The purpose of creating a receipt is to demonstrate or record the completion of a payment that was on hold or pending. In this sense, a receipt is a type of certification that exists in multiple economic spheres, mainly in payment operations between individuals or purchases in SMEs.The utilities of the receipts also go through other points, such as the possibility of the future return of the acquired goods or their exchange for different ones. Often, many merchants also validate receipts as proof or documents of guarantee of the good.

In this sense, this document is also called proof or proof of payment, although in most cases, it does not have sufficient legal validity at levels such as fiscal. This is the opposite of an invoice, for example. The latter happens because a receipt does not have a tax nature. Its usefulness is only limited to providing information and proof of the completion of a transaction. There is no purpose tax purpose.

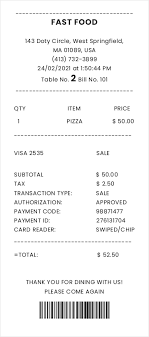

Receipt payment

The payment is usually direct debited in a bank account, but it is also customary to collect at the address of the payer-drawer. In the case of direct debit, the written authorization of the debtor is necessary for the bank to charge or debit the payment. Once this entry is made, the entity sends the debtor the receipt document as proof of payment.

Several customers Online Receipt Maker are normally grouped to send them to the bank. This group of receipts is commonly called a remittance of receipts. The remittance information is usually transmitted to your bank in electronic format, entering the data of each remittance receipt on the bank's website, or even importing a computer file with all the data generated by your remittance program. Bank reconciliation is a handy tool for this type of document since the domiciled payment will be registered automatically.

Characteristics of a receipt

- Identity of the recipient of the subscription and its concept.

- Definition of the concept of payment. That is, the reason for which this particular payment is made must be indicated.

Although this type of proof of payment was created manually, with the development of technology and its application to the specific office automation of companies of all kinds, new printed types have been given way. From there to the next step: in the 21st century, Recipt Generator are increasingly made digitally and taking advantage of the intensive use of new forms of communication (electronic receipts, QR technology, etc.)

Most Common Receipt Types

- Disbursement cash receipt: Certifies that an economic outlay has been made to acquire goods or services, generally in cash.

- Cash box receipt: Receipt Makerallows you to prove that payment for a product or service was received, generally in cash.

- Checking account deposit receipt: The financial institution signs and seals this document to certify that it has received a certain amount of money to pay into the company's checking account. The depositor can withdraw all or part of the available funds by writing checks.

- Leasing receipt: Receipt BuilderAllows justifying the rent payment by a tenant. The owner of the rented property must issue this document.

Comments