Introduction: Bank reconciliation is a critical aspect of financial management for businesses, ensuring accuracy and transparency in financial records. With the advent of technology, businesses are increasingly adopting bank reconciliation automation software to streamline processes and mitigate errors.

Key Features of Bank Reconciliation Automation Software:

Automated Data Matching: The Bank Reconciliation Automation Software for Business between a company's internal financial records and bank statements, reducing the manual effort required for reconciliation.

Rule-Based Matching: Utilizing customizable rules, the software automatically matches transactions based on defined criteria, improving accuracy and efficiency.

Integration with Accounting Systems: Seamless integration with accounting software ensures that reconciled data is synchronized across financial systems, minimizing discrepancies and ensuring data consistency.

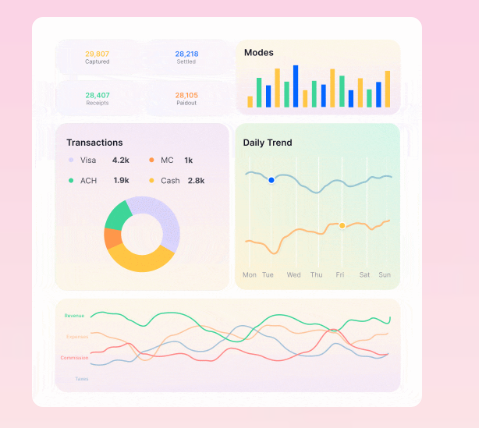

Real-time Monitoring: Advanced software provides real-time dashboards, allowing finance professionals to monitor the reconciliation process, track outstanding items, and quickly address discrepancies.

User-Friendly Interface: Intuitive interfaces make it easy for users to navigate and operate the software, promoting accessibility for finance teams regardless of their technical expertise.

Benefits of Bank Reconciliation Automation Software:

Time Efficiency: Automation significantly reduces the time required for reconciliation tasks, enabling finance teams to focus on strategic financial management and analysis.

Error Reduction: By automating data matching and rule-based reconciliation, the software minimizes the risk of human errors associated with manual processes, leading to more accurate financial records.

Timely Financial Reporting: The streamlined reconciliation process ensures that financial reports are generated promptly, providing businesses with up-to-date insights for decision-making.

Fraud Detection: Automation enhances fraud detection capabilities by identifying unusual patterns or discrepancies in financial transactions, contributing to a more secure financial environment.

Improved Audit Trail: Bank reconciliation automation software creates detailed audit trails, enhancing transparency and accountability in financial operations for both internal and external audits.

Considerations When Choosing Bank Reconciliation Automation Software:

Integration Compatibility: Ensure that the software seamlessly integrates with existing accounting systems to avoid data silos and inconsistencies.

Scalability: Choose software that can scale with the growth of your business, accommodating an increasing volume of transactions and evolving financial needs.

Security Measures: Prioritize software providers that implement robust security measures to protect sensitive financial data and comply with data protection regulations.

Customization Options: Look for software that offers customization options, allowing businesses to tailor the reconciliation process to their specific requirements and complexities.

Training and Support: Opt for providers that offer comprehensive training and support to ensure that finance teams can effectively utilize and maximize the benefits of the software.

Implementation Strategies:

Pilot Testing: Consider implementing the software through pilot testing with a small subset of transactions before full-scale deployment to identify any potential challenges or adjustments needed.

Team Training: Provide thorough training to finance teams to ensure they are proficient in using the software and can leverage its features for optimal results.

Continuous Improvement: Periodically review and refine reconciliation processes based on insights from the software, embracing a continuous improvement approach.

Conclusion: Bank reconciliation automation software for business represents a pivotal advancement in financial technology, empowering organizations to enhance efficiency, accuracy, and security in their reconciliation processes. By choosing the right software and implementing it strategically, businesses can navigate the complexities of financial management with greater ease, ensuring a resilient and agile financial foundation for future growth.

For more info. Visit us:

Comments