- Abuse & The Abuser

- Achievement

- Activity, Fitness & Sport

- Aging & Maturity

- Altruism & Kindness

- Atrocities, Racism & Inequality

- Challenges & Pitfalls

- Choices & Decisions

- Communication Skills

- Crime & Punishment

- Dangerous Situations

- Dealing with Addictions

- Debatable Issues & Moral Questions

- Determination & Achievement

- Diet & Nutrition

- Employment & Career

- Ethical dilemmas

- Experience & Adventure

- Faith, Something to Believe in

- Fears & Phobias

- Friends & Acquaintances

- Habits. Good & Bad

- Honour & Respect

- Human Nature

- Image & Uniqueness

- Immediate Family Relations

- Influence & Negotiation

- Interdependence & Independence

- Life's Big Questions

- Love, Dating & Marriage

- Manners & Etiquette

- Money & Finances

- Moods & Emotions

- Other Beneficial Approaches

- Other Relationships

- Overall health

- Passions & Strengths

- Peace & Forgiveness

- Personal Change

- Personal Development

- Politics & Governance

- Positive & Negative Attitudes

- Rights & Freedom

- Self Harm & Self Sabotage

- Sexual Preferences

- Sexual Relations

- Sins

- Thanks & Gratitude

- The Legacy We Leave

- The Search for Happiness

- Time. Past, present & Future

- Today's World, Projecting Tomorrow

- Truth & Character

- Unattractive Qualities

- Wisdom & Knowledge

Career & Finance Fridays

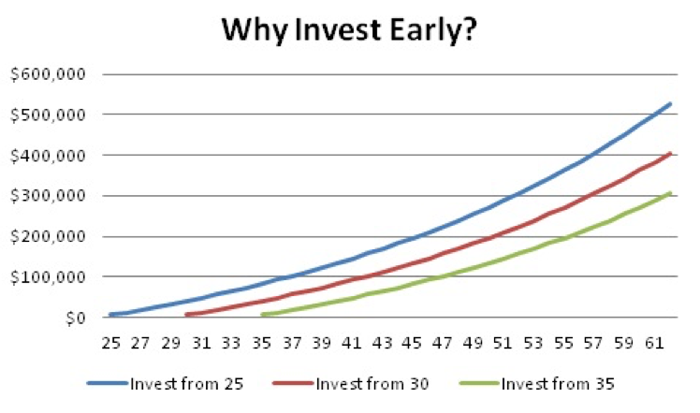

Why You Should Start Investing Your Money Young

“Stocks”, “shares”, and saving for retirement - it all sounds like things I’d expect to come out of my dad’s mouth. It didn’t occur to me that these were things I needed to or should look into and educate myself on.

But the reality is that the cost of living is consistently going up, particularly if you live in a highly concentrated area. And by the time I’m prepared to retire, I’ll certainly need more than I do right now. We all will. And one of the best ways to begin preparing for such is by learning how to actually use my money well, investing & allowing it to bring in revenue.

You can start investing at any point, but doing it young is ideal. Because the more time you have once you’ve begun investing, the more time you have for the investment to do its thing. Investing young also allows you more time and opportunities to do research and learn the craft, particularly since most young people don’t have the responsibility of a high position career or a family.

The Internet has provided us with easy access to a plethora of information and options of how to invest and do it well. This week, take some time to sit down and decide to invest in yourself and your future!

Interesting Fact #1

A 2015 US study showed that the average American approaching retirement (55-64 years of age) had just over $100,000 saved.

Interesting Fact #2

Additionally, the same study discovered that 29% of households that are 55+ had NO retirement savings or benefit plan.

Interesting Fact #3

Most financial advisors recommend saving 10 to 12% of your annual salary every year, beginning as early as possible.

Quote of the day

In investing, what is comfortable is rarely profitable.

Article of the day - How to Start Investing: A Guide for Beginners

Rent, utility bills, debt payments and groceries might seem like all you can afford when you’re just starting out. But once you’ve mastered budgeting for those monthly expenses (and set aside at least a little cash in an emergency fund), it’s time to start investing. The tricky part is figuring out what to invest in — and how much.

As a newbie to the world of investing, you’ll have a lot of questions, not the least of which is: How do I get started investing, and what’s the best strategy? Our guide will answer those questions and more.

Here’s what you should know to start investing.

How to start investing

- Get started investing as early as possible

- Decide how much to invest

- Open an investment account

- Understand your investment options

- Pick an investment strategy

Get started investing as early as possible

Investing when you’re young is one of the best ways to see solid returns on your money. That’s thanks to compound interest, which means your investment returns start earning their own return. Compound interest allows your account balance to snowball over time.

Compound interest allows your account balance to snowball over time.

How that works, in practice: Let’s say you invest $200 every month for 10 years and earn a 6% average annual return. At the end of the 10-year period, you’ll have $33,300. Of that amount, $24,200 is money you’ve contributed — those $200 monthly contributions — and $9,100 is interest you’ve earned on your investment.

There will be ups and downs in the stock market, of course, but investing young means you have decades to ride them out — and decades for your money to grow. Start now, even if you have to start small.

Decide how much to invest

How much you should invest depends on your investment goal and when you need to reach it.

One common investment goal is retirement. If you have a retirement account at work, like a 401(k), and it offers matching dollars, your first investing milestone is easy: Contribute at least enough to that account to earn the full match. That’s free money, and you don’t want to miss out on it.

As a general rule of thumb, you want to aim to invest a total of 10% to 15% of your income each year for retirement — your employer match counts toward that goal. That might sound unrealistic now, but you can work your way up to it over time. (Calculate a more specific retirement goal with our retirement calculator.)

For other investing goals, consider your time horizon and the amount you need, then work backwards to break that amount down into monthly or weekly investments.

Open an investment account

If you don’t have a 401(k), you can invest for retirement in an individual retirement account, like a traditional or Roth IRA.

If you’re investing for another goal, you likely want to avoid retirement accounts — which are designed to be used for retirement, and thus have restrictions about when and how you can take your money back out — and choose a taxable brokerage account. You can remove money from a taxable brokerage account at any time.

A common misconception is that you need a lot of money to open an investment account or get started investing. That’s simply not true. (We even have a guide for how to invest $500.) Many online brokers, which offer both IRAs and regular brokerage investment accounts, require no minimum investment to open an account, and there are plenty of investments available for relatively small amounts (we’ll detail them next).

» Get the details: How to open a brokerage account

Understand your investment options

Whether you invest through a 401(k) or similar employer-sponsored retirement plan, in a traditional or Roth IRA, or in a standard investment account, you choose what to invest in.

It’s important to understand each instrument and how much risk it carries. The most popular investments for those just starting out include:

Stocks

- A stock is a share of ownership in a single company. Stocks are also known as equities.

- Stocks are purchased for a share price, which can range from the single digits to a couple thousand dollars, depending on the company. We recommend purchasing stocks through mutual funds, which we’ll detail below.

» Learn more: How to invest in stocks

Bonds

- A bond is essentially a loan to a company or government entity, which agrees to pay you back in a certain number of years. In the meantime, you get interest.

- Bonds generally are less risky than stocks because you know exactly when you’ll be paid back and how much you’ll earn. But bonds earn lower long-term returns, so they should make up only a small part of a long-term investment portfolio.

» Learn more: How to buy bonds

Mutual funds

- A mutual fund is a mix of investments packaged together. Mutual funds allow investors to skip the work of picking individual stocks and bonds, and instead purchase a diverse collection in one transaction. The inherent diversification of mutual funds makes them generally less risky than individual stocks.

- Some mutual funds are managed by a professional, but index funds — a type of mutual fund — follow the performance of a specific stock market index, like the S&P 500. By eliminating the professional management, index funds are able to charge lower fees than actively managed mutual funds.

- Most 401(k)s offer a curated selection of mutual or index funds with no minimum investment, but outside of those plans, these funds may require a minimum of $1,000 or more.

» Learn more: How to invest in mutual funds

Exchange-traded funds

- Like a mutual fund, an ETF holds many individual investments bundled together. The difference is that ETFs trade throughout the day like a stock, and are purchased for a share price.

- An ETF’s share price is often lower than the minimum investment requirement of a mutual fund, which makes ETFs a good option for new investors or small budgets.

Pick an investment strategy

Your investment strategy depends on your saving goals, how much money you need to reach them and your time horizon.

If your savings goal is more than 20 years away (like retirement), almost all of your money can be in stocks. But picking specific stocks can be complicated and time consuming, so for most people, the best way to invest in stocks is through low-cost stock mutual funds, index funds or ETFs.

If you’re saving for a short-term goal and you need the money within five years, the risk associated with stocks means you’re better off keeping your money safe, in an online savings account, cash management account or low-risk investment portfolio. We outline the best options for short-term savings here.

If you can’t or don’t want to decide, you can open an investment account (including an IRA) through a robo-advisor, an investment management service that uses computer algorithms to build and look after your investment portfolio.

Robo-advisors largely build their portfolios out of low-cost ETFs and index funds. Because they offer low costs and low or no minimums, robos let you get started quickly. They charge a small fee for portfolio management, generally around 0.25% of your account balance.

Question of the day - At what age did you start investing - or if you have yet to begin, are you looking to start?

Money & Finances

At what age did you start investing - or if you have yet to begin, are you looking to start?