Ever watched two companies tie up and wondered what kind of magic-or mayhem-transpires behind the scenes? And such is the world of Mergers and Acquisitions (M&A), where businesses lock arms (or sometimes wrestle) to grow, innovate, or survive.

In this friendly guide, I shall share real world experiences coupled with insider knowledge and field examples to answer the questions Why Does M&A Matter? and How Does It Really Work?

What Are Mergers and Acquisitions?

- Merger: Two companies of roughly equal size agree to combine into a single new entity (think Disney + Pixar in 2006).

- Acquisition: One company buys another outright (for example, Microsoft acquiring LinkedIn in 2016 for $26.2 billion).

“Both moves aim to create synergies - where 1 + 1 equals more than 2.”

Why Do Companies Merge or Acquire?

- Growth and Market Share: At a medium-size fintech startup where I worked, I remember an attempt to acquire a niche payment platform that would have doubled our customer base overnight. Essentially, they would have fast-tracked growth by absorbing the smaller player’s technology and users, instead of building features from the ground.

- Diversification: About 2017, Amazon’s acquisition underneath Whole Foods was something much different than groceries. This was all about maintaining e commerce might and brick and mortar reach to reduce reliance upon any one market.

- Cost Synergies: Huge companies often cut duplicate costs by merging back offices or merging R&D departments and making sure the merged entity is leaner. According to PwC, global M&A deals unlocked over $150 billion in cost synergies in 2022.

- Talent Acquisition (“Acquihires”): Sometimes, it’s all about the people. In 2014, DeepMind’s acquisition granted Google with an instant world-class AI team.

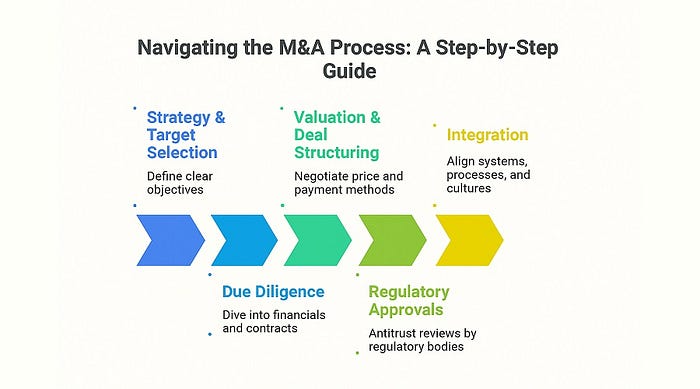

The M&A Process: A Quick Walkthrough

- Strategy & Target Selection: Define clear objectives. Do you want new tech, market access, or cost savings?

- Due Diligence: Dive into the financials, contracts, and culture. Herein lie hidden risks-like lawsuits still pending and customers who feel wronged.

- Valuation & Deal Structuring: Negotiation of price and payment methods: cash, stocks, or a mixture of the two. Valuation models provide a basis for fair offers (DCF, comparables).

- Regulatory Approvals: Antitrust reviews by bodies like the U.S. FTC or India’s CCI can make or break deals.

- Integration: The “people part” is the hardest. Align systems, processes, cultures-often the very stuff that makes or breaks a deal.

Press enter or click to view image in full size

Real world Wins & Warnings

- Success Story: Disney + Pixar has given birth to blockbusters such as Up and WALL E, combining the imagination of Pixar with the marketing strength of Disney.

- Cautionary Tale: The AOL + Time Warner (2001) is famous for clashes of corporate culture and expectation failures. The lesson remains that even huge theoretical synergies can explode without proper integration.

Keys to M&A Success

- Cultural Fit: Shared values and leadership styles reduce friction.

- Clear Communication: Frequent updates keep employees and customers on board.

- PostMerger Planning: Start integration planning before the deal closes - ideally during due diligence.

- Honest Valuation: Don’t overpay for hype; stick to disciplined financial models.

“Deals are made with spreadsheets but won or lost with people”.

- Richard Taub

Conclusion

Even petty mergers (e.g., two local bakeries uniting) could cut costs and expand offerings and increase the buying Mergers and acquisitions are no longer buzzwords reserved for the boardrooms-they are transformative actions that essentially reshape entire industries, initiate innovation, and form new market leaders.

As a research scholar, exploring mergers and acquisitions is more than just analyzing numbers it’s about uncovering patterns, interpreting strategies, and presenting findings with academic precision. With the right research assistant and timely PhD help, you can navigate complex datasets, access credible sources, and structure your study to meet the highest scholarly standards.

Just like successful M&A deals thrive on collaboration, your research journey can reach new heights with the right academic support by your side.

Frequently Asked Questions

1. What’s the difference between a merger and an acquisition?

A merger combines equals into a new entity; an acquisition is one company buying another.

2. How long does an M&A deal take?

Deals usually last from 6 to 18 months beginning from the initial discussions, depending upon the complexity of the matter and on regulatory reviews.

3. Are M&As risky?

Yes, 50–70% of them fail to meet their set expectations due mainly to cultural incompatibilities or faulty integration processes.

4. Who pays for due diligence?

Due diligence costs are also usually covered by the acquirer, but these parties can agree upon negotiation of fees and responsibilities.

5. Can small businesses leverage M&A?

Yes. Small mergers (e.g., two local bakers forming one company) result in greater cost-cutting, increased range of offerings, and better market presence.

Comments