- Abuse & The Abuser

- Achievement

- Activity, Fitness & Sport

- Aging & Maturity

- Altruism & Kindness

- Atrocities, Racism & Inequality

- Challenges & Pitfalls

- Choices & Decisions

- Communication Skills

- Crime & Punishment

- Dangerous Situations

- Dealing with Addictions

- Debatable Issues & Moral Questions

- Determination & Achievement

- Diet & Nutrition

- Employment & Career

- Ethical dilemmas

- Experience & Adventure

- Faith, Something to Believe in

- Fears & Phobias

- Friends & Acquaintances

- Habits. Good & Bad

- Honour & Respect

- Human Nature

- Image & Uniqueness

- Immediate Family Relations

- Influence & Negotiation

- Interdependence & Independence

- Life's Big Questions

- Love, Dating & Marriage

- Manners & Etiquette

- Money & Finances

- Moods & Emotions

- Other Beneficial Approaches

- Other Relationships

- Overall health

- Passions & Strengths

- Peace & Forgiveness

- Personal Change

- Personal Development

- Politics & Governance

- Positive & Negative Attitudes

- Rights & Freedom

- Self Harm & Self Sabotage

- Sexual Preferences

- Sexual Relations

- Sins

- Thanks & Gratitude

- The Legacy We Leave

- The Search for Happiness

- Time. Past, present & Future

- Today's World, Projecting Tomorrow

- Truth & Character

- Unattractive Qualities

- Wisdom & Knowledge

Career & Finance Fridays

Why Buying a House is a Terrible Investment

I live in a pretty metropolitan area, one where housing prices have gone from "maybe by the time I retire I'll have a down payment" to "absolutely never ever ever". Owning your own place is almost impossible as a young adult here, and it got me wondering how valuable of an investment it really is to own your own place.

The more I looked into it, the more I came to the conclusion that buying a house is almost always a terrible investment. Not always a terrible choice, but a terrible investment.

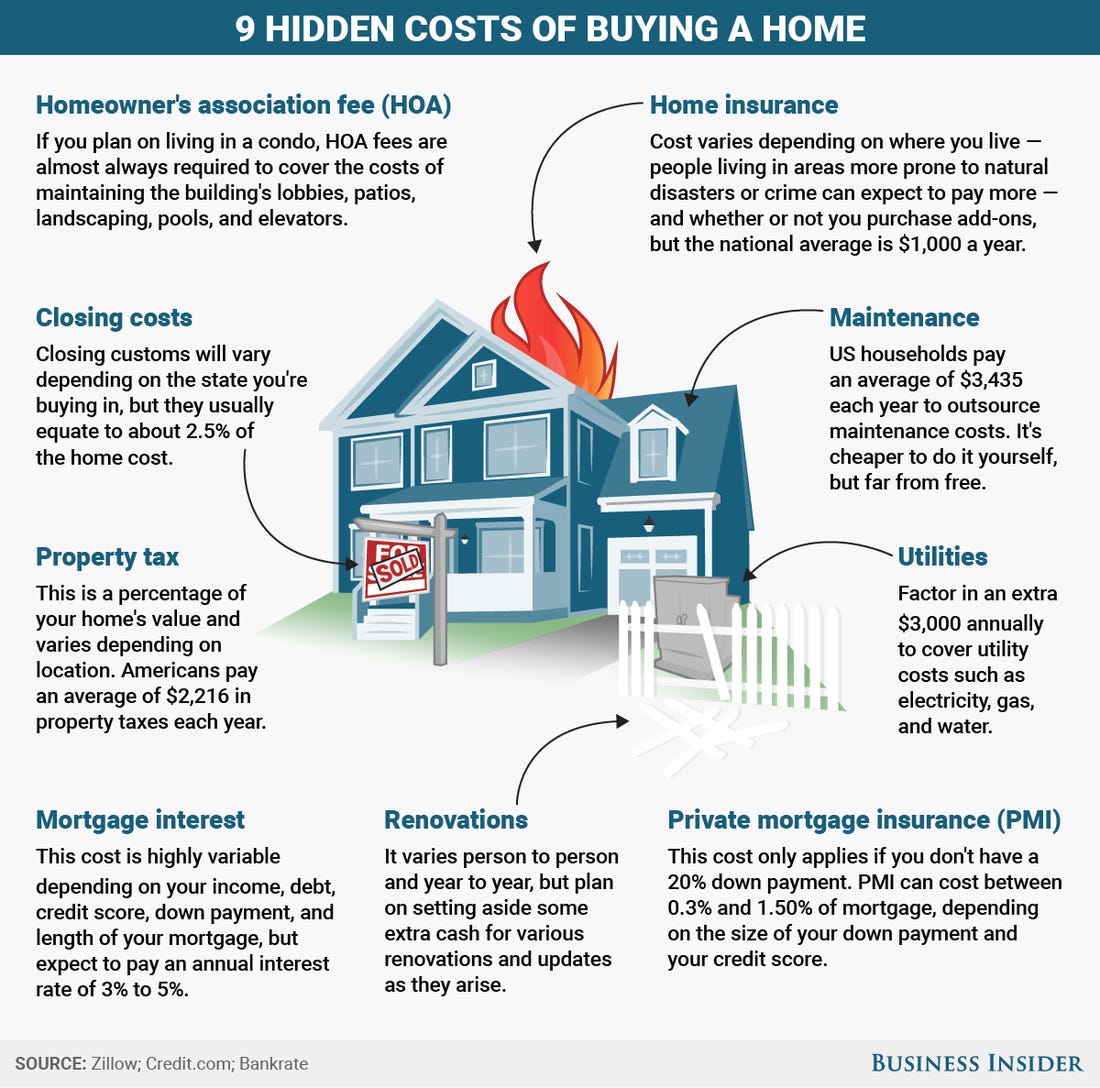

Here's why: aside from the principal cost of the house, you'll pay interest on a mortgage, property tax (which is NO JOKE), maintenance costs, and utilities. This is often the same or higher than average rent costs in an area, meaning that you're spending more every month just to own.

There's also zero guarantee that the value of your house will appreciate. Property values are constantly changing and shifting, as is the economy, and there's really no way to know what things will look like when and if you ever decide to sell.

For the record, if you don't plan on selling -- your house isn't an investment at all, because you're not getting back.

Unless you plan on renting out the basement, running an AirBnb, or getting really creative, buying a house may just be a source of comfort and stability for you. While that's not a bad thing, it's good to know what you're getting into. Being a homeowner feels great, but buying a house is a terrible investment.

Interesting Fact #1

Financial experts estimate that buying a house could cost you 40% more than renting.

Interesting Fact #2

Almost 65% of U.S. Citizens were homeowners in 2018.

Interesting Fact #3

Over 5 million homes were sold in 2018.

Quote of the day

Find out where the people are going and buy the land before they get there.

Article of the day - The Truth? Your House Is Not An Investment

Buying a house is a major financial decision that can give you peace of mind and a wonderful place to live. But it's not an investment.

It’s common for people to think of their house as an investment, but this misses the mark on a few fronts.

Based on a number of factors, a single-family home that you live in is not an investment. That’s not necessarily saying you should avoid homeownership, but if you’re leaning towards buying because you think you’re making a smart investing, think twice.

The idea that your primary residence can be an investment comes from the fact that, historically, real estate values rise. It’s likely that we all know someone—a parent or grandparent, perhaps—who bought their home decades ago for less than $100,000, and it’s now worth many times that sum.

It’s not an investment just because it appreciates

For the sake of this argument, we’re going to ignore the fact that, over the long run, average home values appreciate only slightly more than inflation. (Over 100 years, average U.S. real estate values gained less than 1 percent, when adjusted for inflation).

Assuming a home’s value increased only at the rate of inflation, a property purchased in 1970 for $100,000 would be worth $625,873 today, a 526 percent increase. The real reason your grandfather’s house appreciated so much over 40 years? It’s simply inflation.

It’s not to say real estate values cannot appreciate dramatically. They can, and do. But such appreciation is more likely in specific, desirable real estate markets.

But guess what? It doesn’t matter. Whether or not your home’s value outpaces inflation, there are other reasons your home isn’t an investment.

A true investment requires more than the prospect of an increase in value.

A house has a more important primary purpose

Probably the single biggest reason why a house is not an investment is because its primary purpose is providing shelter. This is more significant than it sounds at first.

One of the most basic factors that makes an investment an investment is your ability to control the timing of your ownership. That means that you can buy it and sell it at times and under circumstances that are likely to maximize your investment return. We can think of traditional investments, such as stocks, bonds, mutual funds—even rental real estate—as providing this ability.

Since your house is your personal residence, you will have little control over the purchase and sale from an investment perspective. You’ll purchase the house when it is needed for shelter purposes, and sell it only when it no longer serves that purpose, and it’s time to move on.

The lack of control over the timing of buying and selling a house had a major negative effect on houses as investments during the financial meltdown. Many people bought houses at the top of the market because that was the time that they needed a home for their families. But still others were stuck having to sell after the market collapse, due to a negative change in their own personal financial situations.

That forced them to buy high, and sell low. That’s not unusual when it comes to residences, and largely disqualifies a house as an investment.

A house can’t be an investment if you never plan to sell it

While it is true that houses generally increase in value, there’s only limited ability to tap into that increase. The most effective and efficient way is to sell the house after it has experienced a significant amount of price appreciation. However, selling a house is highly disruptive because it means you have to move.

More significantly, when you do sell, you will most likely have to use the equity from the sale to purchase the next house. After all, you will be moving from one residence to another. This means that in a real way, home equity is trapped equity.

The only time that house does not fall into this category is when you plan to sell the house, either to trade down to a less expensive house, or to move to a rental situation. In that way, you will sell the property and cash-out on the equity.

Thinking of your house as an investment can lead to equity stripping

There is another way that you can pull equity out of your house, but it is hardly a method that’s risk free. You can borrow the money out of your house, based on the amount of equity you have. This can be done either through a home equity line of credit (HELOC) or through a straight up cash-out refinance of your first mortgage.

But when you do either, you are borrowing money against the house. That may put more cash in your pocket for purposes unrelated to the house, but it also creates a corresponding liability. That liability not only creates a reduction of future cash flow via the monthly payments, but it also puts your house at risk.

A lot of people found that out the hard way during the financial meltdown. As house values either went flat or declined, homeowners realized that they had no equity in their homes. That left them unable to refinance to lower the monthly payments, and unable to sell to move to a less expensive housing arrangement.

The widespread use of HELOCs and cash-out refinances made a lot of people feel richer in the short-term, but it jeopardized their long-term financial security in the process. Thinking of their homes as perpetual investments, many engaged in serial refinances and left themselves “underwater” on their homes—owing more on the house than the house was worth.

That’s where thinking of your house as an investment becomes a dangerous assumption.

The carrying costs of a house are too high for it to be an investment

Typically when you purchase an investment, it doesn’t require an ongoing investment of cash. But a house certainly does.

Not only do you have to make monthly mortgage payments, but you also have to pay real estate taxes, homeowners insurance, sometimes private mortgage insurance, and utilities. You also have to maintain the property, which means providing a regular series of repairs and maintenance as necessary. These expenses are called carrying costs—the costs of carrying the investment.

Even more costly are the major repairs associated with homeownership. This can include replacing the roof, siding, windows and doors, carpets and flooring, and driveways. You may also engage in major remodeling, that will require replacement of kitchens and bathrooms.

Each of those expenses individually can cost thousands of dollars. Over the course of several years or decades, they can cost tens of thousands dollars.

True investments don’t require that kind of ongoing outlay of cash. You can rationalize those expenses based on the fact that the house is providing you shelter. But that gets back to the original premise—a house is shelter, and not really an investment.

Carrying costs can really work against you

Say, for example, you purchase a house for $200,000, and 10 years later you sell it for $300,000. Good investment? Only if you don’t look too closely at the numbers.

If the house cost you $1,000 per month for principal, interest, taxes, and insurance (PITI), plus $300 per month for utilities, you will have spent $15,600 per year, or $156,000 for the decade that you lived in the house.

If you spent another $3,000 per year on routine repairs and maintenance, you will spend another $30,000. And if you did some of the more major repairs, like replacing the roof and flooring, and remodeling the kitchen and bathrooms, you probably easily sunk another $50,000 in during the decade.

That’s a total of $236,000 over a 10 year period, to get a $100,000 gain on the sale.

While it is certainly nice to walk away from the house with $100,000 more than you paid for it, the math doesn’t support the idea of the house as a winning investment. And we haven’t even accounted for transaction expenses (like the 6 percent realtor commission), inflation, or for the fact that the value of the house may not rise that dramatically over the next 10 years.

Your house won’t generate cash flow

It would be bad enough if owning a house “only” required heavy carrying costs, but it gets even worse. A house you use as a primary residence generates no cash flow.

This is a critical consideration. When you buy an investment, you usually expect to have some sort of cash flow on that asset, while you are waiting for it to increase in value. That’s certainly true when it comes to stocks, mutual funds, and exchange-traded funds. You expect to collect dividends while you are waiting to sell your investment position at a future date for a higher price.

But even stable investments, like bonds and certificates of deposit, provide interest income while you own them.

This is not true of the house that you live in as a residence. You might make a case for a cash flow, if the house is a two-to-four family structure and provides rental income from the additional units. But if it is a single-family house, townhouse, or condominium, there’ll be no cash flow.

Appreciation is the magic ingredient, but it’s not guaranteed

Finally, let’s revisit the primary reason why so many people consider their house to be an investment. The whole notion rises and falls on the future value of the property. During times when the value of the house increases, people commonly think of their houses as investments.

But during the financial meltdown, and particularly in certain markets, not only did property values not increase, but most fell. Some fell spectacularly. For people in that situation, not only was their house not an investment, but it had become a major liability.

The possibility of a flat or declining housing market can no longer be discounted. Should that happen, you’ll be forced to live in your house much longer than you expect, and you’ll probably find that you can neither sell the property, nor borrow out the equity.

That doesn’t sound much like an investment at all. And it’s probably best that you think of it as a place to live, rather than as an investment.

So where are we going all this? Basically here: Don’t think of your house as an investment—and make sure that you continue to put money into true investments, like financial assets or real estate that produces rental income.

And then kick back and enjoy living in your house. That’s the real purpose of owning one.

Question of the day - When do you think is the right time to buy a home?

Money & Finances

When do you think is the right time to buy a home?