Global Artificial Urinary Sphincters Market Statistics: US$ 6.5 Billion Value by 2032

Summary:

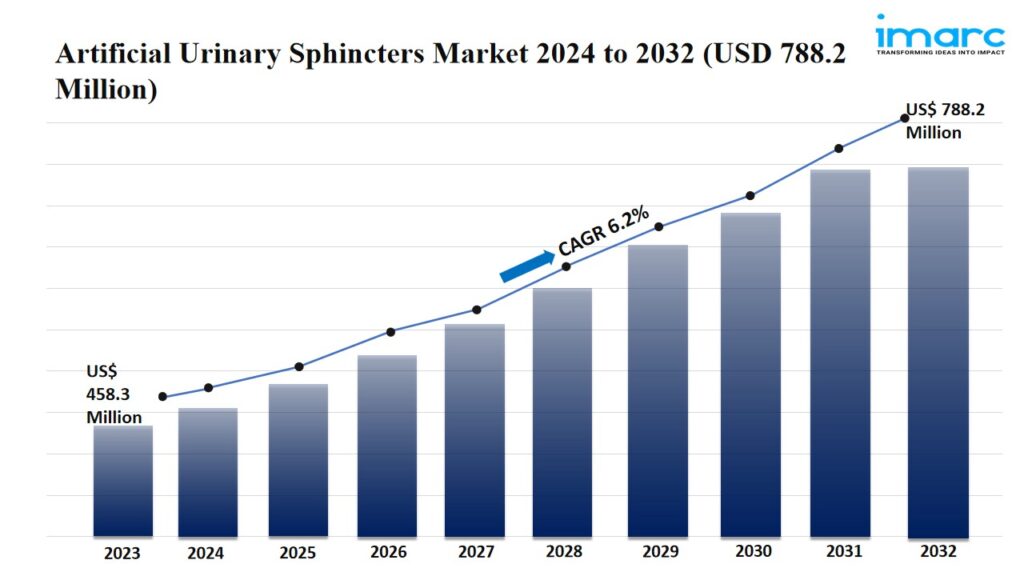

- The global artificial urinary sphincters market size reached USD 458.3 Million in 2023.

- The market is expected to reach USD 788.2 Million by 2032, exhibiting a growth rate (CAGR) of 6.2% during 2024-2032.

- North America leads the market, accounting for the largest artificial urinary sphincters market share.

- AMS 800 accounts for the majority of the market share in the type segment due to its widespread use and proven effectiveness in treating urinary incontinence.

- Male holds the largest share in the artificial urinary sphincters industry.

- Hospitals represent the leading end user segment.

- The increasing prevalence of urinary incontinence is a primary driver of the artificial urinary sphincters market.

- Innovation in device design and the advancements in minimally invasive (MI) surgery are reshaping the artificial urinary sphincters market.

Request PDF Sample for more detailed market insights: https://www.imarcgroup.com/artificial-urinary-sphincters-market/requestsample

Industry Trends and Drivers:

- Increasing prevalence of urinary incontinence:

The growing incidence of urinary incontinence, especially among older adults, represents one of the key factors offering a favorable market outlook. Conditions like prostate cancer, bladder dysfunction, and pelvic surgeries are becoming more common. Many individuals, particularly men who have undergone prostate surgeries, often face incontinence as a long-term side effect. These patients seek effective solutions to regain control over bladder function, and artificial urinary sphincter (AUS) devices offer a reliable, durable option. The increasing prevalence of obesity and diabetes, which can also lead to incontinence, adds to the number of potential patients. The growing awareness and diagnosis of urinary incontinence issues, combined with an aging demographic, are driving the demand for AUS devices.

- Technological advancements in device design:

Technological innovations in AUS design are making these devices more effective and appealing for both patients and healthcare providers. Improvements in material durability, device control, and surgical techniques are making the implantation process smoother and less prone to complications. Newer AUS devices are designed to minimize mechanical failure rates, increase the longevity of the product, and reduce the need for follow-up surgeries. These advancements ensure better control over urinary functions, providing patients with more confidence and reliability in their daily lives. Additionally, these technologies focus on reducing the chances of infection and discomfort, enhancing patient satisfaction. Companies are introducing products that cater to diverse patient needs, including both men and women.

- Advancements in minimally invasive (MI) surgery:

Surgeons are adopting laparoscopic and robotic-assisted procedures for AUS implantation, which offer numerous benefits over traditional open surgeries. These techniques result in smaller incisions, reduced pain, faster recovery times, and fewer complications, making them more attractive to patients. The continuous improvement in surgical technology is increasing the precision and success rates of AUS implantation procedures. This is making the treatment more accessible and less intimidating for patients, leading to a higher number of individuals opting for the procedure. The ability to perform AUS implantation with minimal invasiveness is expanding the market by attracting patients who previously might have avoided surgery due to concerns about recovery and risks.

Artificial Urinary Sphincters Market Report Segmentation:

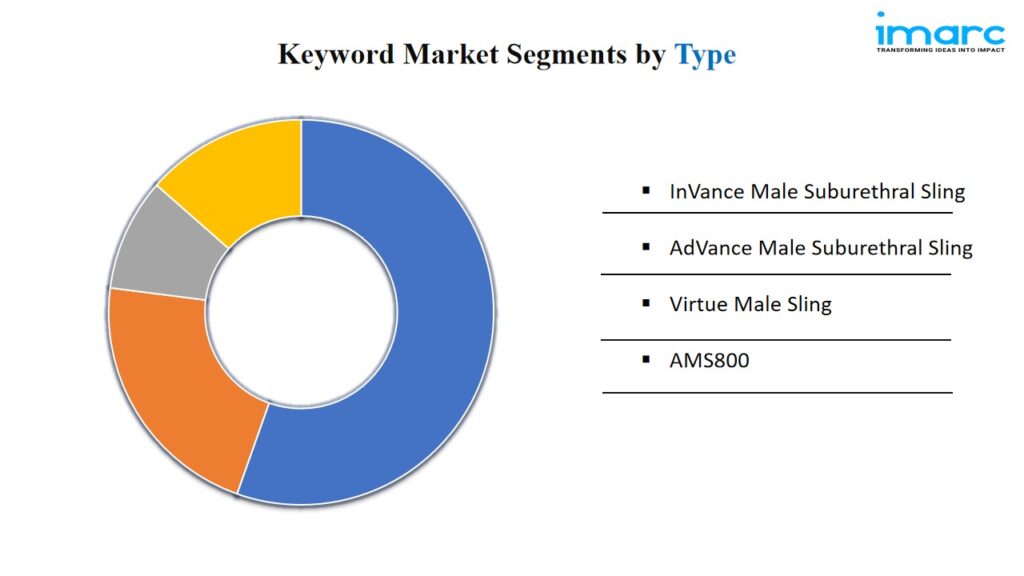

Breakup By Type:

- InVance Male Suburethral Sling

- AdVance Male Suburethral Sling

- Virtue Male Sling

- AMS800

AMS 800 exhibits a clear dominance in the market attributed to its widespread use and proven effectiveness in treating urinary incontinence.

Breakup By Gender:

- Female

- Male

Male represents the largest segment, driven by the need for urinary sphincter implants by men with post-prostatectomy incontinence.

Breakup By End User:

- Ambulatory Surgical Center

- Home Care Settings

- Hospitals

Hospitals account for the majority of the market share, as they are the primary centers for surgical implantation of artificial sphincters.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America dominates the market due to advanced healthcare infrastructure and higher rates of urinary incontinence treatments.

Top Artificial Urinary Sphincters Market Leaders:

The artificial urinary sphincters market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- Boston Scientific Inc.

- Coloplast A/S

- Promedon GmbH

- UroMems

- Zephyr Surgical Implants

Note: If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Comments