Report Overview:

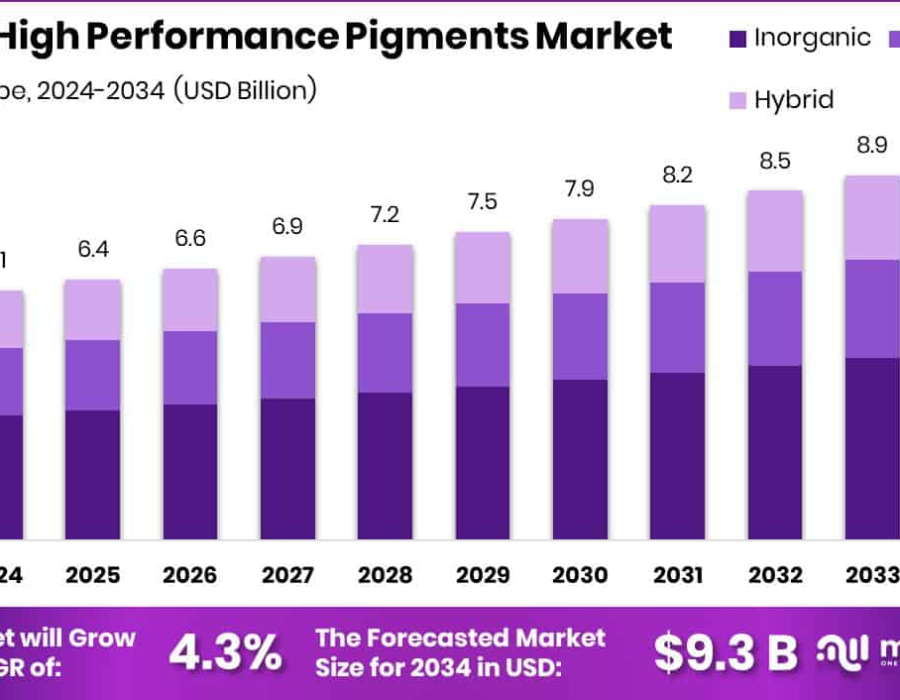

The Global High‑Performance Pigments Market is on a steady growth path, expected to increase from USD 6.1 billion in 2024 to about USD 9.3 billion by 2034, growing at a CAGR of 4.3%. These pigments are highly valued for their strong resistance to heat, light, and chemicals, making them ideal for tough environments like automotive paints, industrial finishes, and construction coatings. Among pigment types, inorganic pigments lead the market, taking up around 49.9% share, mainly because of their excellent durability. In terms of form, powder pigments dominate, making up 59.1% due to their easy handling and longer shelf life. Coatings hold the largest application share, accounting for about 44.2%. The automotive and transportation sector is currently the biggest end-user, with a 34.8% share, driven by the demand for advanced finishes that can endure harsh weather and frequent use.

Europe holds the top position in this market, with an estimated value of USD 2.3 billion in 2024, thanks to its strict environmental policies and strong industrial base. Growth is fueled by the rising need for durable, high-quality coatings in infrastructure and automotive sectors. As cities expand and industries push for better long-term materials, demand for HPPs continues to rise. However, one of the biggest challenges is the high cost of production, which can hold back wider usage—especially in price-sensitive regions. Still, fast-growing markets like Asia-Pacific and Latin America present solid opportunities as they see rapid development in construction and manufacturing. Another growing trend is the shift toward environment-friendly pigments. With stricter global regulations and rising awareness of sustainability, companies are investing more in eco-safe, long-lasting pigments. These efforts not only meet compliance but also help brands stand out in a competitive and evolving market.

Key Takeaways

- The HPP market is set to grow from USD 6.1 billion (2024) to USD 9.3 billion (2034) at a 4.3% CAGR.

- Inorganic pigments lead the market, holding nearly 50% share due to their durability.

- Powder-based pigments are most preferred, making up about 59.1% of the market.

- The coatings segment dominates with a 44.2% share, especially in industrial and automotive use.

- Automotive & transportation applications hold the highest end-use share at 34.8%.

Download Exclusive Sample Of This Premium Report:

https://market.us/report/global-high-performance-pigments-market/free-sample/

Key Market Segments:

By Type

- Inorganic

- Organic

- Hybrid

By Form

- Powder

- Liquid

- Granules

By Application

- Coatings

- Plastics

- Inks

- Cosmetics

- Others

By End-use

- Automotive and Transportation

- Construction and Infrastructure

- Printing

- Others

DORT Analysis

Drivers

- Rising demand from automotive and industrial sectors for coatings that can withstand harsh conditions is pushing HPP growth.

- Expanding urban infrastructure projects are increasing the need for strong, long-lasting finishes.

- The shift toward better aesthetics and performance in everyday products boosts the use of HPPs.

- HPPs help reduce maintenance costs by lasting longer, which appeals to both manufacturers and end-users.

Opportunities

- Growth in emerging markets like Asia-Pacific and Latin America is opening new sales channels.

- Companies investing in green, non-toxic pigments are gaining traction due to stricter regulations.

- New uses in cosmetics, electronics, and aerospace offer opportunities beyond traditional applications.

- Innovations like nanotech and smart pigments are creating premium pigment products.

Restraints

- High raw material costs make HPPs expensive to produce, limiting affordability.

- Volatile prices for inputs create uncertainty and affect profit margins.

- Cost-sensitive industries may choose cheaper alternatives over HPPs.

- Tough environmental regulations can complicate manufacturing processes and increase costs.

Trends

- Inorganic pigments continue to dominate because of their consistent performance in extreme conditions.

- Powder forms are gaining more market share due to convenience and stability.

- The coatings industry remains the top consumer of HPPs, especially in auto and industrial uses.

- There is a strong move toward eco-safe pigments that meet new environmental standards.

- Companies are experimenting with nanotechnology to create next-gen, high-performance pigments.

Market Key Players:

- ALTANA

- BASF SE

- Atul Ltd.

- CINIC

- Clariant

- DIC Corporation

- Ferro Corporation

- GHARDA CHEMICALS

- Heubach GmbH

- LANSCO COLORS

- Lanxess

- Meghmani Organics Ltd.

- Sudarshan Chemical Industries Limited

- Sun Chemical

- Synthesia A.S.

- Venator Materials PLC

- Vijay Chemical Industries

- VOXCO India

Conclusion:

The high-performance pigments market is heading for stable growth as industries demand better, longer-lasting color solutions. From automotive coatings to construction materials, HPPs provide superior protection and vibrant finishes that can handle tough conditions. While Europe leads the global market, the real momentum is shifting toward Asia-Pacific and Latin America, where industrial growth is rising fast. Cost remains a key challenge, but innovation in eco-friendly and sustainable pigments is helping brands adapt and grow.

Advances in technology, such as nanotechnology and bio-based formulations, are also creating exciting new possibilities. As environmental standards get tighter, companies that invest in safer and more efficient pigment solutions will stay ahead. The market is not just expanding—it’s transforming. Businesses that focus on sustainability, innovation, and market-specific strategies will be best positioned to succeed in this competitive and fast-evolving industry.

Comments