Payday Loans Market Insights Unveiled:

Embark on a riveting journey through the realms of the Payday Loans Market with the cutting-edge market intelligence of a distinguished global research firm. Immerse yourself in a rich tapestry of data and captivating visual representations that decode the enigmatic trends of both regional and global markets. This comprehensive report reveals the market's deepest ambitions, shedding luminous beams on the foremost competitors, their market valuation, trendy strategies, targets, and trailblazing products. Venture further into the past and present as this report illuminates the market's recent growth and unfurls its illustrious history, igniting the minds of all stakeholders.

Anticipated Growth in Revenue:

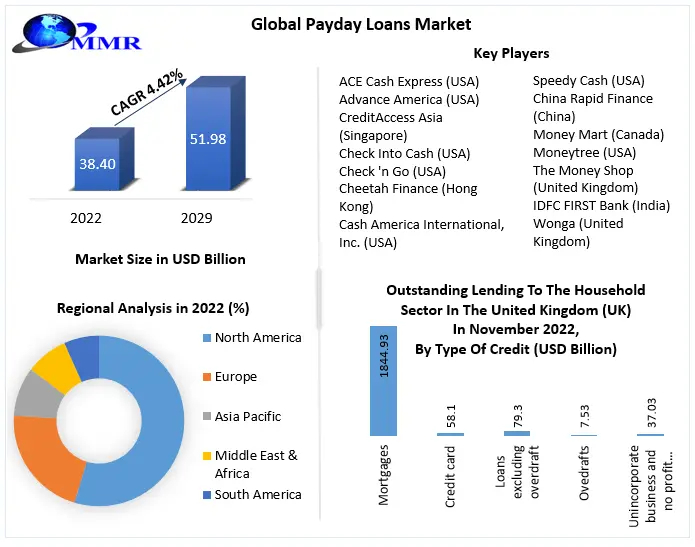

Payday Loans Market size was valued at USD 38.40 Billion in 2022 and the total Payday Loans revenue is expected to grow at a CAGR of 4.42% from 2023 to 2029, reaching nearly USD 51.98 Billion.

Grab your free sample copy of this report Click Here

Unleashing the Market's Potential:

Plunge into the depths of market dynamics as the research report unveils the secrets of trending competitors, their growth trajectory, and the mesmerizing dance of market dynamics. Unravel the mysteries of regional and global market value and demand, discerning the beating heart of the competitive landscape and the untapped potential in production, demand, and supply. Behold

the kaleidoscope of market segmentation, where the psychographic, demographic, geographic, and behavioral elements harmonize, shaping marketing strategies, bespoke products, alluring offers, and unforgettable customer experiences.Harness the power of Porter's analysis to gauge the potency of organizations' competitive positions, propelling them to new heights of profitability. Peer into the crystal ball of Pestle analysis, unveiling the validation of existing products and services within the cosmic context. Finally, let the SWOT analysis shed light on the inner strengths, weaknesses, opportunities, and threats, orchestrating the symphony of a company's destiny. This unparalleled report bequeaths a comprehensive and captivating overview of the enigmatic Payday Loans Market.

For a deeper understanding, click on this link @https://www.maximizemarketresearch.com/request-sample/214503

Segmentation: The Art of Unveiling

by Type

Storefront Payday Loans

Online Payday Loans

According to Type, the storefront payday loans category had the biggest market share of more than 75% in 2022 and would lead the payday loans business. During the forecast period, the segment is expected to increase at a CAGR of 4.48% and continue its dominance by 2029. This expansion can be ascribed to the widespread presence of payday loan establishments around the world. The majority of people prefer to meet with lenders in person to discuss terms and conditions. As a result,

this component promotes segment expansion.by Marital Status

Married

Single

Others

In 2022, the single segment dominated the payday loans market, with the biggest revenue share. During the projection period, the segment is expected to develop at a CAGR of 4.25%. Financial independence, flexibility, and convenience, a lack of credit history or poor credit ratings, lifestyle and social considerations, independent living expenses, and a rising single population are predicted to be the primary drivers of category growth. Payday loans are a practical choice for single people who need quick access to finances for unexpected bills or financial difficulties.

by Customer Age

Less than 21

21-30

31-40

41-50

More than 50

Due to increased financial needs throughout early adulthood, the 21-30 age group sector is considered to be the prospective segment for the payday loans business. This age group is likely to experience unexpected costs as they begin their careers, pursue higher education, or go through financial transformations. Their limited credit history frequently prevents them from obtaining regular loans, making payday loans with more flexible eligibility conditions enticing. Payday loans' flexibility and ease, particularly through online and mobile platforms, correspond to their tech-savvy and digitally engaged lifestyles. In this age bracket, the weight of student debts and

education-related expenses increases the potential for payday loans.Want your report customized? Speak to an analyst and personalize your report according to your needs @ https://www.maximizemarketresearch.com/market-report/payday-loans-market/214503/

Key Players: Masters of the Market Arena

1. Title Max (United States)

2. Cash Money (Canada)

3. Check City Online (United States)

4. Mr. Lender (United Kingdom)

5. Fast Loan UK (United Kingdom)

6. Speedy Cash (United States)

7. GAIN Credit (United States)

8. Creditstar Group (Estonia)

9. Lending Stream (United Kingdom)

10. THL Direct (United Kingdom)

Regional Revelations

Be immersed in the grandeur of formal, functional, and vernacular regional analyses, where the fiery crucible of demand ignites the business landscapes of Asia Pacific, North America, Latin America, the Middle East, Europe, and Africa. Behold the splendor of distinct targets, strategies, and market values, harmonizing the symphony of success in each captivating region.

Related Report Link:

Global Non Invasive Fat Reduction Market https://www.maximizemarketresearch.com/market-report/global-non-invasive-fat-reduction-market/65454/

Cheese Ingredients Market Applications 306 https://www.maximizemarketresearch.com/market-report/cheese-ingredients-market-applications-306/306/

Enter the sanctuary of the market report to unveil the sacred answers that elude curious minds:

- Unveil the essence of the mystical Payday Loans Market.

- Journey through the mists of time with the forecast period of the Payday Loans Market.

- Gaze into the swirling dance of competition in the captivating Payday Loans Market.

- Ascertain the realm where the greatest market sharelies within the Payday Loans Market.

- Embrace the alluring opportunities that beckon in the Payday Loans Market.

- Unravel the hidden forces shaping the growth of the enigmatic Payday Loans Market.

- Encounter the revered guardians of the Payday Loans Market - the illustrious key players.

- Discover the titan reigning supreme, holding the largest share in the resplendent Payday Loans Market.

- Venture into the realm of the Compound Annual Growth Rate (CAGR), unveiling the forecast for the Payday Loans Market's enchanting future.

- Foretell the enchanting trends that shall emerge from the mystical depths of the Payday Loans Market in the years to come.

Key Offerings - The Bountiful Treasures

- Bestow upon your quest the treasure map, leading to Market Share, Size, and Revenue Forecast| 2022-2029.

- Equip yourself with the magic key - Market Dynamics: Growth drivers, restraints, investment opportunities, and key trends.

- Unlock the hidden gates of Market Segmentation, where the arcane secrets of Payday Loans# await your perusal.

- Stand among the giants as you survey the Landscape - Leading key players and other illustrious participants.

About Maximize Market Research:

Maximize Market Research - a coven of versatile market researchers and consulting conjurers, whose magic touches medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology, communication, automotive, chemical products, general merchandise, beverages, personal care, and automated systems, among other enchanting domains. The incantations we offer include market-verified industry estimations,

technical trend analysis, crucial market research, strategic counsel, competition conjuration, production and demand alchemy, and impact studies on our esteemed clients.Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Bangalore Highway, Narhe,

Pune, Maharashtra 411041, India

+91 96071 95908, +91 9607365656

Comments