In the relentless pursuit of growth and profitability, business leaders are constantly scrutinizing their operations for opportunities to enhance efficiency and reduce costs. While much focus is placed on sales, marketing, and product development, one of the most potent—and often overlooked—areas for transformation lies within the finance department. Specifically, the meticulous, time-consuming processes of accounts payable (AP) and accounts receivable (AR).

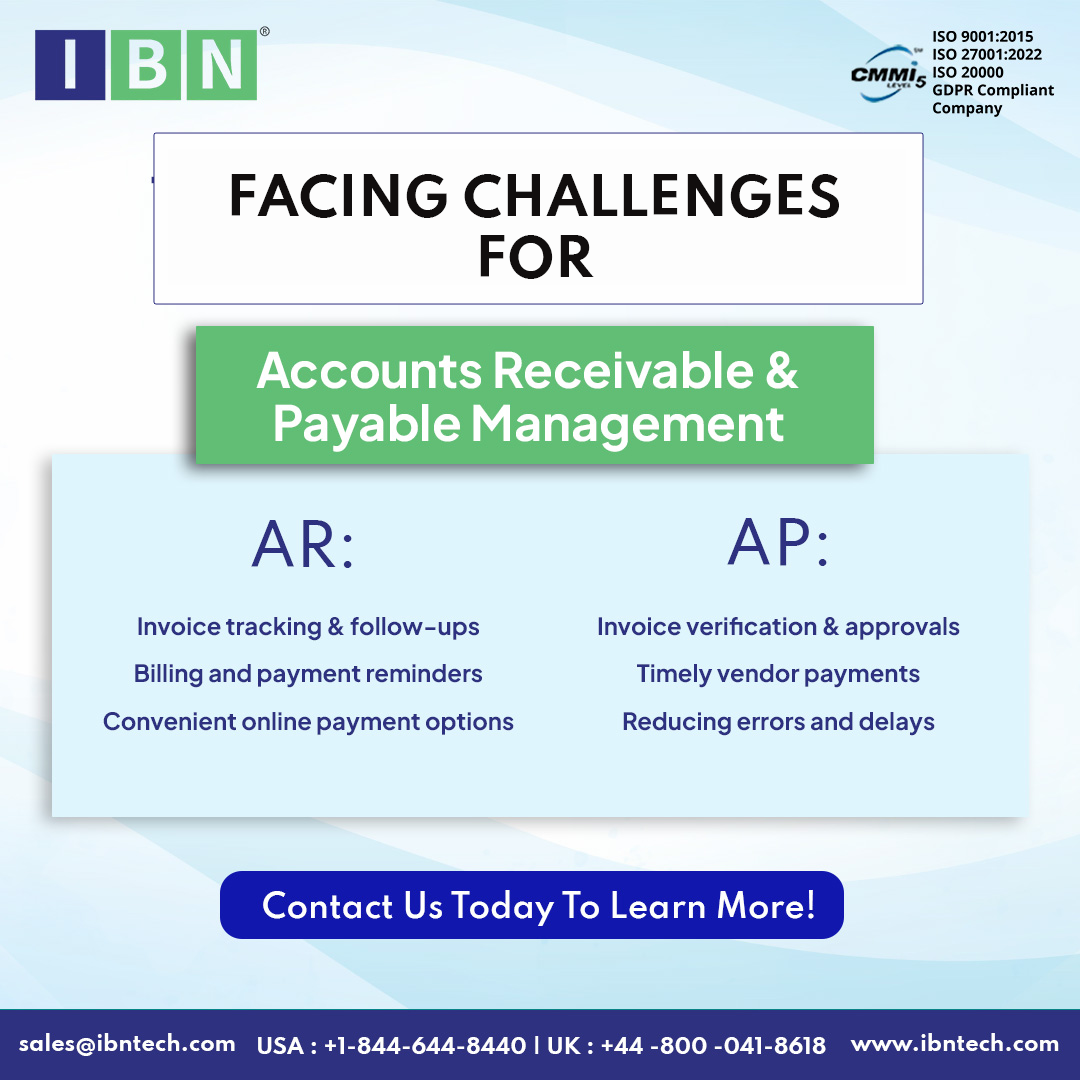

For many companies, managing AP and AR in-house means grappling with a mountain of paper invoices, chasing down payments, managing vendor inquiries, and reconciling statements. This not only drains valuable internal resources but can also lead to delayed payments, missed discounts, and a foggy view of company cash flow. The modern solution? Outsourcing accounts payable and receivable.

This isn't merely about delegating a task; it's a strategic partnership that can redefine your company's financial health. Let's explore the transformative benefits of entrusting these critical functions to a specialized partner.

The Core Benefits: More Than Just Cost Savings

1. Dramatic Cost Reduction and Predictable Overheads

Maintaining an in-house AP/AR department comes with significant, often hidden, costs: salaries, benefits, training, software subscriptions, and office space. By outsourcing accounts payable and receivable, you convert these fixed and variable costs into a predictable, scalable operational expense. You pay only for the services you need, eliminating the financial burden of hiring, training, and retaining specialized staff. Furthermore, expert providers leverage economies of scale and best practices to process transactions more efficiently, leading to direct bottom-line savings.

2. Enhanced Cash Flow Management

Cash flow is the lifeblood of any business. An outsourced team brings discipline and expertise that directly improves your cash conversion cycle.

- On the AP Side: Professionals ensure invoices are processed accurately and on time, allowing you to take full advantage of early payment discounts from vendors. They also prevent late payment penalties and help optimize payment timing to preserve cash on hand.

- On the AR Side: This is where the impact is most profound. A dedicated team proactively manages collections, sends timely payment reminders, and follows up on overdue accounts with a consistency that internal teams often struggle to maintain. This results in a faster inflow of cash, reduced Days Sales Outstanding (DSO), and a significantly lower risk of bad debt.

3. Unparalleled Expertise and Advanced Technology

The world of finance is constantly evolving, with new regulations, fraud schemes, and technologies emerging regularly. A reputable outsourcing partner invests heavily in both.

When you partner with a specialist, you gain immediate access to a team of experts who live and breathe financial processes. They are trained in the latest best practices for fraud detection, compliance, and process optimization. More importantly, you gain access to state-of-the-art technology—cloud-based platforms with automated workflow, OCR (Optical Character Recognition) for data capture, and robust reporting dashboards—without the capital investment and learning curve. This combination of expert human capital and superior technology ensures a level of accuracy and efficiency that is difficult to achieve internally.

4. Strengthened Security and Fraud Prevention

Internal financial processes can be vulnerable to errors and, in worst-case scenarios, fraud. Outsourcing accounts payable and receivable introduces a powerful layer of security and internal control. Reputable providers operate within a framework of strict protocols, segregation of duties, and advanced security measures. Your financial data is protected in secure data centers with robust backup and disaster recovery plans. This structured environment drastically reduces the risk of both internal and external threats to your financial assets.

5. Unlocking Strategic Focus and Scalability

Perhaps the most significant benefit is the freedom it grants your leadership team. The countless hours your staff spends on data entry, matching purchase orders, and calling clients for payments are hours not spent on strategic analysis, forecasting, and decision-support.

By offloading these transactional tasks, your CFO and finance team can pivot from being "number crunchers" to becoming "business partners." They can focus on analyzing financial data to identify growth opportunities, managing budgets, securing funding, and providing insights that drive the business forward.

Furthermore, outsourcing provides inherent scalability. Whether you're experiencing rapid growth, seasonal spikes, or entering new markets, your outsourced partner can instantly scale their services up or down to meet your demand, eliminating the lag and hassle of recruiting and training new employees.

Is Your Business a Candidate for AP/AR Outsourcing?

While businesses of all sizes can benefit, outsourcing accounts payable and receivable is particularly advantageous for:

- Growing Small and Medium-sized Businesses (SMBs): Where the finance team is stretched thin, and manual processes are beginning to crack under increased volume.

- Companies in Rapid Scaling Mode: Needing a financial process that can keep pace with expansion without constant internal restructuring.

- Organizations with High Invoice Volumes: Where the sheer quantity of transactions makes manual processing inefficient and prone to error.

- Businesses Looking to Upgrade Technology: But lack the capital or expertise to implement a new ERP or accounting automation system themselves.

Making the Strategic Leap

Choosing to outsource such a critical function is a significant decision. The key to success lies in selecting the right partner. Look for a provider with a proven track record, robust technology, transparent pricing, and a culture of communication that aligns with your own.

Outsourcing accounts payable and receivable is not an admission of an inability to manage your finances. On the contrary, it is a strategic decision made by forward-thinking leaders who recognize that efficiency, expertise, and a sharp focus on core competencies are the true engines of sustainable growth. It’s about working smarter, not just harder, to build a more resilient and profitable enterprise.

Comments