- Abuse & The Abuser

- Achievement

- Activity, Fitness & Sport

- Aging & Maturity

- Altruism & Kindness

- Atrocities, Racism & Inequality

- Challenges & Pitfalls

- Choices & Decisions

- Communication Skills

- Crime & Punishment

- Dangerous Situations

- Dealing with Addictions

- Debatable Issues & Moral Questions

- Determination & Achievement

- Diet & Nutrition

- Employment & Career

- Ethical dilemmas

- Experience & Adventure

- Faith, Something to Believe in

- Fears & Phobias

- Friends & Acquaintances

- Habits. Good & Bad

- Honour & Respect

- Human Nature

- Image & Uniqueness

- Immediate Family Relations

- Influence & Negotiation

- Interdependence & Independence

- Life's Big Questions

- Love, Dating & Marriage

- Manners & Etiquette

- Money & Finances

- Moods & Emotions

- Other Beneficial Approaches

- Other Relationships

- Overall health

- Passions & Strengths

- Peace & Forgiveness

- Personal Change

- Personal Development

- Politics & Governance

- Positive & Negative Attitudes

- Rights & Freedom

- Self Harm & Self Sabotage

- Sexual Preferences

- Sexual Relations

- Sins

- Thanks & Gratitude

- The Legacy We Leave

- The Search for Happiness

- Time. Past, present & Future

- Today's World, Projecting Tomorrow

- Truth & Character

- Unattractive Qualities

- Wisdom & Knowledge

Career & Finance Fridays

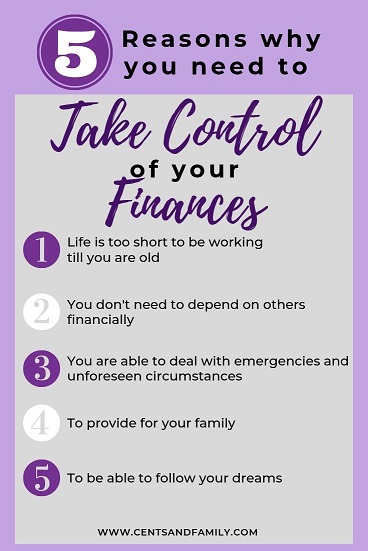

How to Take Control of Your Finances When Things Feel Out of Control

Finance can be overwhelming. If you've had a rough year, a complicated season, or are just feeling stressed out, it can be easy to assume that things are spinning out of control. Taking ownership over your finances is a great way to get yourself back on track and get a mental reset.

Start out by looking at quality resources -- there are tons of books, podcasts, and YouTube videos all designed to help beginners understand and execute their goals. Educate yourself!

If your spending habits aren't what you want them to be, look into creating a budget. Budgets are great tools to help you manage your costs and save more.

Get rid of extra costs. Cable you don't use, streaming services that aren't worth the spend, or unnecessary fun stuff that are holding you back from being able to achieve financial freedom.

Consult a professional if you need to, and start looking into investing! Making your money work for you is an excellent tool, and the sooner you start, the better. Look for ways to build pasive income or get a side hustle and start finding ways to bring in extra every month.

You're the only one who decides your future, and while money certainly isn't everything, it's a pretty powerful tool. How will you use it, and what can you do to set yourself up for success in the future? Take charge of your life and what lies ahead -- it's all up to you.

Interesting Fact #1

In the U.S. alone, there are billions of dollars of non-mortgage debt.

Interesting Fact #2

A personal loan can help you cover both expenses and bulk up your savings.

Interesting Fact #3

In the last 10 years, the average FICO score has steadily increased.

Quote of the day

Too many people spend money they earned..to buy things they don't want..to impress people that they don't like.

Article of the day - 20 Ways to Take Control of Your Finances

Whether you're stuck in a cycle of debt, earn too little to maintain your desired standard of living, or simply want to get a jump start on saving for a major financial goal such as buying a home or investing, you may need help to get on track with your objectives. Follow these strategies for taking control of your finances right now.

Read Books About Personal Finance

If you need help with your finances but aren't sure where to start, seek financial wisdom from books written by experts.

There are many books out there on taking control of your finances, from how to get out of debt to how to build an investment portfolio. Books offer a great way to change your approach to managing money.

To boost your savings, buy used financial books online or borrow them for free at your local library. Consider audiobooks if you would rather receive the advice by ear.

Start Budgeting

If you are struggling to handle your finances, then you likely need to create a budget—a plan for how to spend your money each month that is based on how much you typically earn and spend. A budget is your best tool to change your financial future.1

To start, write down your income and all your expenses, and then subtract the expenses from the income to determine your discretionary spending. At the start of each month, set up a budget to allocate how discretionary funds get spent. Track the spending over the course of the month, and at the end of the month, determine whether you stuck to the budget.

If you spent more than you made, fix your budget by cutting unnecessary expenses or earning more. Implement the revised budget the next month to start living within your means.

Reduce Monthly Bills

One of the easiest things you can do to take control of your finances is to cut your monthly expenses.

While you may not be able to reduce certain fixed expenses, such as rent or a car payment, without drastically altering your lifestyle, you can reduce variable expenses, such as clothing or entertainment, by being flexible and thinking frugally.2

You can, for example, reduce electricity consumption to lower your utility costs, choose different providers for your home or life insurance, or buy your food at a discount at bulk stores.

Cancel Cable

Speaking of cutting monthly bills, there's likely one bill that you could cut right now and potentially save hundreds of dollars every month: your cable bill. If you need a little help with your finances or you just want to reach your financial goals more quickly, you should consider cutting cable.

You don't even have to give up TV altogether. "Cutting the cord," that is, eliminating costly cable services in favor of low-cost streaming services such as Netflix and Hulu, allows you to watch the shows you love without spending a ton each month.

If, after reviewing various streaming options, you're still determined to stick with your cable provider, downgrade to a cable package with fewer channels to save a little money every month.

Stop Eating Out

Looking for an easy way to take control of your variable expenses every month? Curb your habit of eating out. The occasional splurge at a nice restaurant is fine, but the savings can add up if you start cooking at home or bringing bagged lunches to work instead of eating out each day.

Start small by cooking at home at least once a week. The next week, start taking your lunches to work. You may be surprised at just how much you can save. Over a 40-year period, brown-bagging it can save you $1,300 per year, or more than $50,000 over a 40-year career.

Plan a Monthly Menu

If the idea of cooking every night is off-putting to you, plan a monthly menu to make it less intimidating. The advantage of planning meals for the entire month is that you can chop foods or cook meals in batches. This approach also makes it easier to shop for groceries and ensures that you waste less food because you will most likely use all the ingredients you buy while they are still fresh.

An alternative is to use a menu-planning service such as eMeals or PlateJoy to take the effort out of shopping and cooking altogether. These services allow you to choose recipes and have a list of the necessary ingredients sent to your local grocery store for fast pick-up. However, these services cost money, so you'll need to evaluate the cost and determine whether it fits into your budget.

Pay Off Your Debt

One of the most expensive mistakes that you can make is to carry a lot of debt, especially high-interest credit card debt. If you want to change your financial picture and gain more financial opportunities, pay off your debt as quickly as possible.

Start by listing all of your current debts, be it credit card debt, student loan debt, or a car loan, and figure out the minimum amount you owe to remain current with each debt. Simply paying the minimum amount won't get you out of debt quickly, so evaluate your fixed expenses and determine how much of your discretionary spending budget you can allocate toward debt repayment.5

Try to reduce the interest rate on the debt by asking the issuer for a lower rate, consolidating multiple debts into one debt, or transferring high-interest debt to a low-interest credit card, such as a balance transfer card. Then, set up a debt payment plan and adopt sound spending habits to pay off the debt as quickly as possible.

Stop Using Your Credit Cards

If you are struggling to make ends meet each month, you may be relying too much on your credit cards. If you keep using your credit cards as a stop-gap measure to make ends meet, you'll quickly wind up in debt. This will limit how much money you have each month to pay bills, save for retirement, or work toward another financial goal.

If you really want to take control of your finances, stop using your credit cards. In addition to setting up a budget so that you don't have to buy things on credit, switch to cash or debit cards to avoid accruing more debt, open a short-term savings account and draw from it for large expenses, or leave your credit card at home so that you're never tempted to pull it out of your pocket and swipe it.

Manage Your Student Loans

Your student loans can saddle you with debt for years if you are not proactive about paying them off. Whether you need to refinance or consolidate them, see if you qualify for a student loan forgiveness program, or add them to your debt payment plan, getting control of your student loans is an excellent step to take right now to improve your finances.

You don't have to drastically step up your loan repayment schedule, either; by paying half your student loan amount every two weeks, you will make a full extra payment every year. Some lenders will even reduce your interest rate by around 0.25% when you sign up to make automatic loan payments.6

Start Saving Each Week

Like investing, saving is another passive approach to growing your wealth, albeit more gradually. To take control of your finances right now, open and direct money into interest-bearing savings account on a regular basis (every week, month, or a certain time of year, for example).

This may be money that you save on your grocery budget each month, a tax refund, a set amount that you put aside from each paycheck, or an amount that you allocated in your budget to save each month.

No matter which option you choose, and no matter how little you save, look for ways to increase your savings over time. Small gains will amount to big returns over the long run.

Go on a Spending Fast

Another way to help you curb your spending and get your finances in order is to go on a spending fast, which is when you stop spending money for a set period of time.

Often, these are month-long periods of curtailed spending that make exceptions only for essential spending categories, such as food, transportation, and recurring bills.

If you're willing to live like a minimalist for a brief period of time, commit to this challenge to pad your checking account, change your habits, and evaluate what you need as opposed to what you want. The experience may even permanently improve your outlook on money.

Set Up a Financial Plan

A financial plan is essential for taking control of your finances and accomplishing specific goals. In short, a financial plan is a timeline for the big milestones in your life.

It's similar to a budget, but it covers a longer time horizon of 10, 20, or 30 years down the road, whereas a budget is a short-term plan for the weeks or months ahead. The two documents work hand in hand, which is why a budget is often a component of a larger financial plan.

These plans can also help you with your finances by prioritizing your goals, as it is often more effective to focus on one or two financial goals at a time. Your financial plan should include events including buying a home, saving for retirement, and paying for your kids’ college education.

Set Realistic Goals

Take the time to set financial goals that you are working toward, such as buying a house or growing your retirement nest egg. If you do not have specific things that you are working toward, you will have difficulty motivating yourself to keep saving or investing each month.

As you set your goals, ensure that they are realistic. For example, don't set a goal to pay off $40,000 in debt in a single year when your salary is only $30,000. Unrealistic goals that set you up to fail can discourage you from making the right financial moves in the future.

Finally, track your goals over time so that you can see how much you have accomplished. For example, most modern brokerage firms offer tools on their websites that let you monitor your investment portfolio gains and losses over time. These tools can help you stay on track when you are working toward a long-term goal.

Become an Investor

There are two ways to make money: earning it actively by working for it or earning it passively, while you sleep, by saving or investing the money you have in stocks, bonds, mutual funds, real estate, or other financial instruments. Given that the long-term average annual return of the stock market is 10%, or 6% or 7% when adjusted for inflation, investing in the stock market is a great way for the average person to build wealth.

If, like many, the idea of investing intimidates you, enroll in a class on investing basics, meet with a financial advisor, or talk to a trusted family member or friend who has experience in the area. While investing comes with risks, investing consistently and spreading your money in the appropriate percentages across diverse asset classes (stocks and bonds, for example) can help maximize your gains and limit your losses.

Protect Your Savings

If you are great at putting money into savings each month, but you're quick to dip into it to cover a discrepancy in your budget or buy something on an impulse, take steps to protect your savings from yourself.

Solutions include moving your savings to a CD, from a brick-and-mortar bank where the funds are easily accessible to an online bank where the funds are less liquid, or starting an emergency fund at a separate bank than where you bank every day.

Increase Retirement Savings

Retirement is expensive, so you should ideally start saving for retirement when you start your first job. Even if you are working on getting out of debt, contribute up to the match offered by your employer—this is free money, after all.

If you are out of debt, work on increasing your savings. How much you should save depends on how old you are when you start. If you're in your 20s, you can get by with a contribution rate of 10% to 15% of your income, whereas someone starting to save in her 50s should contribute a whopping 60% of her pay toward retirement.11 The earlier you start to save, the better for your wallet, both now and in retirement.

Find Additional Sources of Income

Financial issues sometimes stem from insufficient income as opposed to spending issues. If you are sticking to a budget, not spending money on things you don't need, and still have issues making ends meet, you may want to look for a higher-paying job or generate more than one source of income. More income tends to provide more financial stability, especially if you are single or you are a single-income household.

If you can't get or change a job, look for opportunities to generate income on the side or in addition to your job. Passive income from a rental property is another way to build wealth or find extra money to get out of debt.

Improve Your Job Skills

While it may not seem directly tied to your finances, job security is an important piece of your financial picture because it dictates how regular your paycheck is.

Ensure that you have the skills you need to stay competitive in the workplace. This may mean taking extra certifications or getting training through your current employer. Or, it may mean heading back to college for a graduate degree that qualifies you for a more stable profession.

Get Insured

You can protect your finances by having the right amount of insurance. Common types of insurance include car insurance, renter’s or homeowner's insurance, life insurance, and if your employer doesn't provide it, health insurance.12

While you may be tempted to skimp on insurance, remember that it protects you from catastrophes that can send your finances spiraling.

Make the Most of Employee Benefits

In addition to your retirement and health insurance, your company may offer additional employee benefits, such as dental insurance, vision insurance, and flexible spending accounts.

Not all of these benefits may be worth the additional money that you pay for them, but some can help with your finances by relieving you of the need to pay out of pocket for essential expenses. Take the time to evaluate your options so that you get the most from your employee benefits.

Question of the day - What's the best financial tip you've ever heard?

Money & Finances

What's the best financial tip you've ever heard?