Keeping your QuickBooks Payroll up to date is crucial for the smooth and efficient management of your business's finances. Regular updates ensure that your payroll system is compliant with the latest tax regulations, thereby avoiding potential penalties and fines. Moreover, updated payroll information helps you make timely and accurate payments to your employees, fostering trust and maintaining positive employer-employee relationships.

Outdated QuickBooks Payroll can lead to a host of problems, including incorrect tax calculations, delayed paychecks, and even legal issues. In today's fast-paced business environment, it's essential to stay on top of these updates to streamline your payroll processes and ensure the overall financial health of your organization. By taking the time to update your QuickBooks Payroll, you can save yourself from the headaches and hassles associated with outdated software and stay ahead of the curve.

Understanding QuickBooks Payroll Updates

QuickBooks Payroll updates are released regularly by Intuit, the company behind the QuickBooks software suite. These updates are designed to address a variety of issues, including changes in tax laws, improvements to existing features, and the introduction of new functionalities. Staying up to date with these updates is crucial to ensure that your payroll system is operating at its best and remains compliant with the latest regulations.

The frequency of QuickBooks Payroll updates can vary, with some being released on a monthly or quarterly basis, while others may be issued on an as-needed basis to address specific issues or changes. It's important to stay informed about the latest updates and their release schedules to ensure that your payroll system is always current and functioning optimally.

Failing to update your QuickBooks Payroll can lead to a range of problems, including incorrect tax calculations, delayed payroll processing, and compatibility issues with other software or systems you may be using. By keeping your QuickBooks Payroll updated, you can avoid these issues and ensure that your payroll operations run smoothly, allowing you to focus on other important aspects of your business.

Also recommended: QuickBooks Error 15270

How to Check for Updates in QuickBooks Payroll

Checking for updates in QuickBooks Payroll is a straightforward process that can be done directly within the software. Here's how you can do it:

- Open your QuickBooks Payroll software and navigate to the "Help" menu.

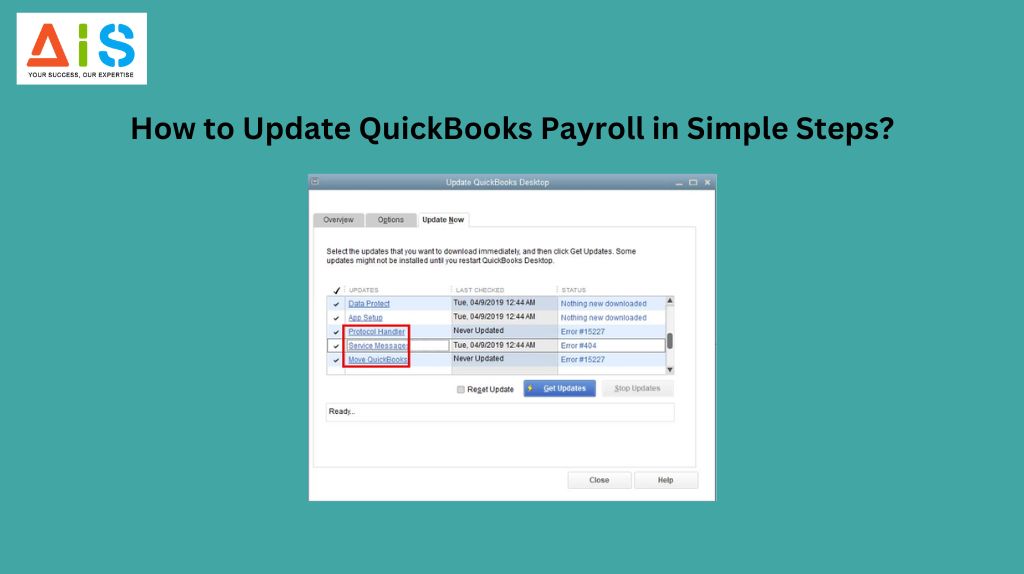

- Select the "Update QuickBooks" option.

- In the "Update QuickBooks" window, click on the "Check for Updates" button.

QuickBooks will then scan for any available updates and display the results. If an update is available, you can proceed with the installation process. It's important to note that the specific steps may vary slightly depending on the version of QuickBooks Payroll you are using, but the general process remains the same.

Alternatively, you can also check for QuickBooks Payroll updates by visiting the Intuit website and navigating to the "QuickBooks Payroll" section. Here, you can find information about the latest updates, release notes, and any known issues or workarounds. This can be a useful resource if you want to stay informed about the latest developments and ensure that your payroll system is always up to date.

It's recommended to check for QuickBooks Payroll updates on a regular basis, such as monthly or quarterly, to ensure that your system is always current and compliant with the latest tax regulations and requirements. By staying proactive with your updates, you can avoid potential issues and maintain the efficiency and accuracy of your payroll processes.

Steps to Update QuickBooks Payroll Manually

If an update is available for your QuickBooks Payroll, you can proceed with the manual update process. Here are the steps to follow:

- Backup Your Data: Before starting the update process, it's essential to create a backup of your QuickBooks Payroll data. This will ensure that you can restore your information in case of any issues during the update.

- Download the Update: Visit the Intuit website or the QuickBooks Payroll update page and download the latest update file.

- Install the Update: Once the download is complete, run the update installer. Follow the on-screen instructions carefully to complete the installation process.

- Verify the Update: After the installation is finished, open your QuickBooks Payroll software and check the version number to ensure that the update was successful.

- Update Payroll Tax Tables: If the update includes new payroll tax tables, you'll need to update them in your QuickBooks Payroll. You can do this by navigating to the "Payroll" menu and selecting the "Update Payroll Tax Tables" option.

- Review and Test: Thoroughly review your payroll information and test the updated system to ensure that everything is functioning correctly. This includes verifying employee information, tax calculations, and other critical payroll data.

- Train Employees: If necessary, provide training to your employees on the updated QuickBooks Payroll system to ensure they are comfortable with the changes and can use the software effectively.

Remember, the specific steps may vary depending on the version of QuickBooks Payroll you are using, so it's important to follow the instructions provided by Intuit carefully. By taking the time to update your QuickBooks Payroll manually, you can ensure that your payroll system is always current and compliant with the latest regulations.

Updating QuickBooks Payroll Automatically

In addition to the manual update process, QuickBooks Payroll also offers an automatic update feature that can simplify the process and ensure that your system is always up to date. Here's how you can set up automatic updates:

Enable Automatic Updates:

In your QuickBooks Payroll software, navigate to the "Preferences" menu and select the "Automatically download and install updates" option.

Schedule Updates:

You can choose to have QuickBooks Payroll automatically check for and install updates on a regular schedule, such as weekly or monthly. This will ensure that your system is always current without requiring your constant attention.

Customize Update Settings:

Depending on your preferences, you can also customize the automatic update settings, such as choosing to receive notifications before the update is installed or selecting specific times of the day when the updates should occur.

Review and Approve Updates:

Even with automatic updates enabled, it's a good practice to review the update details and approve the installation before it takes place. This will give you the opportunity to ensure that the update is compatible with your system and won't cause any disruptions to your payroll operations.

Monitor Update Status:

QuickBooks Payroll will provide you with updates on the status of the automatic updates, including any issues or errors that may occur during the process. It's important to monitor these notifications and address any problems that arise promptly.

By enabling automatic updates for your QuickBooks Payroll, you can enjoy the convenience of having your system consistently updated without the need for manual intervention. This can save you time and effort, while also ensuring that your payroll data remains accurate and compliant with the latest regulations.

Common Issues and Troubleshooting Tips

While updating QuickBooks Payroll is generally a straightforward process, there may be instances where you encounter some issues or challenges. Here are some common problems and troubleshooting tips to help you resolve them:

Update Fails to Install: If the update fails to install, try the following:

1. Check your internet connection and ensure that it is stable and reliable.

2. Close any other running applications and try the update again.

3. Disable any antivirus or firewall software temporarily and try the update.

4. If the issue persists, contact Intuit support for further assistance.

Payroll Tax Tables Not Updating: If the payroll tax tables fail to update, ensure that you have completed the necessary steps to update them manually. You can also try the following:

1. Verify that you have the latest version of QuickBooks Payroll installed.

2. Check for any pending updates and install them.

3. Ensure that you have an active payroll subscription and that it is up to date.

Remember, if you encounter any issues or have questions about the update process, don't hesitate to reach out to Intuit support for assistance. They can provide you with personalized guidance and help you resolve any problems you may be facing.

Benefits of Keeping QuickBooks Payroll Updated

Keeping your QuickBooks Payroll software up to date offers a range of benefits that can positively impact your business operations. Here are some of the key advantages:

- Compliance with Tax Regulations: Regular updates ensure that your payroll system is compliant with the latest tax laws and regulations, helping you avoid penalties and fines.

- Improved Accuracy: Updated payroll tax tables and calculations help you ensure accurate payroll processing, reducing the risk of errors and overpayments.

- Enhanced Efficiency: Newer versions of QuickBooks Payroll often include improved features and functionalities that can streamline your payroll processes, saving you time and effort.

- Increased Security: Software updates often include security patches and improvements, protecting your sensitive payroll data from potential cyber threats.

- Access to New Features: By keeping your QuickBooks Payroll updated, you can take advantage of the latest features and functionalities, allowing you to leverage the software's full capabilities.

- Seamless Integration: Updated versions of QuickBooks Payroll may offer better integration with other business software, enabling a more cohesive and efficient workflow.

- Improved Reporting and Analytics: Newer versions of QuickBooks Payroll may provide enhanced reporting and analytical tools, helping you make more informed business decisions.

- Reduced Downtime: Keeping your QuickBooks Payroll updated can help minimize disruptions and ensure the smooth operation of your payroll processes.

By prioritizing the regular update of your QuickBooks Payroll software, you can enjoy these benefits and ensure that your business remains competitive, compliant, and efficient in the ever-evolving business landscape.

Additional Resources for QuickBooks Payroll Updates

If you need further assistance or information regarding QuickBooks Payroll updates, there are several resources available to you:

Intuit Support:

Intuit, the company behind QuickBooks, offers a comprehensive support network to help you with any issues or questions related to QuickBooks Payroll updates. You can reach out to their customer support team through various channels, such as phone, email, or live chat.

QuickBooks Community:

The QuickBooks Community forum is an invaluable resource where you can connect with other QuickBooks users, share experiences, and seek advice on updating your payroll software. The community members and Intuit experts can provide valuable insights and troubleshooting tips.

QuickBooks Blog:

The official QuickBooks blog often features articles and updates on the latest QuickBooks Payroll features, changes, and best practices. This can be a great source of information to stay informed about the software's development and updates.

QuickBooks Training and Tutorials:

Intuit offers a variety of training resources, including webinars, video tutorials, and in-person workshops, to help you learn how to effectively manage and update your QuickBooks Payroll software.

QuickBooks User Guides and Documentation:

Intuit provides comprehensive user guides and documentation, which can be a valuable resource for understanding the update process and troubleshooting any issues you may encounter.

QuickBooks Accountant and ProAdvisor Network:

If you work with a QuickBooks Accountant or ProAdvisor, they can be a valuable resource for guidance and support on QuickBooks Payroll updates, as they are well-versed in the software and its functionalities.

By leveraging these resources, you can stay informed, get the support you need, and ensure that your QuickBooks Payroll is always up to date and functioning at its best.

Conclusion

Keeping your QuickBooks Payroll updated is a crucial task that can have a significant impact on the overall efficiency and compliance of your business's financial operations. By following the simple steps outlined in this article, you can ensure that your payroll system is always current, accurate, and compliant with the latest tax regulations.

Whether you choose to update QuickBooks Payroll manually or take advantage of the automatic update feature, the process is straightforward and can be completed with minimal disruption to your day-to-day operations. By staying proactive and vigilant with your payroll updates, you can enjoy the numerous benefits, including improved compliance, enhanced efficiency, and better integration with other business software.

Comments