Introduction: In the fast-paced world of financial technology (Fintech), efficient management of financial transactions is crucial for success. Bank reconciliation software plays a vital role in ensuring accuracy, transparency, and compliance in financial operations. This article explores the importance of bank reconciliation software tailored for Fintech companies and highlights key features and benefits.

Automated Reconciliation Process: Bank Reconciliation Software for Fintech the process of matching transactions recorded in a company's accounting records with those in its bank statements. This automation saves time and reduces the risk of errors associated with manual reconciliation, enabling Fintech companies to focus on strategic initiatives.

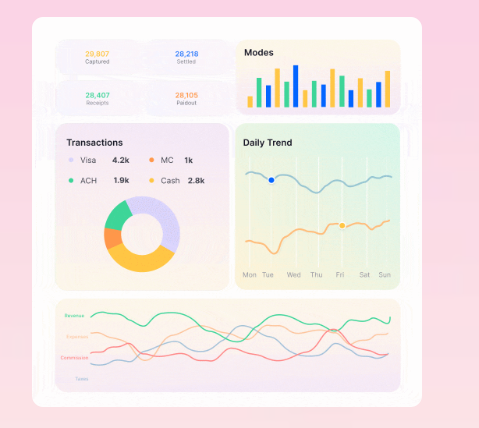

Real-Time Transaction Monitoring: Fintech companies deal with a high volume of transactions daily. Bank reconciliation software provides real-time monitoring of transactions, allowing companies to track and reconcile transactions as they occur. This real-time visibility enhances transparency and enables proactive decision-making.

Integration with Multiple Data Sources: Fintech companies often operate across multiple platforms and channels, resulting in diverse data sources. Bank reconciliation software seamlessly integrates with various data sources, including bank accounts, payment gateways, and financial institutions, consolidating all financial data into a centralized platform for reconciliation.

Customizable Matching Rules: Each Fintech company has unique transaction patterns and reconciliation requirements. Bank reconciliation software offers customizable matching rules that allow companies to define criteria for identifying and reconciling transactions. This flexibility ensures accurate reconciliation tailored to the company's specific needs.

Exception Handling and Resolution: In complex financial ecosystems, exceptions and discrepancies are inevitable. Bank reconciliation software identifies discrepancies and flags them for review, enabling Fintech companies to promptly investigate and resolve issues. Advanced features, such as automated alerts and workflow management, streamline the resolution process.

Compliance and Audit Trail: Compliance with regulatory requirements is paramount for Fintech companies. Bank reconciliation software maintains a comprehensive audit trail of reconciliation activities, including transaction history, adjustments, and resolution steps. This audit trail serves as evidence of compliance during audits and regulatory inspections.

Data Analytics and Reporting: Bank reconciliation software offers robust data analytics and reporting capabilities, providing insights into financial performance, trends, and reconciliation accuracy. Fintech companies can generate customizable reports, such as reconciliation summaries, aging reports, and variance analyses, to support decision-making and regulatory reporting requirements.

Scalability and Adaptability: As Fintech companies grow and evolve, their reconciliation needs may change. Bank reconciliation software offers scalability and adaptability to accommodate growth, changes in transaction volumes, and expansion into new markets. Cloud-based solutions, in particular, offer scalability without the need for infrastructure investments.

Conclusion: Bank reconciliation software tailored for Fintech companies plays a pivotal role in optimizing financial operations, ensuring accuracy, efficiency, and compliance in transaction reconciliation. By automating reconciliation processes, providing real-time transaction monitoring, and offering customizable matching rules, Fintech companies can streamline their operations, enhance transparency, and mitigate risks. Investing in bank reconciliation software empowers Fintech companies to navigate the complex financial landscape with confidence and agility, driving growth and innovation in the digital economy.

For more info. visit us:

Comments