GCC Personal Luxury Goods Market Overview

Market Size in 2024: USD 10.3 Billion

Market Size in 2033: USD 14.7 Billion

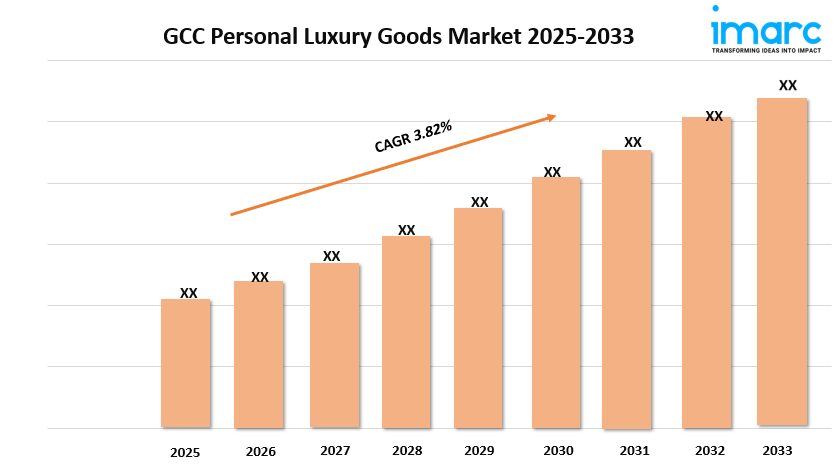

Market Growth Rate 2025-2033: 3.82%

According to IMARC Group's latest research publication, "GCC Personal Luxury Goods Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", the GCC personal luxury goods market size reached USD 10.3 Billion in 2024. The market is projected to reach USD 14.7 Billion by 2033, exhibiting a growth rate (CAGR) of 3.82% during 2025-2033.

How AI is Reshaping the Future of GCC Personal Luxury Goods Market

- Personalized Shopping Experiences: AI-powered recommendation systems enable luxury brands to deliver hyper-personalized product suggestions, with GCC retailers reporting 25% increase in customer engagement through AI-driven platforms.

- Virtual Try-On Technology: AR/AI integration allows customers to virtually experience luxury items before purchase, with UAE leading the adoption of virtual fitting rooms across 60% of high-end retail stores.

- Smart Inventory Management: AI algorithms optimize luxury goods inventory across GCC markets, reducing overstock by 30% while ensuring premium items availability during peak shopping seasons.

- Enhanced Authentication Systems: Blockchain and AI technologies combat counterfeiting in luxury goods, with Qatar implementing advanced authentication systems that have reduced fake luxury products by 40%.

- Predictive Consumer Analytics: AI-driven consumer behavior analysis helps luxury brands anticipate market trends, with Saudi Arabia's luxury retailers leveraging predictive analytics to boost sales conversion by 35%.

Grab a sample PDF of this report: https://www.imarcgroup.com/gcc-personal-luxury-goods-market/requestsample

GCC Personal Luxury Goods Market Trends & Drivers:

The GCC personal luxury goods market is experiencing robust growth driven by rising disposable incomes and elevated consumer living standards. The region's strategic positioning as a global luxury hub, particularly Dubai and UAE, attracts high-net-worth individuals and tourists seeking premium products. The expanding tourism sector, coupled with relaxed trade barriers through agreements like the European Free Trade Agreement (EFTA), facilitates easier access to luxury goods from prestigious European brands like those from Italy and France.

Digital transformation is revolutionizing the luxury shopping experience across the GCC. Online retail platforms are gaining significant traction, with consumers increasingly embracing e-commerce for luxury purchases. Social media marketing and celebrity endorsements are playing crucial roles in driving product demand, while the popularity of limited capsule collections and exclusive fashion drops are creating urgency-driven purchasing behaviors. The region's tech-savvy population and high internet penetration rates support this digital shift.

The changing demographic landscape, particularly the rising working women population and prevalence of western fashion trends, is reshaping luxury consumption patterns. Young affluent consumers are driving demand for authentic, high-quality luxury goods, while the growing secondhand luxury market reflects evolving sustainability consciousness. International luxury brands are investing heavily in authentication procedures and quality checks to maintain brand integrity and combat counterfeiting, ensuring customer confidence in the rapidly expanding market.

GCC Personal Luxury Goods Industry Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest GCC personal luxury goods market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

The report has segmented the market into the following categories:

Breakup by Country:

- Saudi Arabia

- United Arab Emirates

- Qatar

- Kuwait

- Oman

- Bahrain

Breakup by Type:

- Accessories

- Apparel

- Watch and Jewellery

- Luxury Cosmetics

- Others

Breakup by Gender:

- Female

- Male

Breakup by Distribution Channel:

- Mono-brand Stores

- Specialty Stores

- Departmental Stores

- Online Stores

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in GCC Personal Luxury Goods Market

- March 2025: GCC personal luxury market recorded USD 12.8 billion in spending, achieving +6% year-over-year growth despite global luxury market contraction, demonstrating regional market resilience and strong consumer demand.

- April 2025: UAE luxury retailers implemented advanced AI-powered virtual try-on systems across major shopping destinations, with 60% of high-end stores now offering AR experiences that have increased customer engagement by 25%.

- June 2025: Qatar launched a comprehensive anti-counterfeiting initiative using blockchain technology and AI authentication systems, successfully reducing fake luxury goods circulation by 40% and boosting consumer confidence in authentic luxury purchases.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Comments