Introduction to Finance Reconciliation Software:

Finance reconciliation software plays a vital role in modern businesses by automating and simplifying the process of matching and verifying financial transactions. These software solutions are designed to save time, reduce errors, and ensure accuracy in financial records.

Importance of Finance Reconciliation Software:

Accuracy: Software for Finance Reconciliation manual errors, ensuring accurate matching of transactions.

Efficiency: Automated processes save time and resources, allowing finance teams to focus on strategic tasks.

Compliance: Helps maintain compliance with accounting standards and regulations by providing detailed audit trails.

Key Features of Finance Reconciliation Software:

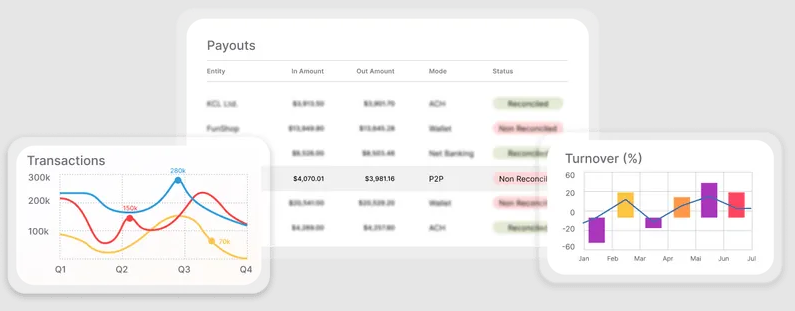

Transaction Matching: Automatically matches transactions from different sources, such as bank statements and accounting systems.

Exception Handling: Flags discrepancies and exceptions for review, reducing the risk of missing errors.

Reporting and Analytics: Generates detailed reports and analytics for insights into financial performance and trends.

Integration: Seamless integration with existing accounting systems, ERP software, and banking platforms.

Benefits of Using Finance Reconciliation Software:

Time Savings: Speeds up the reconciliation process, reducing manual effort and time spent on tedious tasks.

Reduced Errors: Minimizes human errors associated with manual reconciliation, leading to more accurate financial reporting.

Improved Visibility: Provides real-time visibility into financial data, enabling better decision-making.

Auditing and Compliance: Facilitates compliance with regulatory requirements by maintaining accurate and auditable records.

Types of Finance Reconciliation Software:

Bank Reconciliation Software: Matches bank transactions with internal records to ensure accuracy.

Account Reconciliation Software: Helps reconcile accounts receivable, accounts payable, and general ledger accounts.

Credit Card Reconciliation Software: Streamlines the reconciliation of credit card transactions.

Intercompany Reconciliation Software: Facilitates reconciliation between different entities within the same organization.

Choosing the Right Software:

Assess Needs: Identify the specific reconciliation needs of your business, such as bank reconciliation or intercompany reconciliation.

Features: Look for software with robust matching algorithms, reporting capabilities, and user-friendly interfaces.

Integration: Ensure the software integrates seamlessly with your existing systems.

Vendor Support: Consider the reputation and support provided by the software vendor.

Conclusion:

Finance reconciliation software is a valuable tool for modern businesses looking to streamline financial processes, improve accuracy, and save time. By automating the reconciliation process and providing detailed insights, these software solutions empower finance teams to make informed decisions and maintain compliance. Invest in finance reconciliation software to enhance efficiency, accuracy, and transparency in your financial operations.

For more info. visit us:

Treasury Management Software for Fintech

Automated reconciliation software

Automated account reconciliation

Comments