements in sensor and artificial intelligence (AI) technology are playing a critical role in the development and refinement of ACC systems, making them more reliable and accessible for mass-market vehicles. ACC systems rely on sensors such as radar, lidar, and cameras to detect other vehicles and obstacles, and advancements in these technologies have made ACC systems more accurate, responsive, and efficient. The integration of AI enables ACC systems to interpret data from these sensors in real-time, allowing the system to adapt to changing driving conditions more effectively. Innovations in sensor technology have also reduced production costs, enabling ACC to be included in more mid-range and entry-level vehicles, further strengthening the market growth.

Adaptive Cruise Control Market Report Segmentation:

Breakup By Technology:

- Light Detection and Ranging (LiDAR) Sensors

- Ultrasonic Sensors

- Image Sensors

- Laser Sensors

- RADAR Sensors

RADAR accounts for the majority of shares due to its high accuracy in detecting vehicle distances and speed in various weather conditions.

Breakup By Vehicle Type:

- Commercial Vehicles

- Passenger Cars

Passenger cars dominate the market as ACC is increasingly becoming a standard feature in consumer vehicles, driven by rising demand for driver assistance systems.

Breakup By End Use:

- OEMs

- Aftermarket

OEMs hold the majority of shares because ACC is primarily installed during the manufacturing process to meet consumer and regulatory demands.

Breakup By Region:

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- North America (United States, Canada)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others)

- Middle East and Africa ( Turkey, Saudi Arabia, Iran, United Arab Emirates, Others)

North America holds the leading position due to strong regulatory support for vehicle safety, high consumer adoption of ADAS technologies, and a well-established automotive industry.

Top Adaptive Cruise Control Market Leaders:

The adaptive cruise control market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies.

Some of the key players in the market are:

- Continental Ag

- Ford Motor Company

- Hella KGaA Hueck & Co. (Faurecia SE)

- HL Mando Corporation

- Magna International Inc.

- Robert Bosch GmbH

- Valeo

- ZF Friedrichshafen AG

Ask Analyst & Browse full report with TOC List of Figures: https://www.imarcgroup.com/request?type=report&id=7184&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Comments