- Abuse & The Abuser

- Achievement

- Activity, Fitness & Sport

- Aging & Maturity

- Altruism & Kindness

- Atrocities, Racism & Inequality

- Challenges & Pitfalls

- Choices & Decisions

- Communication Skills

- Crime & Punishment

- Dangerous Situations

- Dealing with Addictions

- Debatable Issues & Moral Questions

- Determination & Achievement

- Diet & Nutrition

- Employment & Career

- Ethical dilemmas

- Experience & Adventure

- Faith, Something to Believe in

- Fears & Phobias

- Friends & Acquaintances

- Habits. Good & Bad

- Honour & Respect

- Human Nature

- Image & Uniqueness

- Immediate Family Relations

- Influence & Negotiation

- Interdependence & Independence

- Life's Big Questions

- Love, Dating & Marriage

- Manners & Etiquette

- Money & Finances

- Moods & Emotions

- Other Beneficial Approaches

- Other Relationships

- Overall health

- Passions & Strengths

- Peace & Forgiveness

- Personal Change

- Personal Development

- Politics & Governance

- Positive & Negative Attitudes

- Rights & Freedom

- Self Harm & Self Sabotage

- Sexual Preferences

- Sexual Relations

- Sins

- Thanks & Gratitude

- The Legacy We Leave

- The Search for Happiness

- Time. Past, present & Future

- Today's World, Projecting Tomorrow

- Truth & Character

- Unattractive Qualities

- Wisdom & Knowledge

Mastery Mondays

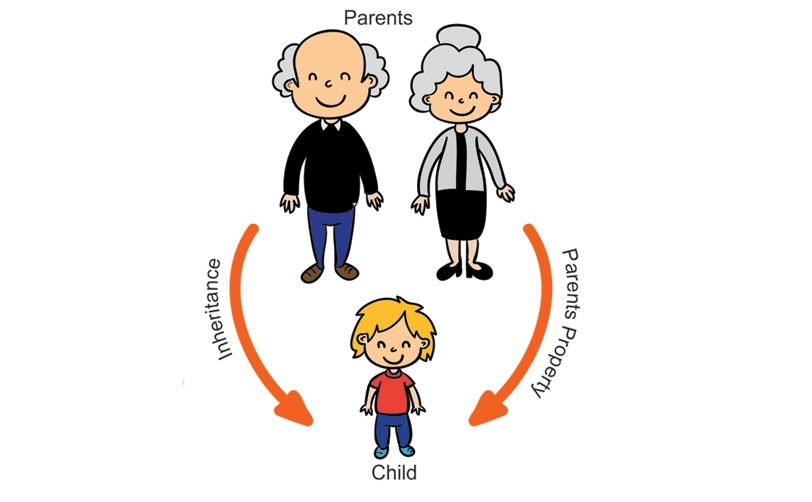

Receiving an Inheritance

What a bitter-sweet moment. You’ve just lost someone you love - the grief is overwhelming. You would give anything to have them back.

And then you learn that they have left you an inheritance. What a blessing!

Now you have to decide what to do with the inheritance.

But first things first - what did you inherit?

Some people inherit a home, while others inherit possessions. Often the inheritance is liquid cash. Depending on what the inheritance is will greatly impact your first step moving forward.

Many people suggest that after you have lost someone near and dear to you, that you wait at least a year before making any big decisions about your life…because grief can hugely impact the way that you make decisions. Sometimes more distant relatives or friends can leave you an inheritance as well - and in those cases you might be in a more solid mental state to make those bigger life decisions.

While it’s best to wait it out on those major decisions, sometimes decisions need to be made quickly.

Let’s take, for example, inheriting a house. There are a LOT of things to think about there. Will you move in? How will you pay the property taxes and utility bills? How will you manage the lawn care and snow removal? Does the house need any immediate repairs?

There are so many things to think about that it can be totally overwhelming. Maybe you can’t afford the upkeep on the property. Depending on some of these factors, this may be one of those scenarios that you cannot sit on for any length of time.

In a case like that, if you are in the midst of a deep season of grief, it’s recommended that you ask someone you trust for some help and some council to walk alongside you as you make these decisions.

Because, ultimately, the person who left the inheritance wanted it to be a blessing to you.

Interesting Fact #1

Over the next 20 years, Canadians will inherit $1 trillion.

Interesting Fact #2

A trend has been developing of late for the likes of the rich and famous. Millionaires and billionaires have publicly declared that they will be giving the lion’s share of their wealth to charity — not their children — when they die.

Interesting Fact #3

To develop a strategy for the inheritance, assess the intention of the inheritance and try to be true to the gifter so that you feel at peace with your decision

Quote of the day

Inheritance taxes are so high that the happiest mourner at a rich man's funeral is usually Uncle Sam. Olin Miller

Article of the day - What should young Ellis do with a $500,000 inheritance?

Q: My parents recently passed away and I inherited close to $500,000. I am 24 years old working as an engineer-in-training in Toronto with an annual salary of $65,000. My student loans are paid off and I carry no credit card debt. I currently live off my own salary with ~40% of my after-tax income going towards rent and car payments. I put 8% of my salary towards a company matched RRSP and they match an additional 4%. My TFSA is capped in a mix of ETFs.

My question is: what do I do with $500,000? I have looked into mutual funds and ETFs or buying instead of renting while maintaining a safety net since I will never be able to move back in with my parents should things go south. I am unsure what would be considered “safe,” yet I know I should start thinking net worth and building on this nest egg. Sorry for the open-ended questions, I am just looking for advice. Let me know if more details would help.

—Ellis

A: Thanks for your question, Ellis. I am sorry to hear about your parents. My philosophy on life as well as financial planning is: Invest for the future, pay back the past, and live for the now.

If I were in your shoes I would:

1) Invest for the Future. Take 1/3rd of the inheritance and invest it into a non-registered investment account (how you invest the money is actually the easy part and perhaps a discussion for another day). This account can act as future retirement savings, emergency fund, etc.

2) Payback the Past. Take 1/3rd of the inheritance and use it as a down payment on a home, and I would mortgage the remaining amount. The funds that you are currently using for rent can now be used to pay down the mortgage.

3) Live for the Now. The final 1/3rd of the inheritance I would use to go on an amazing trip, buy a sports car, see the world, cross something off your bucket list, make a charitable donation to your parent’s favorite charity, upgrade your education. Think outside the box. You may not get another chance in your life to do something amazing. Give yourself permission to follow your dreams. Maybe that is what your parents would have wanted you to do.

Question of the day - Have you ever received an inheritance that you did not want?

Other Beneficial Approaches

Have you ever received an inheritance that you did not want?