Introduction:

In the highly competitive and rapidly evolving landscape of the insurance industry, Third-Party Administrators (TPAs) play a vital role in handling claims, managing risks, and delivering customer service. Charles Taylor, a global leader in the provision of professional services to the insurance industry, has established itself as a frontrunner in the Insurance TPA Market. With a rich history of providing comprehensive services to insurers, reinsurers, brokers, and corporates, Charles Taylor has been at the forefront of adapting to emerging trends, leveraging cutting-edge technologies, and developing strategic solutions to meet the evolving needs of the insurance ecosystem.

Overview of Charles Taylor: A Trusted Leader in Insurance Services

Founded in 1884, Charles Taylor is an international provider of insurance services, offering a wide range of services that include claims management, risk management, and consultancy. With offices in over 30 countries, the company has established a strong global presence and a deep understanding of the complex challenges faced by insurers and policyholders.

Charles Taylor’s TPA division provides specialized claims handling, underwriting support, and operational management services, with a focus on improving claims processing, optimizing risk management, and delivering enhanced customer experiences. Over the years, the company has built a reputation for providing customized, efficient, and reliable solutions to meet the diverse needs of its clients in both mature and emerging markets.

Strategic Approach: Customer-Centricity and Efficiency

At the heart of Charles Taylor's success lies a customer-centric approach that prioritizes the needs of both insurers and policyholders. The company’s strategy focuses on offering flexible, scalable solutions that address the unique challenges of its clients, whether they are insurers seeking to optimize their claims management or corporations looking for expert risk management services.

One of Charles Taylor's key strategies is its emphasis on building long-term relationships with clients by offering tailored services that align with their business goals. The company recognizes that each insurer has its own set of challenges, and therefore provides customized solutions that meet the specific needs of each client. This approach ensures that Charles Taylor's services are not only efficient but also adaptable to the changing needs of the insurance market.

Emerging Innovations in the TPA Market: How Charles Taylor is Leading the Way

The insurance industry is undergoing significant transformation, driven by technological advancements and changing customer expectations. Charles Taylor has recognized these shifts and responded by incorporating innovative solutions that are reshaping the TPA landscape. The following are some of the key innovations that the company has integrated into its offerings:

1. Digital Claims Management Platforms

One of the most significant innovations Charles Taylor has embraced is the implementation of digital claims management platforms. The company has invested heavily in creating sophisticated online platforms that enable insurers to manage claims in real-time, offering increased transparency and efficiency throughout the process. These platforms streamline data collection, enable instant communication with claimants, and reduce administrative workloads, allowing claims to be processed faster and with greater accuracy.

By leveraging these digital solutions, Charles Taylor enables insurers to provide a seamless claims experience to policyholders, while also improving operational efficiency. These platforms also help reduce the risk of errors, minimize fraud, and enhance overall customer satisfaction, making them a crucial part of the company's TPA services.

2. Artificial Intelligence (AI) and Automation

Artificial intelligence (AI) and automation are increasingly central to the modern insurance landscape, and Charles Taylor has been quick to adopt these technologies to improve its TPA services. AI is being used to analyze large volumes of claims data, identify patterns, and predict outcomes. This allows Charles Taylor to prioritize claims more effectively, flag potential fraud risks, and expedite the claims settlement process.

Automation has also been implemented to reduce manual workloads and improve operational efficiency. By automating routine tasks such as data entry, document processing, and report generation, Charles Taylor ensures faster processing times and fewer human errors. This technological integration not only benefits insurance companies by reducing costs but also enhances the overall experience for policyholders who expect quick and hassle-free claims resolution.

3. Data Analytics and Predictive Modeling

In a data-driven world, Charles Taylor has been leveraging advanced data analytics and predictive modeling to improve claims management and risk assessment. The company’s use of data analytics allows it to gain valuable insights into claims trends, policyholder behaviors, and market conditions. By analyzing historical claims data and external factors, Charles Taylor can provide insurers with actionable insights that help them better understand risks, optimize pricing, and prevent future claims.

Predictive modeling also enables the company to forecast potential claims and assess the likelihood of future losses, allowing insurers to make more informed decisions and proactively manage risks. This approach enhances risk mitigation strategies and ensures that clients can take preemptive measures to avoid costly claims.

4. Cloud-Based Solutions for Scalability and Flexibility

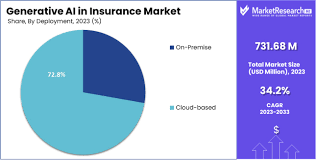

As the insurance industry becomes more globalized and interconnected, Charles Taylor has embraced cloud-based solutions to offer greater scalability and flexibility in its TPA services. Cloud technology enables the company to provide clients with real-time access to claims data, documentation, and performance metrics, regardless of their location. This has become particularly important as insurers and policyholders increasingly demand seamless, 24/7 access to information.

Cloud solutions also allow Charles Taylor to scale its services in line with client demands, ensuring that both large and small insurers can benefit from the same level of service and technology, without worrying about infrastructure limitations. With the ability to handle a large volume of claims and adjust to changing business needs, cloud-based solutions are a key component of the company’s strategic approach to delivering high-quality TPA services.

5. Blockchain Technology for Secure Claims Processing

Blockchain technology is rapidly gaining traction in the insurance industry due to its ability to offer secure, transparent, and tamper-proof transaction records. Charles Taylor has been exploring the use of blockchain to enhance its claims processing services. By implementing blockchain, the company can ensure that claims data is stored securely and that all parties involved in the claims process have access to the same information in real-time.

Blockchain also offers the potential to streamline claims payments and reduce fraud by providing a decentralized ledger that is resistant to manipulation. As insurers look for ways to improve transparency and security in their claims processes, blockchain technology presents a valuable solution, and Charles Taylor is positioning itself as a leader in adopting this emerging innovation.

Key Developments and Market Trends Shaping Charles Taylor's Strategy

In addition to its technological innovations, several broader developments in the TPA market have shaped Charles Taylor's strategy and market positioning:

1. Regulatory Changes and Compliance

The global insurance market is increasingly governed by complex regulatory frameworks, and Charles Taylor has made regulatory compliance a top priority. By staying ahead of evolving regulations, particularly in data protection, privacy, and claims processing, the company ensures that it can continue to offer services that are fully compliant with local and international laws. Regulatory expertise is an important aspect of the TPA business, and Charles Taylor's ability to navigate the complexities of the insurance landscape positions it as a reliable partner for insurers worldwide.

2. Shift Towards Self-Insurance Models

As companies increasingly turn to self-insurance or captive insurance models to reduce costs and increase control over claims, Charles Taylor has adapted by offering specialized services for self-insured entities. The company provides customized claims management and risk mitigation services that cater to the unique needs of self-insured clients, helping them reduce risk exposure and manage their claims effectively.

3. Global Expansion and Market Penetration

Charles Taylor has been expanding its global footprint, capitalizing on growth opportunities in emerging markets. By offering scalable TPA services in regions such as Asia-Pacific, Latin America, and the Middle East, the company is positioning itself as a global leader in the TPA space. Its ability to adapt to diverse market conditions and regulatory environments allows it to serve a broad range of clients across the globe.

Conclusion: Charles Taylor’s Continued Leadership in the TPA Market

Charles Taylor has firmly established itself as a leader in the Insurance TPA market by embracing emerging technologies, delivering innovative solutions, and maintaining a client-focused approach. With its adoption of AI, data analytics, blockchain, cloud-based platforms, and digital claims management tools, the company is at the forefront of transforming the way claims are processed and managed.

As the insurance industry continues to evolve, Charles Taylor’s commitment to technological innovation, regulatory compliance, and customer satisfaction will ensure that it remains a key player in the TPA market. By continuously adapting to changing market dynamics and investing in cutting-edge solutions, Charles Taylor is well-positioned for sustained growth and success in the global TPA market.

Comments