A receipt is a piece of paper attesting that a buyer has paid a seller. Fake receipts generator contains the date, details about the item the consumer purchased, and the payment method used. It is a statement made by the seller to the customer confirming receipt of payment for a good or service.

Make fake receipt by selecting from a range of templates. Then, please include your company's logo and colours to give it a polished, unique look. View more of your billing tools to see how they can help you manage your company more effectively.

Using the Receipt Maker

Follow these detailed instructions to create a receipt with fake receipt maker free, and you'll have a polished receipt for your clients in no time.

- Add your business's logo (optional).

- Type in the details of your business, such as its legal name and street address, and then click "Continue."

- Type your client's contact details, such as their legal name and postal address, and then click "Continue".

- Type a title for your receipt, a summary, a receipt number, and the date.

- Enter the amount, price, tax rate, line item information, and a short description.

- To add a new line item to your receipt with more than one, select "Add new item."

- If additional information is required, add it to the "Notes" section.

- To get your receipt after completing the aforementioned procedures, click "Generate receipt."

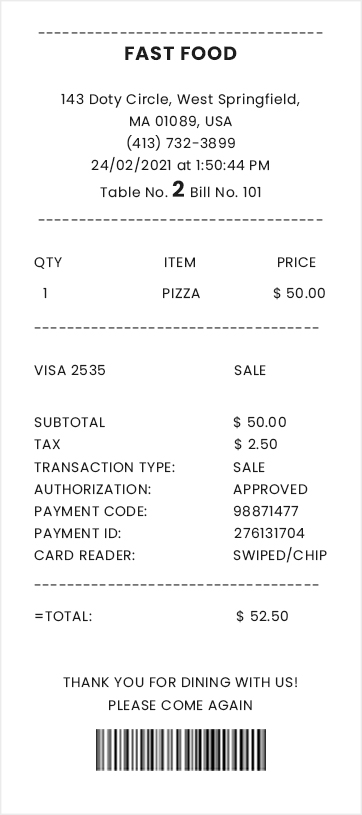

Important components of a receipt

You should be aware of the 8 components that make up a receipt; some are essential, while others can be customised.

1. Title: A receipt's title is essential since it enables you and your client to distinguish between receipts. This is useful for keeping precise records of your receipts during tax season.

2. Description:By including a description, you can make it easier for your consumer to comprehend the kind of goods and services the receipt is for.

3. Your Company Name & Address: To identify the business supplying the receipt for the services given, your company's name and address are often included at the top of a receipt.

4. Receipt Number: Each invoice has a unique identification number that makes it easier for you to maintain track of several invoices. Formatting options for invoice numbers include file numbers, billing codes, and date-based purchase order numbers.

5. Date: The date of receipt identifies the time that payment for the goods and services was made. This makes it easier to track when you have been paid for the items or services you have rendered to clients.

6. Line Item: A description of the rendered goods and services should be included with each line item on an invoice. For the client to understand how many items or services they are being charged for, the line item's cost and the tax rate that applies to it, line items must also have a quantity.\

7. Payment Type: free fake receipt maker used to receive the payment, such as a credit card or debit card.

8. Total: The total shows the balance owed, determined by adding up the costs of all the invoice's line items. This is the amount that your client must pay you.

Comments