Introduction

Managing personal finances can be a daunting task, but with the right tools, it becomes a breeze. Monthly budget templates and spreadsheets are powerful resources that help individuals take control of their financial well-being. From tracking expenses and bills to planning for the future, these tools provide valuable insights into spending patterns, savings, and financial goals. In this article, we will explore the benefits and features of various budget templates, including the Monthly Budget Spreadsheet, Annual Budget Planner, Bill Planner Spreadsheet, Monthly Bill Tracker, Personal Finance Tracker, and Budget Google Sheets.

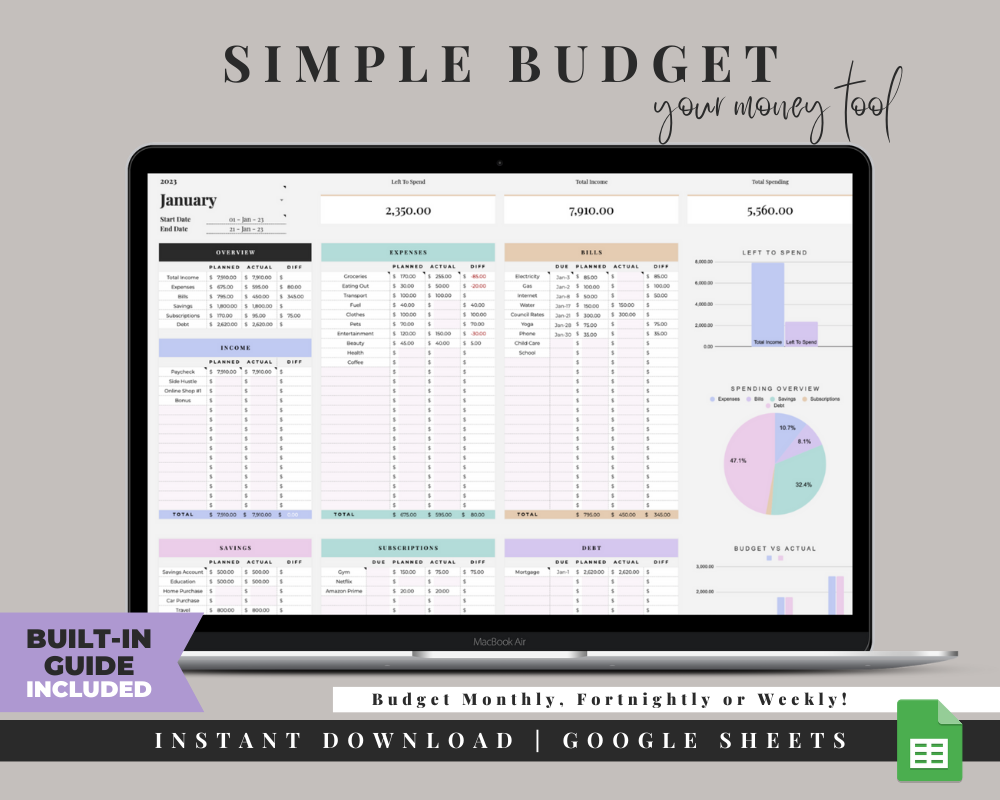

Monthly Budget Spreadsheet

A Monthly Budget Spreadsheet is a comprehensive tool that assists individuals in organizing and managing their finances on a monthly basis. This spreadsheet typically includes sections for income, expenses, savings, and debt. Users can input their various sources of income and list their recurring expenses such as rent, utilities, groceries, transportation, and entertainment. The spreadsheet will automatically calculate the total income, total expenses, and the resulting surplus or deficit. By regularly updating this sheet, users gain valuable insights into their financial health and can identify areas where they need to cut back or increase savings.

Annual Budget Planner

While a Monthly Budget Spreadsheet focuses on short-term financial planning, an Annual Budget Planner takes a broader view. It allows users to create a comprehensive budget for the entire year, incorporating both regular expenses and one-time events like vacations, major purchases, or medical expenses. An Annual Budget Planner is especially helpful for those with fluctuating incomes or who want to set long-term financial goals. It encourages disciplined saving and financial planning by providing an overview of the entire year's financial outlook.

Bill Planner Spreadsheet

Late bill payments can lead to unnecessary fees and stress. A Bill Planner Spreadsheet helps users avoid such situations by providing a centralized location to track all their bills and their respective due dates. Users can set up reminders or alerts to ensure they never miss a payment. Additionally, this spreadsheet can be integrated with other budget templates to factor in recurring bills when calculating monthly expenses. Staying on top of bills fosters financial responsibility and improves credit scores.

Monthly Bill Tracker

A Monthly Bill Tracker complements the Bill Planner Spreadsheet by allowing users to record the actual payment dates and the confirmation numbers of each bill paid. This level of detail enables users to monitor their payment history, ensuring all bills are cleared promptly. Moreover, it serves as a handy reference in case of any payment discrepancies or disputes. With a Monthly Bill Tracker, users gain a clear picture of their payment habits and can make necessary adjustments for better financial planning.

Personal Finance Tracker

A Personal Finance Tracker is an all-encompassing tool that combines budgeting, expense tracking, goal setting, and net worth calculation. It serves as a financial dashboard, offering a holistic view of one's financial health. With features like graphs, charts, and visualizations, users can quickly assess their progress towards financial goals and identify trends. This powerful tool facilitates comprehensive financial planning and empowers users to make informed decisions about their money.

Budget Google Sheets

In the digital age, cloud-based tools are increasingly popular for their convenience and accessibility. Budget Google Sheets leverage the power of Google's cloud-based platform, allowing users to access their budget templates from anywhere with an internet connection. Multiple users can collaborate on the same sheet simultaneously, making it ideal for couples or roommates managing shared expenses. Moreover, Google Sheets offer various add-ons and integration options, further enhancing the budgeting experience.

Conclusion

Financial management is a crucial aspect of our daily lives, and monthly budget templates and spreadsheets provide invaluable assistance in achieving financial stability and meeting our goals. From tracking expenses to planning for the future, these tools offer a wide range of features tailored to different financial needs. By adopting one or more of these budgeting tools, individuals can take charge of their finances, alleviate financial stress, and work towards building a secure financial future. Whether it's a simple Monthly Budget Spreadsheet or a comprehensive Personal Finance Tracker, these resources are here to empower users on their journey to financial success.

For more info:-

Comments