In the world of financial markets, trading is often described as a blend of art and science. Traders constantly seek innovative ways to maximize their profits while minimizing risks. One of the critical strategies gaining traction in recent years is the use of advanced trading signal system and a deep understanding of intelligent money concepts. In this article, we will delve into these two crucial aspects of modern trading.

Understanding Advanced Trading Signal Systems:

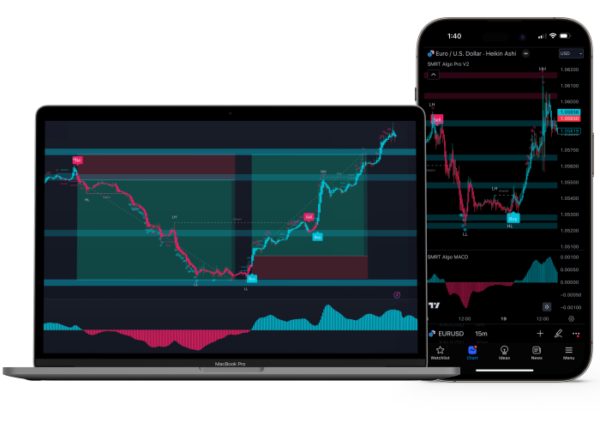

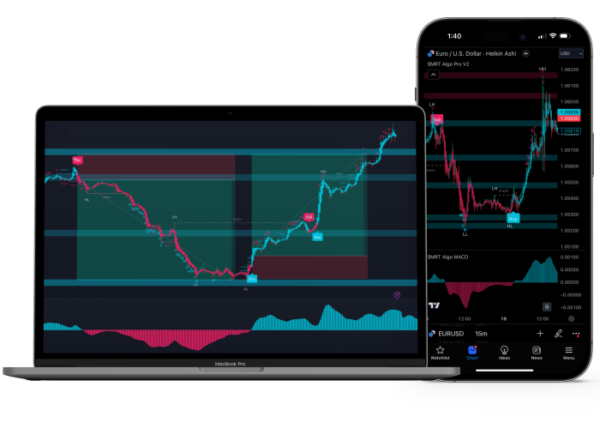

The Evolution of Trading Signals: Trading signals have come a long way from their early days when traders relied solely on technical indicators like moving averages and relative strength index (RSI). Today, an advanced signal system for trading leverages cutting-edge technologies, such as artificial intelligence (AI) and machine learning, to provide more accurate and timely signals.

Algorithmic Trading: Algorithmic trading, also known as algo trading, is a subset of advanced signal systems for trading that uses mathematical algorithms to execute trades automatically. Algorithms analyze vast amounts of historical and real-time data to make split-second trading decisions. This approach allows traders to react to market movements faster than human traders.

Technical vs. Fundamental Signals: Advanced signal systems for trading can be categorized into technical and fundamental signals. Technical signals rely on chart patterns and statistical indicators, while fundamental signals are based on economic and corporate data. Combining both types of signals can provide a more comprehensive trading strategy.

The Smart Money Concept in Trading:

What Is Smart Money?

Smart money refers to the funds managed by experienced and knowledgeable institutional investors, hedge funds, and large traders. These entities often possess superior market insights and execute trades with significant capital. Recognizing their actions can be a valuable asset for retail traders.

Tracking Smart Money: Retail traders can track innovative money activity through various means, including analyzing institutional ownership data, studying order flow, and monitoring options trading. These techniques help identify trends and potential market-moving events driven by competent money participants.

Contrarian Strategies: smart money concepts in trading are known to move against the crowd when necessary. Retail traders can adopt contrarian strategies by observing brilliant money movements, understanding their motivations, and making informed decisions to profit from market sentiment shifts.

Bringing it All Together: Advanced signal systems for trading and the intelligent money concept are intertwined in modern trading strategies. By utilizing advanced signal systems, traders can stay ahead of the curve and make informed decisions. Imaginative money concepts enable traders to gain insights from the actions of institutional investors and other significant market participants.

Conclusion:

In the dynamic world of trading, staying well-informed and adopting advanced strategies is crucial for success. Advanced signal systems for trading and a keen understanding of imaginative money concepts are powerful tools that can help traders navigate the markets effectively. To explore the advanced signal systems for trading and imaginative money concepts further, visit smrtalgo.com, where you can access valuable resources and tools to enhance your trading journey.

Source Url:- https://sites.google.com/view/smrtalgocom44/home

For More Info:-

Comments