- Abuse & The Abuser

- Achievement

- Activity, Fitness & Sport

- Aging & Maturity

- Altruism & Kindness

- Atrocities, Racism & Inequality

- Challenges & Pitfalls

- Choices & Decisions

- Communication Skills

- Crime & Punishment

- Dangerous Situations

- Dealing with Addictions

- Debatable Issues & Moral Questions

- Determination & Achievement

- Diet & Nutrition

- Employment & Career

- Ethical dilemmas

- Experience & Adventure

- Faith, Something to Believe in

- Fears & Phobias

- Friends & Acquaintances

- Habits. Good & Bad

- Honour & Respect

- Human Nature

- Image & Uniqueness

- Immediate Family Relations

- Influence & Negotiation

- Interdependence & Independence

- Life's Big Questions

- Love, Dating & Marriage

- Manners & Etiquette

- Money & Finances

- Moods & Emotions

- Other Beneficial Approaches

- Other Relationships

- Overall health

- Passions & Strengths

- Peace & Forgiveness

- Personal Change

- Personal Development

- Politics & Governance

- Positive & Negative Attitudes

- Rights & Freedom

- Self Harm & Self Sabotage

- Sexual Preferences

- Sexual Relations

- Sins

- Thanks & Gratitude

- The Legacy We Leave

- The Search for Happiness

- Time. Past, present & Future

- Today's World, Projecting Tomorrow

- Truth & Character

- Unattractive Qualities

- Wisdom & Knowledge

Relationships Sundays

Interdependence & Independence

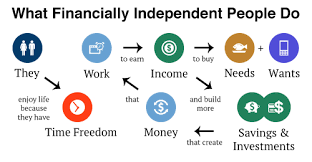

How to Become Financially Independent

Stability is a beautiful thing. Freedom from month-to-month stress, low to no pressure, and being able to relax and trust in your provision. Financial independence is the way to get there.

The definition, according to Wikipedia, is “the status of having enough income to pay one's living expenses for the rest of one's life without having to be employed or dependent on others.” Essential, having yourself covered no matter what. It’s freedom.

What many people don’t realize is that financial independence is not only achieved by billionaires or big earners. It can be accomplished at any age of life by anyone willing to work for it.

Of course, to be financially independent, you need money. But your day job doesn’t/shouldn’t be the only stream of cash flow if financial independence is your goal. Multiple streams of passive income are often the key to unlocking a life of freedom and indepedence.

One of the greatest benefits of financial independence is that frees you up to simply be - in life, in your relationships, in all things, you don't have to depend on someone else. There's no politics or stress about who covers what bills or who's paying for dinner. You have clear boundaries and don't have to worry.

Given that finances are one of the leading causes for divorce, this can be a huge relief. Financial independence means that you care for yourself, and you can focus on the people in front of you without asking anything of them.

Stay the path, own your goals, and create a life that's sustainable. There's no better feeling than freedom.

Interesting Fact #1

24% of young adults are financially self-sustaining.

Interesting Fact #2

60% of parents are supporting adult children.

Interesting Fact #3

Most Americans say that parents do too much for their adult children.

Quote of the day

To achieve what 1% of the worlds population has (Financial Freedom), you must be willing to do what only 1% dare to do..hard work and perseverance of highest order.

Article of the day - The One Way To Fast Track Your Financial Independence

What is the best way to solve a problem?

Anyone who is seeking Financial Independence (FI) is ultimately trying to solve a problem.

What they’re seeking is usually not a money problem per se but a bigger life problem.

“How can I achieve financial independence?” could be translated into:

- How can I achieve financial joy and no money worries?

- Or – How can I get more of my life and time back?

- It could even be – How can I have the option to choose when I work? etc

Ofcourse financial independence has a core definition that is understood by most.

However, the underlying meaning usually means something different to different people.

Hence why the motivation and path to financial independence will be different for everyone.

The best way that I have found for solving problems is to apply design thinking.

If you spend time looking at the fascination with financial independence in the media, a lot of it is focused on the mechanics.

I’ve had some media interest lately and a number of them have mainly focused on headlines.

Don’t get me wrong, the buzz is great… but I can assure you, the buzz gets you nowhere.

In fact, the vast majority of FI enthusiasts will sadly get nowhere because they’ll remain in buzz land.

What does get you somewhere is creativity. And this is where the silver bullet for fast tracking FI comes in.

I can only speak for myself, and what I’ve noticed in all the media bits I’ve had is that not a single one tracked my growth over time.

Did you know that there is a positive correlation between having goals and having a high bank balance?

Let me put it another way –

No goals = No bank balance.

Now the thing about goals is that they usually don’t achieve themselves.

Someone has to achieve the goal and that someone has to be either you or me.

This brings us to the subject of this post.

The single most important way to fast track your financial independence is to focus on personal development.

You’re probably thinking…huh!? Is that it? Yup!

The number 1 asset you will ever have by a mile is you, my friend.

Let me break down why all this matters:

Victim vs Victor

‘Personal development’ will be an entirely different language if you’re one of those lazy complainers that lurk the internet.

Those people (and there are many of them), usually fall into the victim bucket.

They are usually waiting for things to be handed to them or even to inherit things.

This group moan about how terrible life is and never ever move forward because they never stop to see what they have in their hands.

If you have one of these people as friends, I’d personally cut them lose because they’ll drag you down with them.

Close to the victim group and those who are lukewarm and have no say about anything.

They’re neither hot nor cold and will joyfully sit in the same job for decades with no progress.

This group will also get nowhere near FI and you might as well avoid them too whilst you are at it.

The final group sit in the victor bucket and have a bias towards action.

They might be poor today or even in a lot of debt, but they wake up every day thinking of a way out.

I particularly love this group because you’ll always identify a positive and proactive trait among them.

They don’t complain about politics and see it as part of life’s expected problems. It always exists and is never seasonal.

Instead, they spend time thinking of how they can surf above the noise and get to where they want.

You can even identify them by language. This group will say things like “Yes and” rather than “Yes but”.

Now here is why this segmentation matters –

The only group that will likely fast track and achieve FI are the victors.

The lukewarm group could be made warm and turned. But, the ‘Victims’ are sadly a lost cause.

You’re probably thinking – “Ken, that’s a bit harsh!”.

Well, yes… But it is true.

It’s for this reason that I write this blog for The Fearless Generation.

If you identify yourself with this group of Victors, then read on.

How You Can Grow

Below are some examples of how to develop personally. This is not a complete list but these have worked for me:

1. Hang out with winners

I am a firm believer that iron sharpens iron.

What this means in everyday speak is that if you hang out with losers, you will become one too.

Wanna become better? Richer? Smarter? Etc. Hang out with people who you identify have those traits.

I get this every day in my day job, close-knit friendships, and family members.

These people invest in me daily and I invest in them.

It’s for this reason that I encourage people to take out coaching with others.

The people you need to move to the next stage of your life are out there.

Find them and hang out with them. Don’t just aim to take from them but also make sure you sow.

Remember, the sustainable asset you get from hanging out with winners is the relationship.

2. Read books etc

One really important reason for reading books is that it opens up your imagination.

If you ever feel that your universe is getting smaller and more boring, it’s a sign you need to read.

Whether you’re reading fiction or non-fiction, it’s always a good way to build that creative muscle.

Here’s a really practical example of what I learned from reading –

It was only through reading a few autobiographies that I realised that:

Rich people make money in business and reinvest it in other cashflow generating assets like property.

Had I not seen it play out in a book, I won’t have moved to seek environments where I’d meet such people!

In addition to reading books, also explore podcasts, specialist courses etc.

All of this will be pointless if you don’t already have or develop a growth mindset:

3. Set Goals

I don’t want to labour the point here…

But if you consider your life situation right now and you have no goals… then you’re going nowhere.

Goals are forward-looking. The more you focus on goals the more your thoughts will lead to actions that achieve those goals.

Financial Independence is no small walk in the park. It’s the culmination of setting and hitting many goals whilst failing at others.

4. Take Risks

Designers don’t think their way forward, they build their way forward.

This means that they experiment and try things out. They take risks!

Take this blog that you’re reading for example. It’s an experiment and you’re a subject in that experiment.

But to see whether I’d get the desired results from my experiment, I actually had to start the blog.

I had to cast aside my fears and get my feet wet.

The same thinking can be applied to many other things, and I’ve done it for property investing, asking for promotions etc.

So can you in many other ways. Key is to do things that build your creativity muscle and experiment to see what happens.

5. Program the subconscious

This one will seem somewhat weird but here it goes…

If you’ve ever seen the movie “The Matrix”, then you might understand some of this.

Everything I have been talking about above has been all about developing your conscious mind i.e. creativity.

Circa 95% of our life comes from what gets programmed into our lives in the first 7 years of life.

So if you come from a poor family, and grew up being told “you’re poor”, then it’s what program you’ll grow up with.

Essentially to be conscious, you need certain programs to be conscious of.

The way to re-program what you grew up with (e.g. mindset blocks) is through reprogramming your subconscious.

One way of doing this is through repetition. I.e. a habit.

If you go through the day telling yourself “I’m successful”, “I’m successful”, “I’m successful”. Then you will take action when you’re conscious to be successful.

This is exactly why affirmations and gratitude journals etc have been so popular. It’s because they encourage repetition.

Each day you write down what you are grateful for, it not only gives you optimism, but it reprograms your subconscious mind.

I have a saying that I repeat with my sons every day at home:

“Every single day, in every way, I’m getting better and better” – Emile Coue

This saying partly accounts for a lot of my attitude through the day. I leave home already winning in my mind.

Add to this, I avoid listening to naysayers or reading the general press, which is mostly negative.

By doing all the above, I am working on both the conscious and subconscious mind.

Link To Financial Independence

The only way you’ll go beyond relying on your savings rate only as the lever to financial independence is to:

i) Bring creativity and imagination into the FI framework

ii) Challenge your fear on the journey

By pursuing personal development, you’re developing both aspects of your life.

The minute you start to understand and apply these, you’ll find yourself doing the unusual e.g.

- Finally leaving that job that you hate and moving to get paid better.

- Setting income goals per annum and even aiming to 10X your income one day.

- Starting side hustles simply because you can. By the way, these are no-brainers!

- Sharing risk and doing a business joint venture with a friend.

- Doing the numbers and exploring property investing with other people’s money.

- Opening your mind up to renting out a spare room if you have one.

- Exploring geo-arbitrage or even moving back home with parents to boost savings.

- Prioritising optionality in all you do and asking for equity in exchange for expertise.

- Flipping properties or ‘businesses in a box’ because you can.

This list goes on… Creativity unites them all.

Fast-tracking the journey to FI requires singleness of thought and action.

You’ll spot opportunities that many will not see because they don’t have the creative mind you have.

Best of all, you’ll do something about them.

This is a big part of how we sped up our journey to FI.

Thing is, the minute you let fear take over, you’ll do nothing and won’t take advantage of these opportunities nor take risk.

Final Words…

There is a lot of noise out there about FI and there will continue to be. Most of the people making all the noise will get nowhere.

If you take a step back and think of this journey with design thinking and have a bias for action, prioritising personal development, then you’ll run a race to win.

None of this will happen overnight. It has taken us just under a decade and we did it.

No reason why you can’t too provided you understand that this is never a smooth journey although you can speed it up.

Question of the day - Is financial independence a goal of yours?

Interdependence & Independence

Is financial independence a goal of yours?