Setting a wedding budget is one of the first—and, frankly, most important—planning tasks to complete. After all, you can't move forward with your vision until you know how much money you have to spend. But if you've been avoiding your wedding budget because it's stressing you out, we're here to help. It's no secret that wedding budget planning can feel daunting, particularly because weddings are expensive. In fact, The Knot 2021 Real Weddings Study found that the average cost of a wedding is $28,000 (excluding the engagement ring). If you've never hosted an event of comparable size before, the financial aspect might feel like a completely new world of terminology and rules. We'll let you in on a secret, though: Making your wedding budget doesn't have to be hard or scary. It can actually be downright simple, especially with the help of our comprehensive wedding budget breakdown.

Unlike other financial management tools out there, we have direct insight into what a typical wedding budget looks like for real couples just like you. Thanks to our annual Real Weddings study, we've created a wedding cost breakdown that's based on actual data—and we're revealing it right here. Consider this the ultimate destination for wedding budget planning.

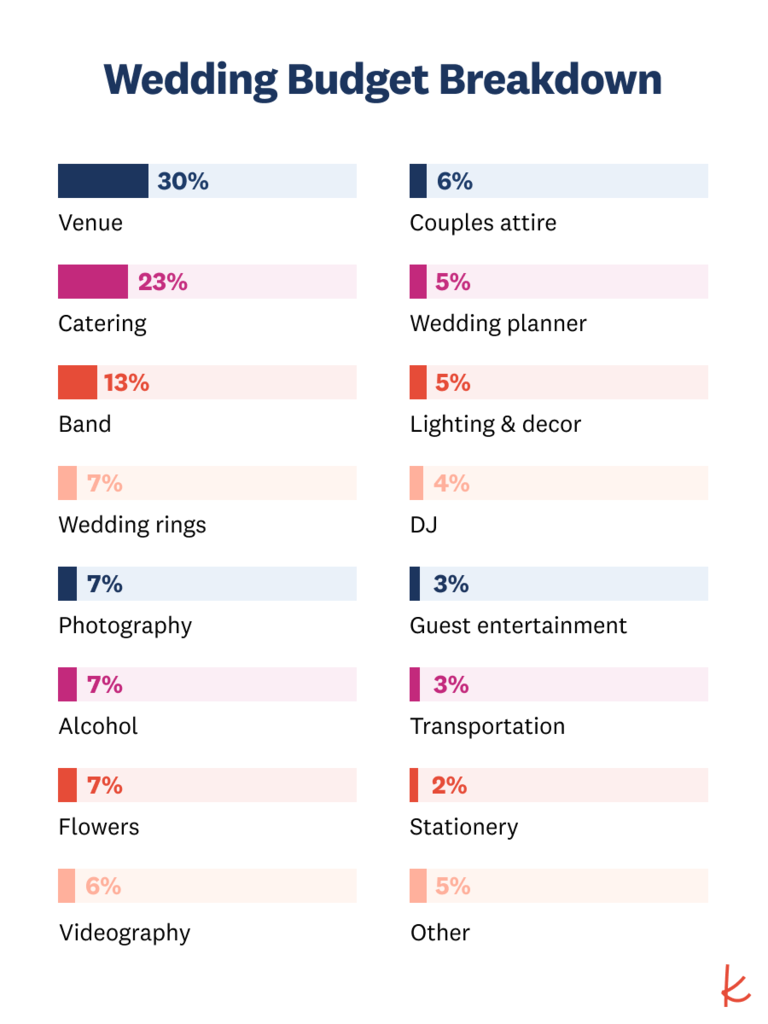

Below, you'll find a sample wedding budget breakdown with percentages pulled directly from our insights, which will help you determine how to allocate the funds you have available. Plus, we share the most important things to consider when making your budget, along with nine common mistakes to avoid, straight from industry experts. Finally, click here for even more savings tips and discounts on wedding planning essentials (like save-the-dates and invitations).

Wedding Budget Breakdown

When creating your wedding budget, it can be helpful to use a sample as a guide. And if you're a visual learner, seeing wedding budget percentages will help you understand exactly where to allocate various dollar amounts. Here, we've compiled a complete wedding budget checklist, which highlights the top expenses to include in your list. This wedding budget breakdown also indicates the general percentage each element should contribute to your overall spend, which we've calculated using our data from The Knot 2021 Real Weddings Study.

It's important to note, though, that this wedding cost breakdown is based on national averages and should simply be used as a starting point. You might also notice that the percentages don't add up to 100%—and that's on purpose! Your final wedding cost breakdown ultimately depends on a number of factors, like how much money you and your S.O. have to spend, the location and time of year you're getting married, and your top priorities. This will inform which expenses you ultimately include in your budget... which will be different for every couple. This wedding budget breakdown is simply to be used as a starting point to give you a general understanding of how to allocate your funds.

Venue: 30%

Unsurprisingly, the biggest chunk of your wedding budget will go to the biggest investment, which is often the venue. Our study found that couples typically spend about 30% of their overall budget on the setting of their nuptials.

Catering: 23%

Catering is another big-ticket item, taking up about 23% of the average wedding budget. (This is the cost-per-head for food items at your reception.) Depending on packages offered by your venue, this element may include alcohol and a cake. Some couples, though, opt to budget for those separately.

Band: 13%

Live entertainment will make your wedding day that much more memorable. Couples who choose to have a live band typically allocate 13% of their wedding budget breakdown to their performers.

Wedding Rings: 7%

Pro top: Don't forget to include rings in your wedding budget checklist. Excluding the engagement ring, we found that couples usually spend about 7% of their budget on wedding bands.

Photography: 7%

Photography is one of the best investments for your wedding. Great photos will last a lifetime and become prized keepsakes from the big day, making this a splurge-worthy purchase. To-be-weds usually spend about 7% of their wedding budget on their photographer.

Alcohol/Liquor: 7%

If your wedding venue package doesn't cover alcohol and you're planning on incorporating it into your nuptials, we recommend slotting about 7% of your budget toward this expense.

Flowers: 7%

Flowers can completely transform the look of your wedding. Plus, many couples opt to carry bouquets or wear boutonnieres too. We found that, on average, 7% of the wedding budget is dedicated to florals.

Videography: 6%

Much like pictures, a video will also memorialize your wedding day. We're big proponents of investing in a wedding videographer, because nothing will bring back your favorite wedding memories quite like a short film. If your wedding budget planning allows, we recommend setting aside about 6% for a videographer.

Couples Attire (Dress & Suit): 6%

Your outfits are key components of your overall wedding budget. Our data shows that couples typically slot 6% of their budget on their attire. This percentage should include the cost of the wedding dress and/or suit, along with shoes and any accessories, such as jewelry or cufflinks.

Wedding Planner: 5%

A wedding planner can make all the difference when it comes to your special day. After all, you can rest easy knowing that your celebration will go off without a hitch when you have a great professional taking care of all the details. Save 5% of your total budget to cover the cost of a wedding planner.

Lighting & Decor: 5%

In addition to flowers, lighting and decor are impactful ways to personalize the look of your wedding. This includes everything from candles to statement lighting installations, as well as signage, table displays, non-floral centerpieces, and other decorative elements. Use about 5% of your budget on these accents.

DJ: 4%

For those that want a DJ handling entertainment, we suggest using about 4% of your budget to cover their fees.

Guest Entertainment: 3%

Guest entertainment is an extra element of the wedding budget breakdown to consider if you have leftover funds available. This includes unique experiences, like live painters, dancers, additional musical performers, poets, tarot card readers, caricature artists, interactive food or drink servers, and more—the sky is truly the limit. Set aside 3% of your budget for this fun addition.

Transportation: 3%

Many couples like to hire transportation to ensure their guests get to the right venue at the right time. This may involve hiring a bus or shuttle to run to and from the hotels. Others like to hire a limo for the wedding party or an elaborate getaway car after the reception. Save at least 3% of your wedding budget for transportation.

Stationery: 2%

Wedding invitations and paper goods are very important details of your nuptials. Just think, your save-the-date cards and formal invitations are the first glimpses of your wedding that your guests will receive. This stationery budget will also cover your ceremony programs, menus, thank-you cards and more. Reserve 2% of your budget for your stationery suite.

Hair & Makeup: 2%

Earmark at least 2% of your budget for your hair and makeup. And while you certainly don't have to cover the cost of HMU for your bridesmaids or additional wedding party members, it's something to keep in mind when building out this portion of your wedding budget breakdown

Cake/Desserts: 1%

It's true that some venues include wedding cake or other sweet treats within their packages, but it's common for couples to outsource the dessert portion of their wedding. Whether you're planning to have a traditional cake or a spread of alternative sweets, use about 1% of your wedding budget here.

Wedding Favors & Gifts: 1%

One of the final pieces of your wedding budget breakdown includes the cost of party favors and gifts for those who made your day extra special. Some couples like to provide their guests with a parting gift to remember their wedding by. It's a small gesture that will go a long way. Set aside about 1% of your budget for these items.

Officiant: 1%

If you're hiring an officiant to legally marry you during the wedding ceremony, allocate 1% of your budget to cover these costs.

What to Consider When Allocating Your Wedding Budget

Now that you know what a typical wedding budget breakdown looks like, it's crucial to familiarize yourself with the top things to keep in mind when allocating your funds. As mentioned above, a number of factors go into how you actually spend your money. This means that no two wedding budgets will look the same. Here are five key factors to consider when determining how to allocate your wedding budget.

What You Can Afford

It's imperative to be honest about your wedding day expectations from the start. What you can actually afford will impact how you spend your budget. "The best way to stay on budget is to be realistic about what you are willing to pay each step of the way, from the venue to the vendors to your dress and accessories," explains Kristen Gall, retail expert and president of Rakuten Rewards. "Couples may need to compromise and cut back on spending in one area to get what they want in another. For example, you might cut back on the floral spend to account for your catering bill." Sit down with your S.O., as well as anyone else who might be financially contributing to your wedding, and have an honest conversation about what you have to spend, and how you should prioritize the investments.

The Guest List Size

The size of your wedding has a massive impact on the amount you'll spend. There's a per-head cost for food and liquor, and these two are typically the biggest expenses of the whole wedding. As a result, changing the guest list size is the surest way to increase or decrease your costs. Plus, with a smaller wedding, you'll save more on other details, including decor, stationery, favors and rentals, because you won't need as much of everything.

The Venue

Some cities and towns are just more expensive than others. New York, Chicago and Los Angeles are the obvious culprits, but small towns and remote destinations can entail greater costs if things like flowers and talent have to come from afar. Tourist towns can also up your wedding price tag during peak travel season. Likewise, certain venues are more expensive than others. Some—such as a city park—come with no (or low) fees, while others, like a grand ballroom, might cost you the equivalent of a year's college tuition. Also, be aware that many popular locations have headcount minimums, meaning they won't host a wedding that's too small, and some may also have a per-head minimum that requires your event to be a certain size.

The Date and Time

Highly sought-after seasons and days of the week are pricier for obvious reasons. An event hosted in the middle of wedding season, which spans from May through October, will likely come with higher costs. An evening wedding reception is usually more expensive than a brunch or afternoon reception, not only because of higher catering costs for dinner, but also because people tend to drink less during the daytime. Plus, many couples choose to go more low-key on elements like lighting, music and decor. Similarly, weddings on Saturdays and Sundays tend to be more costly than those hosted on a weekday.

The Wedding Style

Generally speaking, the more formal the affair, the more expensive. This is because you might find yourself matching the site, food and musical entertainment to the overall upscale tone. The outlay for a full six-course meal is typically greater than for a cocktail soirée with mostly hors d'oeuvres; the fee for a 12-piece band is greater than that for a DJ or quartet; all-out decor like lighting, specialty linens and dramatic floral displays also will run up the bill.

Common Wedding Budget Mistakes to Avoid

As a budding wedding budget expert, you're well on your way to completing your expense breakdown. The final wedding budget planning step is to familiarize yourself with potential blunders you'll want to avoid. Here's the good news: We know the most common wedding budget planning mistakes couples often make, which means we can help prevent you from doing the same. Below, we explain where people go wrong, and how to avoid doing it yourself.

1. Not Allocating Funds Correctly

When it comes to financing a wedding, figure out how much you need to spend to get what you want. Set your expectations accordingly, and use our budget breakdown above as a guide. Plus, if you're paying for the honeymoon yourselves, remember to budget for that as well… or set up a honeymoon fund on your registry to crowdsource some extra cash. You'll be thankful you did!

2. Not Keeping Track of Your Spending

Put your accounting skills to the test by deciding on a budgeting system to track all the money coming in and out. The easiest way? The Knot Wedding Budget Planner, which automatically tells you how much you should be spending on everything from music to mother-in-law gifts, and allows you to track all your payments and their due dates. Otherwise, you can put all your info in an old-fashioned Excel spreadsheet. Just make sure you record every payment, because organization is key for keeping your wedding expenses breakdown organized.

Schedule frequent check-ins with your fiancé, as well as anyone else financially contributing to your big day, to ensure everyone is on the same page and your spending is on track. "I recommend that you sit down for a monthly reconciliation to document what was spent out of your budget," says Andrew Westlin, Certified Financial Planner at Betterment. "That also gives you and your partner dedicated time to discuss and align on your plan."

3. Forgetting to Budget for Hidden Costs & Extras

Knowing all the costs upfront will guarantee that your wedding budget can actually cover it all. Of course, it's nearly impossible to budget for every single unforeseen hidden cost, but having some extra space built out in your budget will save you in the long run. "Even the best planners who budget early on might forget to add items or will inevitably have things they need to add on," Westlin adds. "A buffer gives you flexibility which is such a powerful tool when it comes to financial planning."

We recommend researching potential hidden fees that can add up over time to prevent unexpected surprises. Here are five common extras to keep in mind:

- Overtime: If the party's still going strong on the dance floor, an extra 45 minutes may whiz by—but you'll pay in overtime costs for everyone from the photographer to the venue manager. If you suspect the wedding may go long, work overtime costs into your budget. And if you don't use it, it'll be a nice surprise chunk of cash.

- Service fees: The "service charge" is an additional fee venues charge to cover their own cost of hiring servers, coat checkers, and bathroom and parking attendants, which typically amounts to 20%-25%of the event's total food and drink fee.

- "Free" trials: A florist's demo may be gratis the first time, but if you make repeated changes, you risk being billed. And you'll definitely want to factor in your hair trial with your stylist into your overall hair budget.

- Extra decorations: Things like stamps for the RSVP cards, ribbons for the favors and marriage license fees seem so small that you can shrug them off, but like any costs, they add up. Going "just over budget" in a few different categories with a vague plan of making it up somewhere else can push you past your limit.

- Gratuities and vendor tips: From the sexton who cleans the church to the hotel steward who delivers your welcome bags, even conservative tipping can add hundreds to your wedding cost. Make sure to account for these costs in your initial budget. You should also set aside at least $800 for gratuities (the additional amount given to your wedding vendors for their hard work). As with a waiter or your hairdresser, tips are generally expected unless you're unhappy with the service.

4. Not Allowing Room for Overspending

Here's the one wedding budget hack you need: If you account for budget overages, then you never actually blow your budget. "Going over your wedding is likely in 2022 more than ever due to inflation and an increase in goods due to supply chain issues," warns Gall. "Couples should plan ahead by aligning on what they are willing to spend, including the max that they will spend for each vendor, and cross-reference that with their overall budget."

Try to earmark 5% of your budget for unforeseen costs. Here are three areas where you might go over: flowers (a last-minute realization that something previously unconsidered needs to be decorated, or a request that an additional family member wears a boutonniere or corsage); weather-related expenses (umbrellas for a rainy day, space heaters for an unseasonably cool day or additional shade for a particularly hot or humid one); and small accidents (a gown that needs last-minute spot removal, something that breaks in the days before the ceremony or menus that get damp and need to be reprinted).

5. Not Taking Advantage of Rewards Programs

Take advantage of budgeting and money management tricks along the way. Put all your wedding money in one separate account, so you can easily track additions and withdrawals without getting it confused with the rest of your day-to-day funds. We also recommend familiarizing yourself with the best credit cards for wedding planning and opening an account with the one best fit for your needs. Then, pay for as many of your expenses as possible on one credit card that offers benefits like mileage, rewards or cashback. Make sure everyone making purchases (your partner, mom and so on) is all on the same card system, allowing you to benefit from the rewards and also from the easy tracking of your purchases. To avoid credit card fees, pay the bill off in full each month.

Gall also suggests using smart-shopping programs to make the most out of your purchases. "Use cash-back programs, like Rakuten, on your wedding purchases," she recommends, noting that such sites offer this benefit on top of deals and credit card rewards. "These programs are a great way to maximize savings."

6. Not Discussing Priorities from the Start

Whatever your budget, you don't have to resort to last-minute DIY projects to come in on target. Instead, be honest about what's most important to everyone involved up-front. Pick your top three priorities and allocate a little extra money for them (such as your attire, catering and band). Next, pick the three things that come lowest on your priority list and budget accordingly.

Also, note that glamorous details on items you're indifferent about spike costs without adding any fun to your day. Free yourself of the pressure to upgrade and instead make honest choices based on what you want. As a general rule, before you sign a contract, look through the itemized list of what you're buying and ask yourself, "Will anyone notice if we don't do this?"

Keeping your priorities in check is the best way to avoid taking on too much debt as well. "You don't want to enter your marriage by taking on debt, as it can cause stress," warns Westlin. "Your wedding is an incredible life milestone, but you need to have a realistic understanding of your financial picture and also prioritize what is most important."

7. Not Being Tough on the Guest List

It can be challenging, but one of the fastest and most effective ways to lower your wedding cost is to pare down the invitees. At $100 a head, taking 10 guests off the guest count saves $1,000. Also, consider the size of your wedding party; Gifts and transportation are cheaper for three than for ten.

8. Forgetting to Invest in Insurance

If the COVID-19 pandemic taught us anything, it's that special event insurance is absolutely worth the investment. "Special event coverage that protects in the event of a cancellation or postponement—for whatever reason—is important to consider," says Laura Piwinski, Insurance Product Director at Lemonade. She notes that insurance (such as liability coverage) is particularly important for any wedding events held at home, like a backyard ceremony. But beyond that, some vendors will require insurance coverage too.

Even if it seems like wedding insurance is one area you can skip, consider the mental benefits of knowing your big day will be protected no matter what. "The sense of security insurance provides, like knowing deposits or non-refundable payments are covered, will make the planning process that much easier," Piwinski adds.

9. Not Being Realistic

As mentioned above, it's easy to oversimplify some of the financial aspects of a wedding. To stay on top of your wedding budget, you have to be realistic about what each element generally costs. Once you know this, it's easier to allocate funds from your budget.

There's a lot to keep track of when it comes to wedding budget planning, but it doesn't have to be stressful. Follow our tips above and you'll be more equipped to stay within your means.

Comments