In the rapidly evolving world of finance, artificial intelligence (AI) is proving to be a game-changer, especially in the realm of stock chart analysis. As market dynamics become increasingly complex, the need for advanced tools to analyze and interpret stock data has never been greater. AI is stepping into this breach, offering sophisticated solutions that are transforming how investors and analysts approach the stock market.

The Rise of AI in Financial Analysis

AI’s entry into financial markets is not a sudden phenomenon but a gradual evolution. Traditional Ai Stock Chart Analysis relies heavily on human expertise and manual interpretation of data. Analysts use various tools to assess historical price movements, patterns, and trends to make informed predictions. However, human analysis is inherently limited by cognitive biases and the sheer volume of data.

AI, with its capacity for processing and learning from vast amounts of information, offers a significant upgrade. Machine learning algorithms, a subset of AI, can analyze historical stock data at an unprecedented scale and speed. They identify patterns, correlations, and anomalies that might elude even the most seasoned analysts.

How AI Enhances Stock Chart Analysis

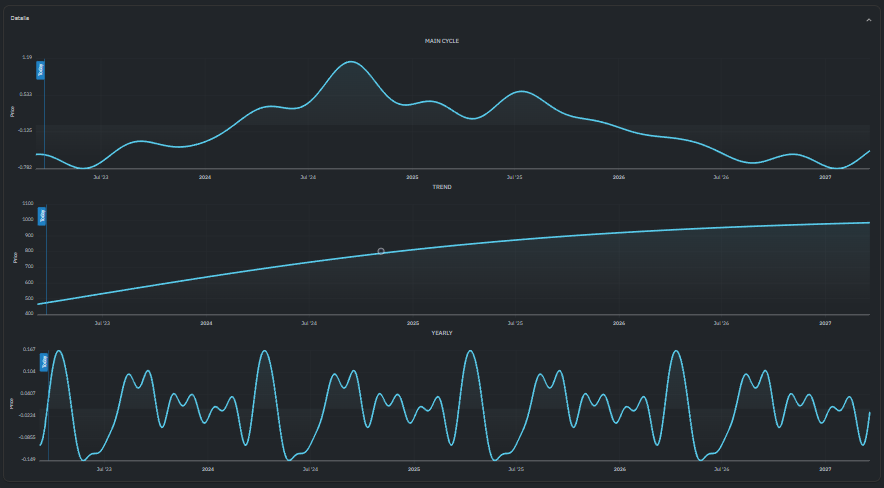

Pattern Recognition: One of AI's most powerful capabilities is pattern recognition. Machine learning models can sift through years of stock market data to identify patterns and trends that are often too complex for human analysts. For instance, AI can recognize subtle shifts in market behavior that precede significant price movements, providing investors with advanced warning signals

.

Predictive Analytics: AI excels in predictive analytics, using historical data to forecast future stock movements. By employing various algorithms, such as neural networks and decision trees, AI models can generate predictive insights that help investors make more informed decisions. These predictions can be based on a combination of historical price movements, trading volumes, and even external factors like economic indicators.

Real-Time Analysis: Traditional analysis methods can be slow and may not account for real-time market changes. AI systems, on the other hand, can process data in real-time, offering instantaneous insights and recommendations. This capability is particularly useful in fast-moving markets where timely information is crucial.

Sentiment Analysis: AI can also analyze market sentiment by processing news articles, social media posts, and other textual data. By understanding the general mood of the market, AI can gauge how external factors might impact stock prices. For example, an AI system might detect negative sentiment around a company and predict a potential decline in its stock value.

Risk Management: Effective risk management is essential for successful investing. AI can assist in identifying potential risks by analyzing historical data and detecting patterns that indicate market volatility. This enables investors to adjust their strategies proactively and mitigate potential losses.

Challenges and Considerations

Despite its advantages, AI in stock chart analysis is not without challenges. The accuracy of AI models depends on the quality and relevance of the data they are trained on. Inaccurate or biased data can lead to flawed predictions. Additionally, the complexity of AI systems means that they require ongoing monitoring and adjustment to ensure they remain effective.

Moreover, while AI can enhance analysis, it does not eliminate the need for human judgment. Investors must still interpret AI-generated insights and consider other factors, such as market conditions and geopolitical events, that may impact stock performance.

Looking Ahead

The integration of ai for stock prediction marks a significant advancement in financial technology. As AI continues to evolve, its role in the stock market will likely become even more profound. Investors who leverage AI tools effectively can gain a competitive edge, making more informed decisions and potentially achieving better outcomes.

In conclusion, AI is reshaping the landscape of stock chart analysis, offering enhanced pattern recognition, predictive analytics, real-time insights, and risk management. While challenges remain, the future of stock market analysis appears to be intricately linked with AI, promising a new era of precision and efficiency in financial decision-making.

Comments