In the vast and ever-changing ocean of the financial markets, traders need powerful tools to steer their investment strategies. One such tool that has gained immense popularity is the Leviathan a combination of a trading watchlist and options charts and we will explore how this dynamic duo can help traders make informed decisions and ride the waves of profitability.

Understanding the Trading Watchlist:

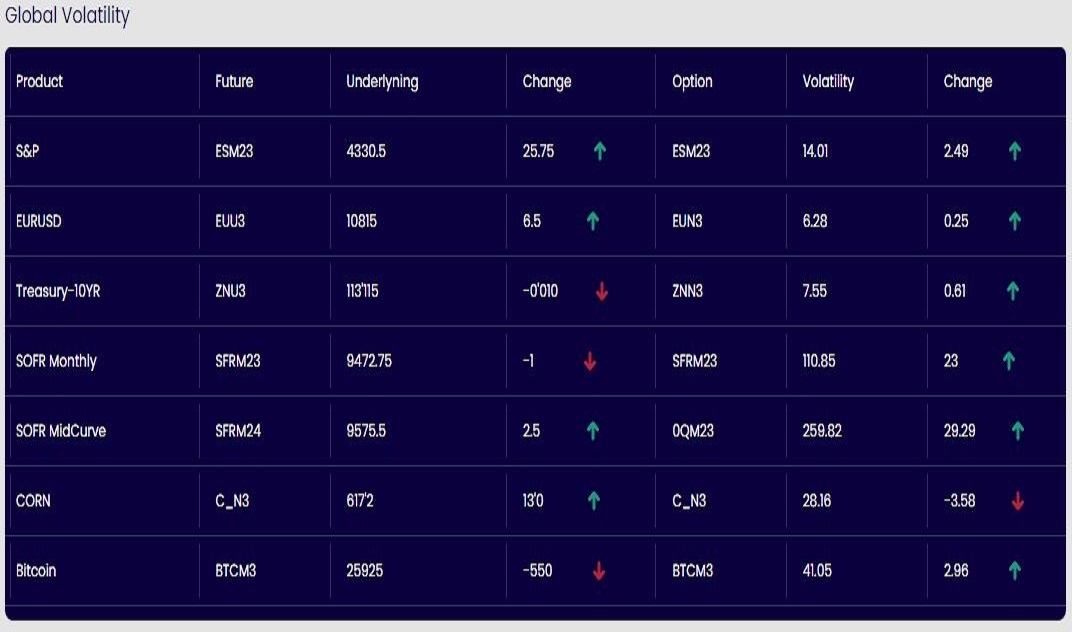

The watchlist serves as the captain's log, keeping traders informed about the movements and trends of various securities. It is a personalized list of selected stocks, indices, commodities, or currencies that a trader actively monitors. By carefully curating this watchlist, traders can focus on the assets that align with their investment goals and strategies.

A well-constructed watchlist can provide a wealth of information at a glance. Traders can track real-time prices, monitor volume and liquidity, observe price patterns, and identify potential opportunities or risks. With the ability to customize and prioritize assets, traders can efficiently navigate the vast seas of financial markets.

Leveraging Options Charts:

Trading options chart are vital for traders, particularly those engaged in derivatives trading. We visually represent an asset's price movements, volatility, and the behavior of options contracts associated with that asset. With the help of options charts, traders can assess the risk and potential rewards of different options strategies.

Options charts enable traders to analyze key metrics such as implied volatility, open interest, and option Greeks like delta, gamma, theta, and vega. By interpreting these indicators, traders can evaluate the market sentiment, gauge potential price movements, and determine the best course of action for their trades.

The Synergy of Leviathan:

When combined, the trading watchlist and options charts create a powerful synergy, equipping traders with comprehensive market insights. By integrating options charts into their watchlist, traders can identify specific opportunities for their chosen assets. They can spot potential entry or exit points, monitor critical support and resistance levels, and optimize their options trading strategies based on real-time market data.

Conclusion:

In the world of trading, where speed and accuracy are crucial, having a trading watchlist and options charts at hand is akin to commanding a mighty Leviathan. With these tools, traders can navigate the unpredictable seas of the financial markets, making informed decisions and increasing their chances of success.

For more info :-

Comments