Report Overview:

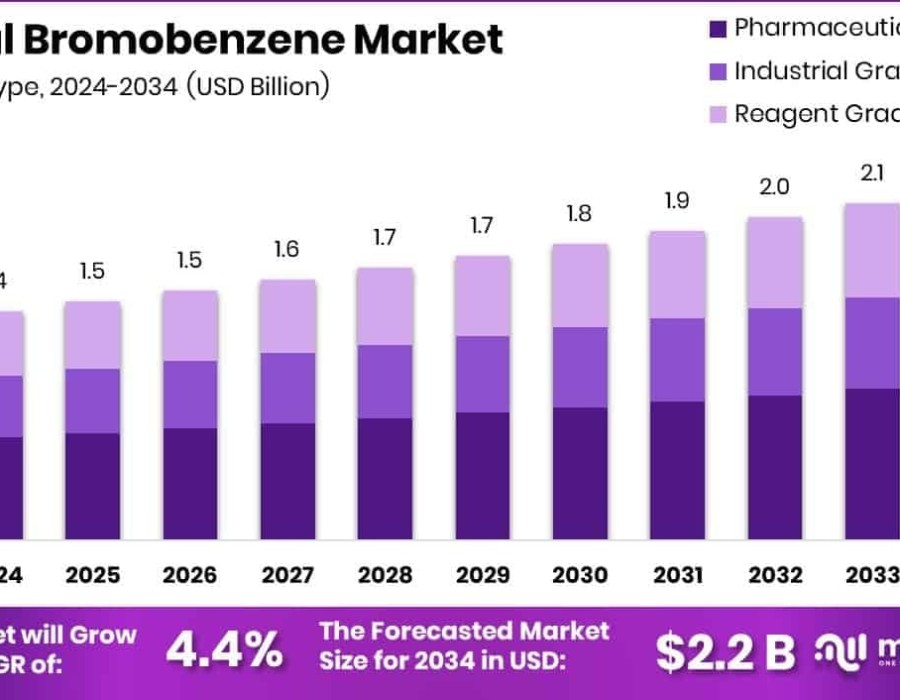

The global bromobenzene market is expected to grow steadily, moving from USD 1.4 billion in 2024 to about USD 2.2 billion by 2034, with an annual growth rate of 4.4%. This growth is largely driven by its wide usage in pharmaceuticals, which currently makes up nearly 48.5% of total consumption. Bromobenzene is especially valued for its high-purity (≥99%) form, which accounts for 67.3% of the market, due to its importance in accurate and controlled chemical reactions. Additionally, it’s commonly used as a solvent, holding a 36.1% share, reflecting its usefulness in both labs and industry. Regionally, Asia-Pacific leads the way, capturing over 56.9% of the market, thanks to its fast-expanding pharmaceutical and chemical manufacturing sectors. The consistent demand for cleaner and more efficient processes continues to fuel interest, making bromobenzene a key compound in the evolving landscape of global chemicals.

Bromobenzene (C₆H₅Br) is a useful organic compound primarily applied in solvents and as an intermediate in complex chemical syntheses. It plays a vital role in the pharmaceutical sector, especially in making active pharmaceutical ingredients (APIs). In 2024, pharmaceutical-grade bromobenzene led with a 44.8% share, showing how important it is in drug manufacturing. The high-purity segment (≥99%) dominates due to the demand for precision, especially in sensitive chemical reactions, contributing 67.3% to the overall market. Its role as a solvent making up 36.1% of the market is also essential in lab and industrial environments. The Asia-Pacific region commands the largest share, thanks to industrial growth and expanding pharmaceutical production, particularly in countries like China and India. As innovation in green chemistry and sustainable manufacturing rises, bromobenzene continues to see stable demand. The market is poised for further development through modernization and demand from advanced applications.

Key Takeaways

- Market size is projected to rise from USD 1.4 billion (2024) to USD 2.2 billion (2034), at a CAGR of 4.4%.

- Pharmaceutical-grade bromobenzene accounts for the largest share at 44.8%.

- The high-purity segment (≥99%) dominates with 67.3% of the total market.

- Solvent applications make up 36.1%, showing its versatility.

- Pharmaceuticals are the biggest end-use sector, taking up 48.5%.

- Asia-Pacific leads globally with a 56.9% market share.

Download Exclusive Sample Of This Premium Report:

http://market.us/report/bromobenzene-market/free-sample/

Key Market Segments:

By Type

- Pharmaceutical Grade

- Industrial Grade

- Reagent Grade

By Purity

- <99%

- ≥99%

By Application

- Solvent

- Chemical Intermediate

- Grignard Reagent

- Others

By End-Use

- Pharmaceuticals

- Agrochemicals

- Chemicals

- Others

DORT Analysis

Drivers

- Growing pharmaceutical production is boosting demand for bromobenzene as an intermediate.

- Asia-Pacific’s industrial expansion adds significant momentum to market growth.

- High-purity requirements in complex synthesis are increasing product demand.

- Widespread use as a solvent keeps its relevance in various industries.

Opportunities

- Developing nations are stepping up pharmaceutical production, opening up new markets.

- New production technologies are making bromobenzene cleaner and more efficient to produce.

- Demand for custom chemical intermediates in specialty sectors is rising.

- Companies adopting green and sustainable solutions can gain a competitive edge.

Restraints

- Environmental regulations on brominated substances can limit production flexibility.

- Raw material costs especially for bromine and benzene can impact pricing.

- Handling and transport safety concerns may discourage some users.

- Smaller players may lack access to facilities needed for high-purity production.

Trends

- There's a shift toward greener manufacturing techniques.

- Automation is being widely adopted in chemical production.

- Demand is growing for tailored, high-purity bromobenzene variants.

- Asia-Pacific continues to attract investment in chemical infrastructure.

- Innovation is focusing on specialty chemical and electronics applications.

Market Key Players:

- Aarnee International

- Aarti Industries

- Chemcon Speciality Chemicals Limited

- Haihang Industry Co., Ltd

- Heranba Industries Ltd.

- Lanxess

- Merck KGaA

- Pragna Group

- Sandoo Pharmaceuticals and Chemicals Co., Ltd.

- Yancheng Longshen Chemical Co., Ltd.

- Yogi Intermediates PVT. LTD.

- Yurui (shanghai) chemical Co., Ltd

Conclusion:

The bromobenzene market is on a reliable growth path, fueled by its vital use in pharmaceutical and industrial chemical production. With rising demand for high-purity and pharmaceutical-grade compounds, bromobenzene has become essential in various chemical processes. Asia-Pacific dominates the market due to its expanding industrial and pharma sectors.

Even though the bromobenzene industry faces hurdles like strict environmental regulations and fluctuating raw material prices, it continues to present strong growth opportunities. Manufacturers focused on clean, efficient, and innovative production processes are likely to lead in the coming years. As markets demand better quality, precision, and sustainability, bromobenzene’s relevance is only expected to increase. In summary, it's a dependable chemical compound with growing value in a world that’s shifting toward high-performance, eco-conscious manufacturing.

Comments