IMARC Group, a leading market research company, has recently released a report titled “Venture Capital Investment Market Report by Sector (Software, Pharma and Biotech, Media and Entertainment, Medical Devices and Equipment, Medical Services and Systems, IT Hardware, IT Services and Telecommunication, Consumer Goods and Recreation, Energy, and Others), Fund Size (Under $50 M, $50 M to $100 M, $100 M to $250 M, $250 M to $500 M, $500 M to $1 B, Above $1 B), Funding Type (First-Time Venture Funding, Follow-on Venture Funding), and Region 2024-2032”. The study provides a detailed analysis of the industry, including the global venture capital investment market trends, trends, size, and industry trends forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

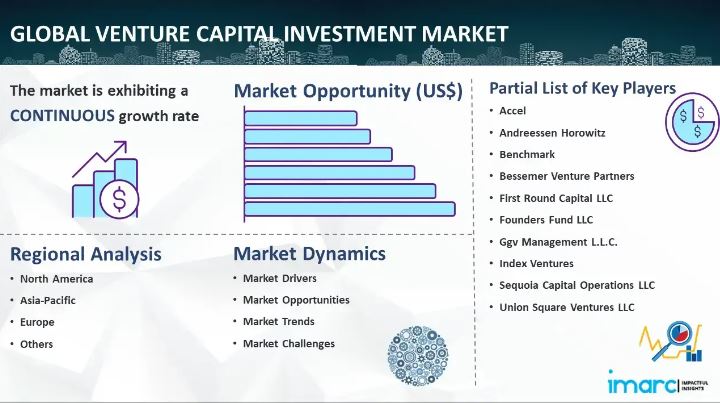

The global venture capital investment market size reached US$ 284.8 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 1,310.8 Billion by 2032, exhibiting a growth rate (CAGR) of 17.9% during 2024-2032.

Global Venture Capital Investment Market Trends:

The increasing globalization is contributing to market growth, as investors seek opportunities beyond traditional markets, tapping into diverse talent pools and emerging economies. In addition to this, the democratization of entrepreneurship through online platforms and remote work has expanded the pool of potential startups, creating a positive outlook or market expansion.

Furthermore, a cultural shift towards sustainable investing, with a growing emphasis on environmental, social, and governance (ESG) criteria is acting as another significant growth-inducing factor. Apart from this, the rise of specialized venture capital funds focusing on niche sectors such as space exploration, deep tech, or cultural industries is fueling the market growth.

Request to Get the Sample Report:

https://www.imarcgroup.com/venture-capital-investment-market/requestsample

Factors Affecting the Growth of the Venture Capital Investment Industry:

· Technological innovation:

In today's rapidly evolving landscape, breakthrough technologies emerge frequently, disrupting traditional industries and creating new markets. Venture capitalists actively seek out startups and entrepreneurs at the forefront of these innovations, recognizing the potential for significant returns on investment. Whether it's artificial intelligence, biotechnology, blockchain, or renewable energy, novel technologies attract substantial funding as investors anticipate their transformative impact on society and the economy.

Moreover, the scalability and disruptive potential of innovative technologies make them particularly attractive for venture capital investment, fueling the growth of startups and fostering a culture of entrepreneurship.

· Market demand:

Entrepreneurs often identify unmet needs or inefficiencies within existing markets and develop solutions to address them. Venture capitalists assess the market demand for these solutions and invest in startups with promising products or services that cater to consumer preferences or business requirements. The scalability and market potential of a startup's offering plays a significant role in attracting venture capital funding.

Additionally, emerging trends and shifts in consumer behavior influence investment decisions, as investors seek opportunities in sectors experiencing rapid growth or disruption. For instance, the rise of e-commerce, digital healthcare, and sustainability-driven initiatives has led to increased investment in startups operating in these areas, fostering market expansion.

· Economic conditions:

Factors such as interest rates, inflation, and overall economic stability impact investor confidence and risk appetite. During periods of economic expansion and favorable market conditions, venture capital investment tends to increase as investors seek higher returns in riskier asset classes. Conversely, economic downturns or market volatility may dampen investor sentiment and lead to a slowdown in venture capital activity as investors become more risk-averse. However, certain sectors, such as technology and healthcare, may remain resilient or even thrive during economic downturns, attracting continued investment despite broader market challenges.

Moreover, government policies and regulations can influence venture capital investment by creating incentives or barriers for entrepreneurs and investors, further shaping the overall investment climate.

Venture Capital Investment Market Report Segmentation:

By Sector:

· Software

· Pharma and Biotech

· Media and Entertainment

· Medical Devices and Equipment

· Medical Services and Systems

· IT Hardware

· IT Services and Telecommunication

· Consumer Goods and Recreation

· Energy

· Others

Software represents the largest segment by sector due to its scalability, high profit margins, and widespread adoption across industries.

By Fund Size:

· Under $50 M

· $50 M to $100 M

· $100 M to $250 M

· $250 M to $500 M

· $500 M to $1 B

· Above $1 B

$500 M to $1 B dominates the market, indicating a balance between substantial capital availability and manageable investment risk for venture capitalists.

By Funding Type:

· First-Time Venture Funding

· Follow-on Venture Funding

Follow-on venture funding accounts for the majority of the market share, reflecting investor confidence in established startups with proven track records and growth potential.

Regional Insights:

· North America

· Asia Pacific

· Europe

· Others

North America leads the market, driven by its mature startup ecosystem, access to capital, supportive regulatory environment, and strong entrepreneurial culture.

Competitive Landscape with Key Players:

The competitive landscape of the venture capital investment market size has been studied in the report with the detailed profiles of the key players operating in the market.

Some of These Key Players Include:

· Accel

· Andreessen Horowitz

· Benchmark

· Bessemer Venture Partners

· First Round Capital LLC

· Founders Fund LLC

· Ggv Management L.L.C.

· Index Ventures

· Sequoia Capital Operations LLC

· Union Square Ventures LLC

Ask Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=2336&flag=C

Key Highlights of the Report:

· Market Performance (2018-2023)

· Market Outlook (2024-2032)

· Market Trends

· Market Drivers and Success Factors

· Impact of COVID-19

· Value Chain Analysis

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St

Brooklyn, NY 11249, USA

Website: imarcgroup.com

Email: [email protected]

Americas: +1-631-791-1145 | Europe & Africa: +44-753-713-2163 | Asia: +91-120-433-0800

Comments